Best Lease Deals For Jeep Cherokee: Your Ultimate Guide to Smart Leasing

Best Lease Deals For Jeep Cherokee: Your Ultimate Guide to Smart Leasing jeeps.truckstrend.com

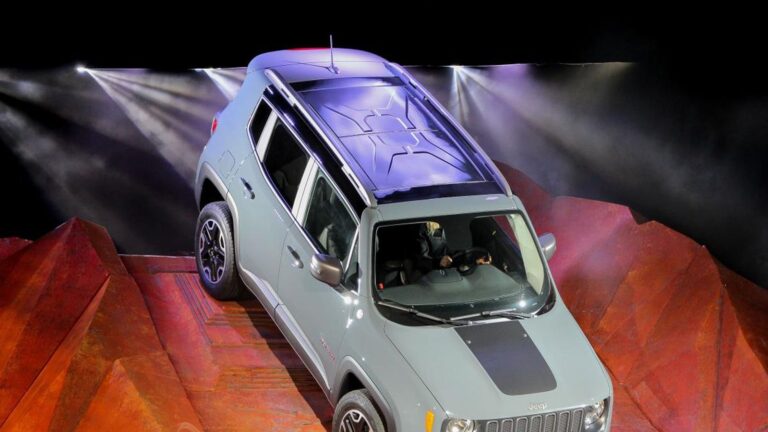

The Jeep Cherokee has long been a favorite among SUV enthusiasts, blending iconic Jeep capability with everyday comfort and modern technology. Its rugged charm, versatile interior, and confident on-road manners make it an attractive option for a wide range of drivers, from urban commuters to weekend adventurers. While purchasing a Cherokee is a popular choice, leasing has emerged as an increasingly intelligent and flexible alternative for many. The "best lease deal" isn’t just about the lowest monthly payment; it’s about securing a comprehensive package that aligns with your budget, lifestyle, and driving needs. This guide will meticulously break down everything you need to know to unlock the best lease deals for a Jeep Cherokee, ensuring you drive away happy and financially savvy.

Why Lease a Jeep Cherokee? The Allure of Flexibility and Freshness

Best Lease Deals For Jeep Cherokee: Your Ultimate Guide to Smart Leasing

Leasing a vehicle, particularly a popular one like the Jeep Cherokee, offers a unique set of advantages that often appeal to consumers looking for flexibility and predictable costs.

- Lower Monthly Payments: Compared to financing a purchase, lease payments are typically significantly lower because you’re only paying for the depreciation of the vehicle over the lease term, not its full purchase price.

- Drive a New Car More Often: Leasing allows you to upgrade to a brand-new vehicle every few years (typically 24 to 48 months), meaning you’re always driving the latest models with the newest features, safety technologies, and styling.

- Warranty Coverage: Throughout most standard lease terms, your Jeep Cherokee will remain under the manufacturer’s bumper-to-bumper warranty, minimizing unexpected repair costs.

- Less Hassle with Selling: At the end of the lease, you simply return the vehicle to the dealership (assuming it meets wear-and-tear guidelines and mileage limits). There’s no need to worry about trade-in values or the complexities of selling a used car.

- Predictable Costs: Besides your monthly payment, your main ongoing costs are fuel, insurance, and routine maintenance, making budgeting straightforward.

For the Jeep Cherokee, specifically, leasing means you can enjoy its blend of off-road prowess and daily drivability without committing to long-term ownership. You get to experience its evolving technology, updated safety features, and refined comfort with greater financial flexibility.

Understanding Jeep Cherokee Trims and Their Impact on Lease Deals

The Jeep Cherokee comes in a variety of trims, each offering a different level of features, luxury, and off-road capability. The specific trim you choose will significantly impact the vehicle’s Manufacturer’s Suggested Retail Price (MSRP), which in turn directly influences your lease payments. Understanding these trims is crucial for finding your "best" deal.

- Latitude / Latitude Plus: These are typically the entry-level or mid-range trims, offering a strong balance of essential features, comfort, and affordability. They often present the most attractive lease payments due to their lower MSRP.

- Altitude: A sportier version of the Latitude, often featuring blacked-out accents and unique wheels. Still generally good for lease deals.

- Limited: Steps up the luxury with premium interior materials, more advanced tech, and comfort features. Lease payments will be higher than Latitude but can still be competitive.

