How Much Is A Jeep Wrangler Car Note? Navigating the Path to Iconic Off-Road Ownership

How Much Is A Jeep Wrangler Car Note? Navigating the Path to Iconic Off-Road Ownership jeeps.truckstrend.com

The Jeep Wrangler is more than just a vehicle; it’s a symbol of adventure, freedom, and a unique lifestyle. From its unmistakable seven-slot grille to its removable doors and roof, the Wrangler embodies the spirit of exploration. However, before you embark on your off-road adventures, a crucial question arises: "How much is a Jeep Wrangler car note?"

Understanding your potential car note—the monthly payment you make on an auto loan—is paramount to responsible vehicle ownership. It’s not just about the sticker price; it’s about the intricate dance of factors like trim level, financing terms, your credit score, and additional costs that ultimately determine the size of that recurring monthly obligation. This comprehensive guide will delve into every aspect of calculating and understanding your Jeep Wrangler car note, helping you budget wisely and make an informed decision on your journey to Wrangler ownership.

How Much Is A Jeep Wrangler Car Note? Navigating the Path to Iconic Off-Road Ownership

Understanding the Jeep Wrangler Car Note: The Core Components

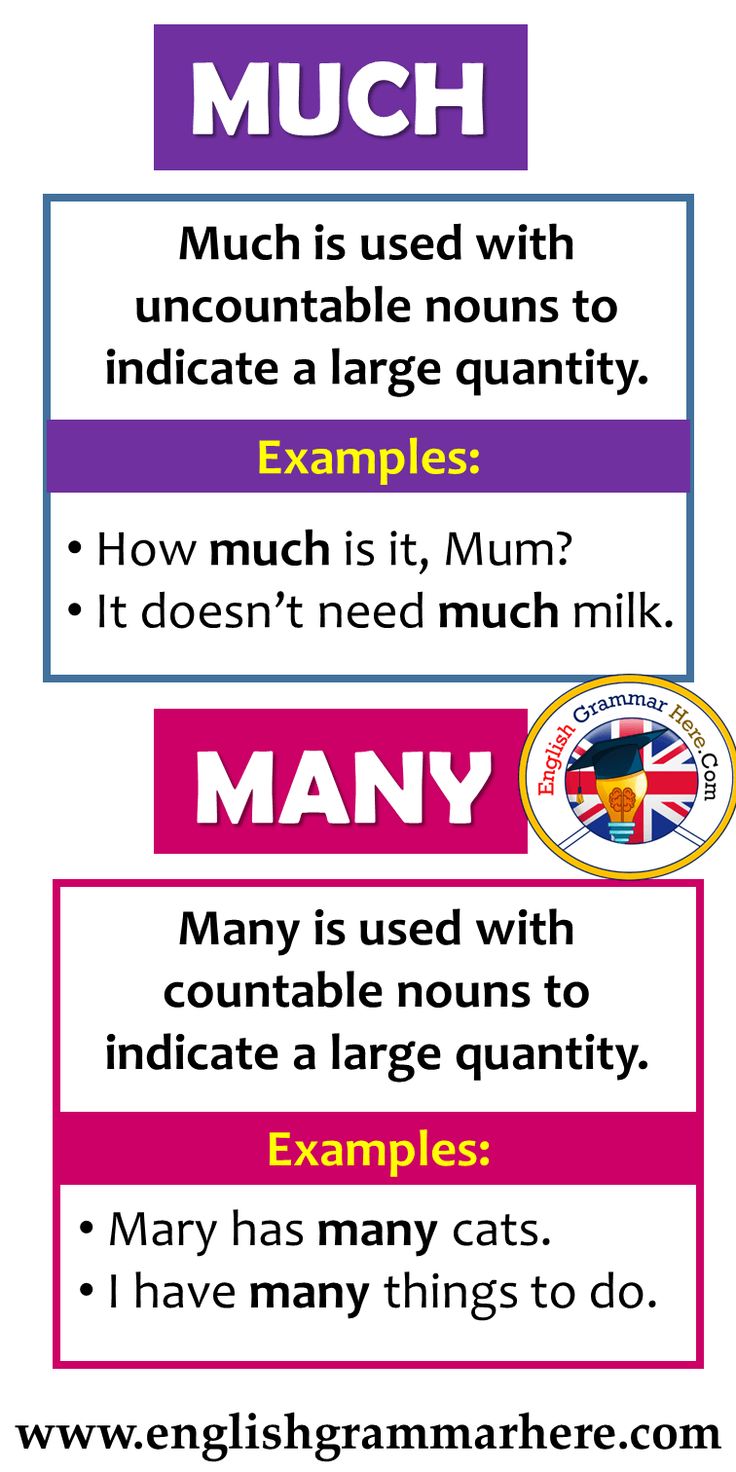

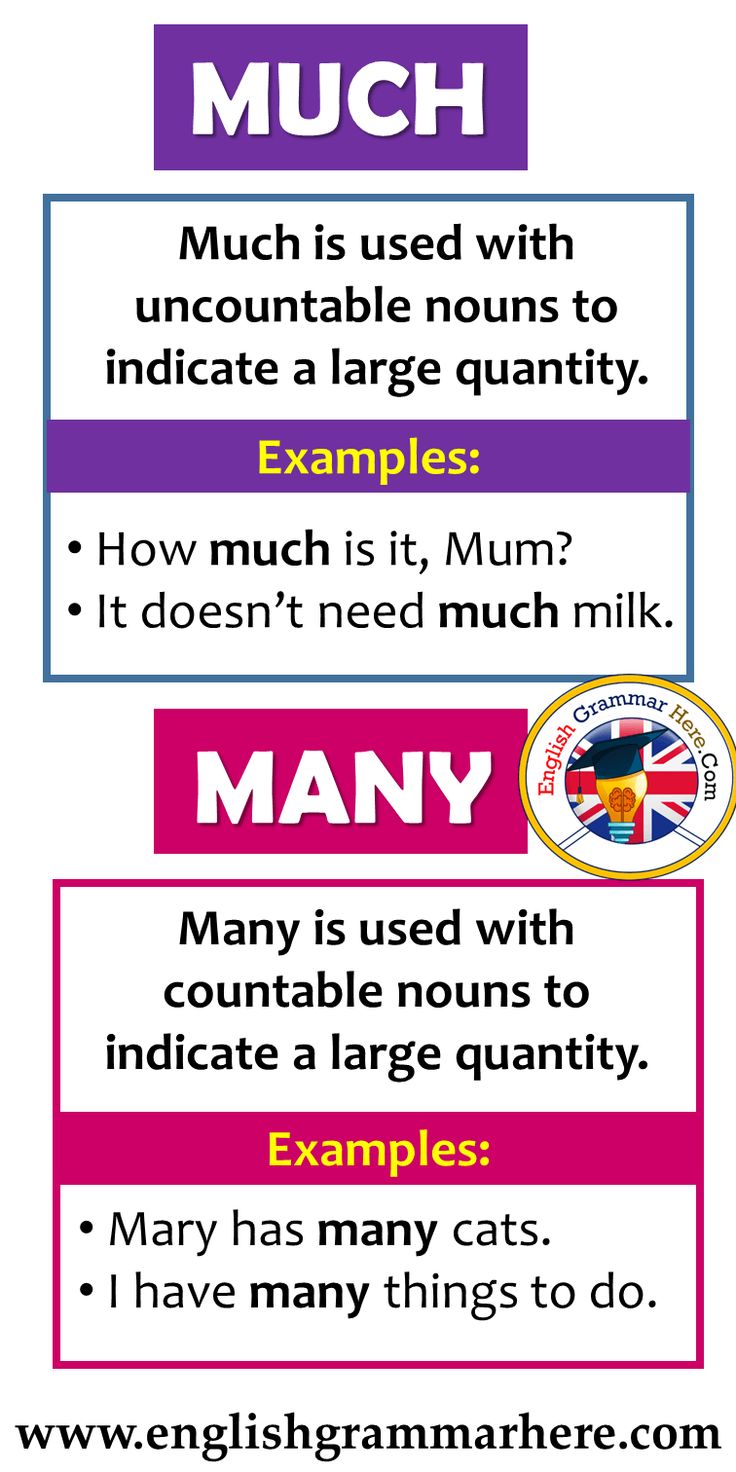

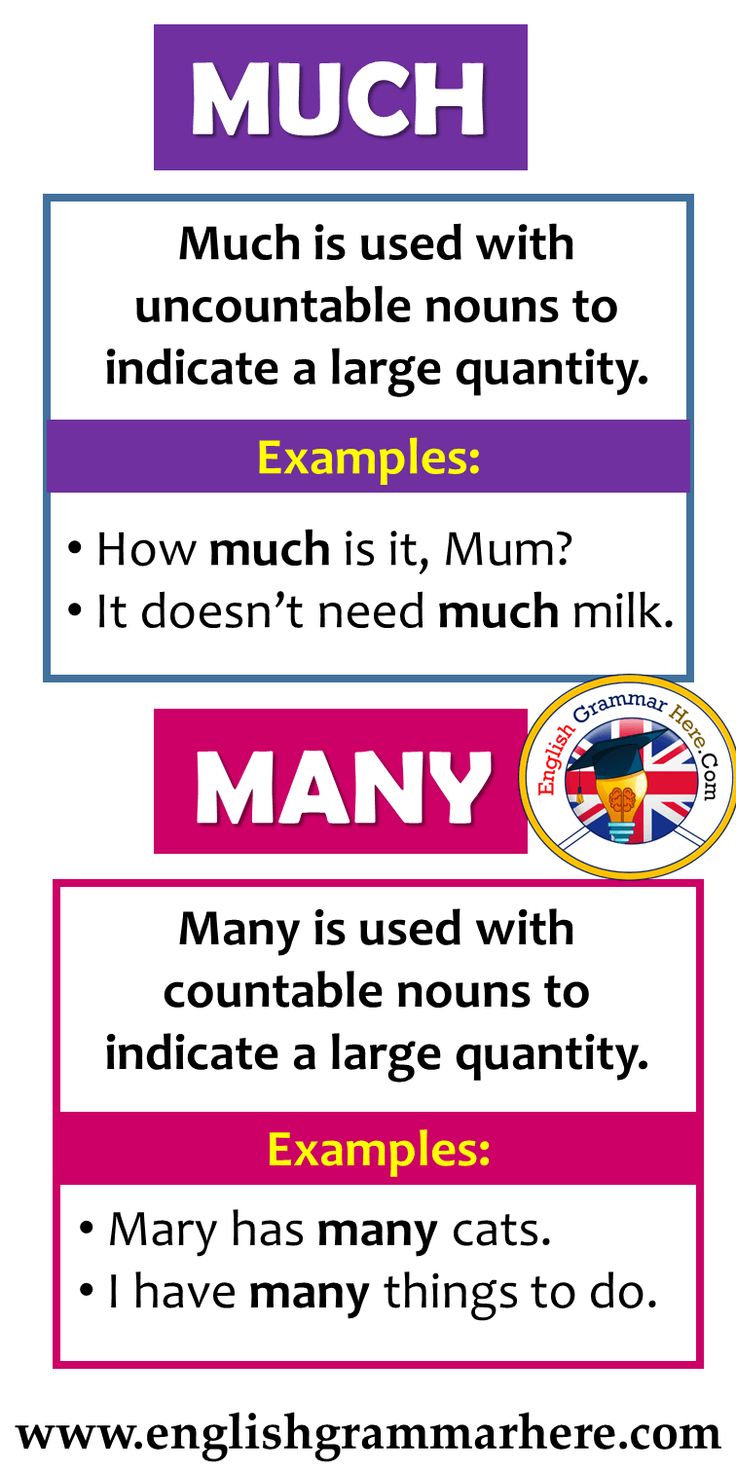

At its heart, a car note is a reflection of your loan’s principal amount (the total borrowed) spread out over a specific period, plus interest. For a Jeep Wrangler, this calculation is influenced by several interconnected variables:

- Vehicle Price (MSRP): The Manufacturer’s Suggested Retail Price (MSRP) is the starting point. Wranglers come in various trim levels (Sport, Willys, Sahara, Rubicon, High Altitude, 4xe), each with a significantly different base price. Optional packages, premium paint, specialized tops, and factory accessories can quickly add thousands to this figure.

- Down Payment: This is the initial lump sum you pay upfront. A larger down payment reduces the amount you need to borrow, directly lowering your monthly principal and, consequently, your car note.