- Trailhawk: Designed for serious off-road enthusiasts, featuring enhanced suspension, skid plates, and unique styling. While highly capable, its higher MSRP and specialized nature can sometimes make lease deals less aggressive than on more mainstream trims.

- Overland / Summit (if available in current model year): These are the top-tier luxury trims, offering the most advanced features, premium materials, and sophisticated styling. They will command the highest lease payments.

For the absolute best lease deals in terms of lowest monthly payments, focusing on the Latitude, Latitude Plus, or Altitude trims is often the most strategic approach. These trims frequently benefit from manufacturer incentives aimed at moving higher volumes.

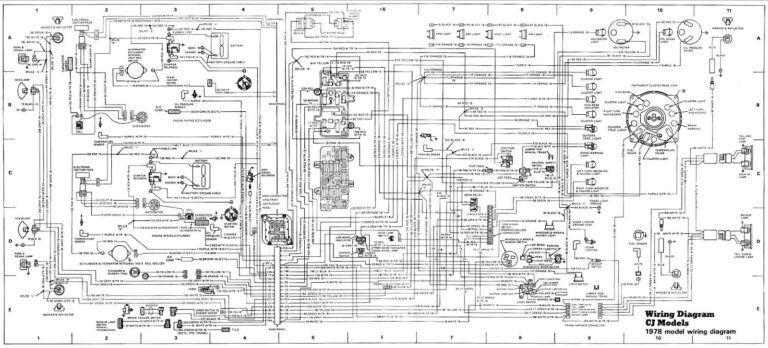

Key Factors Influencing Your Jeep Cherokee Lease Deal

To truly grasp what constitutes a "best" lease deal, you must understand the core components that dictate your monthly payment. These are the numbers you’ll need to negotiate and scrutinize.

- MSRP (Manufacturer’s Suggested Retail Price): This is the sticker price of the vehicle. While you don’t "buy" the car, the MSRP is the starting point for negotiations and the basis for calculating depreciation.

- Capitalized Cost (Cap Cost): This is the negotiated selling price of the vehicle, similar to the purchase price if you were buying. Lowering the cap cost is the single most effective way to reduce your monthly lease payment. Treat this as if you’re buying the car – negotiate hard!

- Residual Value: This is the estimated value of the vehicle at the end of the lease term, expressed as a percentage of the MSRP. A higher residual value is better for leasing because it means the car is projected to depreciate less, resulting in lower monthly payments. Manufacturers set residuals, but they can vary slightly by trim and term.

- Money Factor (Interest Rate): Often expressed as a very small decimal (e.g., 0.00200), the money factor is essentially the interest rate you pay on the lease. To convert it to an APR, multiply by 2400 (e.g., 0.00200 x 2400 = 4.8% APR). A lower money factor is always better. Your credit score significantly influences the money factor you qualify for.

- Lease Term: The duration of the lease, commonly 24, 36, or 48 months. Shorter terms (e.g., 24-36 months) often have higher residual values, which can lead to attractive monthly payments despite being for a shorter period.

- Mileage Allowance: The annual mileage limit (e.g., 10,000, 12,000, or 15,000 miles). Higher mileage allowances result in lower residual values (because the car will depreciate more) and thus higher monthly payments. Be realistic about your driving habits to avoid costly overage fees at the end of the lease.

- Down Payment / Capitalized Cost Reduction: Any money you pay upfront to reduce the total amount being leased. While a down payment lowers your monthly payment, it’s generally advised to put down as little as possible on a lease. If the vehicle is totaled, you might lose that upfront money. Instead, aim to roll fees into the monthly payment or negotiate a lower cap cost.

- Taxes and Fees: These include an acquisition fee (charged by the leasing company), disposition fee (charged at lease end for returning the vehicle), registration, license plates, and sales tax (which varies by state and how it applies to leases).

How to Find the Best Lease Deals for a Jeep Cherokee

Finding an optimal lease deal requires research, negotiation, and strategic timing.

- Research Current Manufacturer Incentives: Jeep (or Stellantis Financial) frequently offers special lease programs, rebates, and low money factor promotions. Check the official Jeep website, local dealership websites, and national automotive sites (like Edmunds, TrueCar, Leasehackr) for current offers. These incentives can drastically improve a deal.

- Negotiate the Selling Price (Cap Cost): This is paramount. Don’t focus solely on the monthly payment. Negotiate the price of the Cherokee as if you were buying it outright. A lower cap cost directly translates to a lower monthly payment. Aim for a discount off MSRP, just as you would for a purchase.

- Compare Dealer Offers: Get quotes from at least three different dealerships, ideally more. Be transparent that you’re shopping around. A common tactic is to use a competitive offer from one dealer to get a better deal from another.

- Ask for the Numbers: Always request the specific breakdown of the lease: MSRP, negotiated cap cost, residual value (as a percentage and dollar amount), money factor, lease term, and mileage allowance. This allows for an apples-to-apples comparison.

- Utilize Online Lease Forums and Calculators: Websites like Leasehackr and Edmunds Forums have dedicated sections where users share lease deals and experts break down the numbers. You can learn what a "good" residual and money factor are for a Cherokee in your region. Their lease calculators can help you plug in numbers and understand the impact of each variable.

- Timing is Key:

- End of the Month/Quarter: Dealerships often have sales targets to hit, making them more motivated to offer aggressive deals.

- Model Year Changeovers: When a new model year arrives, dealers are eager to clear out the previous year’s inventory, often leading to excellent lease incentives on outgoing models.

- Holiday Sales: Major holidays (Black Friday, Presidents’ Day, Memorial Day, etc.) often bring special promotions.

Table: Illustrative Sample Lease Deals for Jeep Cherokee (Hypothetical Estimates)

Please Note: These figures are purely illustrative and subject to significant fluctuations based on market conditions, manufacturer incentives, regional pricing, credit score, and dealership negotiation. They are provided to give you an idea of how different trims and factors might influence a lease deal.

| Trim | MSRP (Est.) | Negotiated Cap Cost (Est.) | Residual Value (36 mo/10k mi) | Money Factor (Est.) | Lease Term (Months) | Annual Mileage | Estimated Monthly Payment (Excl. Tax/Fees) | Due at Signing (Est.) |

|---|---|---|---|---|---|---|---|---|

| Latitude FWD | $32,000 | $29,500 | 58% ($18,560) | 0.00180 | 36 | 10,000 | $315 | $1,500 (1st month, fees) |

| Latitude 4×4 | $33,500 | $30,800 | 57% ($19,095) | 0.00190 | 36 | 10,000 | $340 | $1,700 (1st month, fees) |

| Altitude FWD | $34,500 | $31,500 | 56% ($19,320) | 0.00195 | 36 | 10,000 | $360 | $1,800 (1st month, fees) |

| Limited 4×4 | $38,000 | $35,000 | 55% ($20,900) | 0.00210 | 36 | 10,000 | $425 | $2,000 (1st month, fees) |

| Trailhawk 4×4 | $42,000 | $38,500 | 54% ($22,680) | 0.00220 | 36 | 10,000 | $490 | $2,300 (1st month, fees) |

| Limited 4×4 | $38,000 | $35,000 | 52% ($19,760) | 0.00210 | 48 | 10,000 | $375 | $2,000 (1st month, fees) |

| Latitude 4×4 | $33,500 | $30,800 | 55% ($18,425) | 0.00190 | 36 | 12,000 | $365 | $1,700 (1st month, fees) |

Disclaimer: These are rough estimates for illustration purposes only. Actual lease terms and prices will vary widely.

Important Considerations Before Signing Your Lease

Even with a seemingly great deal, there are crucial aspects to review before committing.

- Total Lease Cost: Don’t just look at the monthly payment. Calculate the total cost of the lease (sum of all monthly payments + due at signing + acquisition fee + disposition fee). This gives you the full picture.

- Wear and Tear Guidelines: Understand what constitutes "excessive wear and tear" according to the lease agreement. Minor dings and scratches are usually fine, but larger damage, tire wear beyond a certain limit, or interior stains could result in charges.

- Early Termination Penalties: Breaking a lease early can be incredibly expensive, often requiring you to pay most or all of the remaining payments plus substantial fees. Be sure you can commit to the full term.

- Insurance Requirements: Lease agreements typically require comprehensive and collision coverage with higher liability limits than you might normally carry. Factor these increased insurance costs into your budget.

- End-of-Lease Options:

- Return the Vehicle: The most common option.

- Buy Out the Lease: You have the option to purchase the vehicle for its residual value (plus any purchase fees). If the car’s market value is higher than its residual, this can be a smart move.

- Extend the Lease: Some lessors offer short-term extensions, which can be useful if you’re waiting for a new model or need more time.

Tips for Optimizing Your Jeep Cherokee Lease

- Be Flexible with Trim and Color: While you might have a dream configuration, being open to different colors or slightly different option packages can unlock better deals, especially on vehicles dealers want to move quickly.

- Aim for a Low or No Down Payment: As mentioned, minimizing your upfront cash is generally safer with leases. Roll fees into the monthly payment if possible.

- Know Your Credit Score: A strong credit score (typically 700+) is essential for securing the best money factors. Check your score before you shop.

- Read the Fine Print: Never sign anything without thoroughly reading the entire lease agreement. Understand all clauses, fees, and responsibilities.

- Test Drive Thoroughly: Ensure the Jeep Cherokee meets your needs for comfort, performance, and features before you enter into lease negotiations.

Potential Challenges and Solutions

While leasing offers many benefits, it’s important to be aware of potential challenges and how to address them.

- High Monthly Payments:

- Solution: Focus intensely on negotiating down the cap cost. Consider a lower trim level or fewer optional features. Extend the lease term if it significantly lowers payments, but be mindful of the total cost.

- Excessive Mileage:

- Solution: Accurately estimate your annual mileage upfront and choose the appropriate allowance. If you anticipate going over, it’s often cheaper to purchase extra miles at the beginning of the lease rather than pay overage fees at the end. For significant overages, consider buying the vehicle at lease end.

- Wear and Tear Charges:

- Solution: Treat the vehicle well. Get it professionally detailed and address any minor dents, scratches, or interior issues before returning it. Have an independent inspection done a few weeks before turn-in to identify potential charges.

- Poor Credit Score:

- Solution: A lower credit score will result in a higher money factor. Consider having a co-signer with excellent credit. You might also need to put down a larger security deposit or a higher capitalized cost reduction, though the latter is less ideal.

Frequently Asked Questions (FAQ)

Q1: Is leasing a Jeep Cherokee better than buying one?

A1: It depends on your priorities. Leasing is often better if you prefer lower monthly payments, enjoy driving new cars every few years, don’t drive excessive miles, and want to avoid the hassle of selling. Buying is better if you drive many miles, want to customize your vehicle, prefer long-term ownership, or value building equity.

Q2: What’s a good money factor for a Jeep Cherokee lease?

A2: A "good" money factor is typically below 0.00200 (equivalent to about 4.8% APR). Excellent credit scores can sometimes achieve money factors as low as 0.00050 to 0.00100 during special promotions. Always aim for the lowest possible.

Q3: Can I negotiate the residual value of a Jeep Cherokee lease?

A3: No, the residual value is set by the leasing company (e.g., Stellantis Financial) at the beginning of the lease and is generally non-negotiable. It’s based on projections of the vehicle’s value at the end of the term.

Q4: What happens if I go over my mileage limit?

A4: You will be charged an overage fee for each mile exceeding your allowance, typically ranging from $0.15 to $0.25 per mile. These fees can add up quickly, so accurately estimate your driving habits.

Q5: Can I buy my leased Jeep Cherokee at the end of the term?

A5: Yes, most lease agreements include an option to purchase the vehicle at the end of the lease for the predetermined residual value (plus any purchase option fees and applicable taxes).

Q6: Are there special lease deals for military personnel or students?

A6: Jeep and its dealerships often offer special incentives or discounts for military personnel, veterans, and sometimes recent college graduates. Always inquire about these programs, as they can further enhance your lease deal.

Q7: What credit score do I need to lease a Jeep Cherokee?

A7: While specific requirements vary, generally a FICO score of 700 or higher is considered "Tier 1" or "prime" and will qualify you for the best money factors and lease terms. Scores below 660 might face higher money factors or require a larger down payment/security deposit.

Concluding Summary

Securing the best lease deal for a Jeep Cherokee is an art form that combines diligent research, shrewd negotiation, and a clear understanding of the lease components. It’s not just about chasing the lowest advertised monthly payment, but rather optimizing the capitalized cost, understanding the residual value, and securing the most favorable money factor. By focusing on popular trims, leveraging manufacturer incentives, and meticulously comparing offers, you can drive home a new Jeep Cherokee with the financial flexibility and peace of mind that smart leasing provides. Remember to read every line of the contract, understand your responsibilities, and you’ll be well on your way to enjoying your capable and stylish new ride.