- Trade-In Value: If you’re trading in an existing vehicle, its appraised value acts similarly to a down payment, reducing the total loan amount.

- Credit Score: This three-digit number is arguably one of the most critical factors. Lenders use your credit score to assess your creditworthiness. A higher score (e.g., 700+) typically qualifies you for lower interest rates (APR), which significantly reduces the total interest paid over the loan term and thus your monthly payment. A lower score can lead to much higher interest rates, making the same Wrangler substantially more expensive each month.

- Interest Rate (APR): The Annual Percentage Rate (APR) is the cost of borrowing money, expressed as a percentage. Even a difference of 1-2% in APR can translate to hundreds or thousands of dollars over the life of the loan.

- Loan Term: This is the duration of your loan, typically expressed in months (e.g., 36, 48, 60, 72, or even 84 months). A longer loan term results in lower monthly payments but means you’ll pay more in total interest over time. Conversely, a shorter term means higher monthly payments but less total interest.

- Sales Tax, Fees, and Other Charges: Don’t forget these! Sales tax (varies by state), documentation fees, registration and title fees, and destination charges are often rolled into your loan, increasing the total amount financed. Optional add-ons like extended warranties, GAP insurance, or service plans can also be included.

Key Factors Influencing Your Monthly Payment

Let’s break down the impact of these factors with more detail:

-

MSRP & Trim Levels:

- Jeep Wrangler Sport (2-door/4-door): Often the most affordable entry point, starting in the low $30,000s. A well-equipped Sport S could push into the mid-$30,000s.

- Jeep Wrangler Willys/Sahara: Mid-range options, typically starting in the low to mid-$40,000s, offering more features and comfort.

- Jeep Wrangler Rubicon/High Altitude: The premium and most off-road capable trims, starting from the mid-$50,000s and easily reaching $60,000+ with options.

- Jeep Wrangler 4xe (Plug-in Hybrid): These models combine electric power with gasoline, offering unique benefits and starting prices often in the high $50,000s to low $70,000s.

-

Down Payment & Trade-In: The general rule is the more, the better. A 10-20% down payment is often recommended. On a $45,000 Wrangler, a $4,500 down payment (10%) significantly reduces the principal and demonstrates financial stability to lenders.

-

Credit Score’s Crucial Role:

- Excellent Credit (750+): You might qualify for the lowest advertised rates, sometimes even 0% APR on special promotions.

- Good Credit (680-749): Expect competitive rates, perhaps 3-6% APR depending on market conditions.

- Fair Credit (620-679): Rates could jump to 7-12% APR or higher.

- Poor Credit (Below 620): You might face very high rates (15%+) or require a co-signer, making the monthly payment substantially higher.

-

Loan Term vs. Total Cost:

- Shorter Term (36-60 months): Higher monthly payment, significantly less interest paid overall. You build equity faster.

- Longer Term (72-84 months): Lower monthly payment, but you pay much more in interest. You risk being "upside down" on your loan (owing more than the car is worth) for a longer period.

Estimating Your Jeep Wrangler Car Note: A Practical Guide

To get a realistic estimate of your car note, follow these steps:

- Determine Your Budget: Before falling in love with a specific trim, establish what you can comfortably afford each month, factoring in insurance, fuel, and maintenance.

- Research MSRP & Desired Features: Visit Jeep’s official website or dealership sites. Configure your ideal Wrangler, noting the total MSRP with all desired options.

- Assess Your Credit Score: Obtain a free credit report from annualcreditreport.com or use services like Credit Karma. This will give you a good idea of the interest rates you might qualify for.

- Estimate Down Payment/Trade-In: Decide how much cash you can put down or get an appraisal for your trade-in.

- Use Online Calculators: Plug in the estimated loan amount (MSRP – down payment – trade-in + taxes/fees), your estimated interest rate, and preferred loan term into an online auto loan calculator (many bank websites or financial planning sites offer these).

- Factor in Sales Tax & Fees: Research your state’s sales tax on vehicles and estimate common dealership fees (e.g., $300-$800 for documentation). Add these to your loan amount.

Strategies to Lower Your Jeep Wrangler Car Note

If your initial estimated note is higher than desired, consider these strategies:

- Increase Your Down Payment: Even an extra $1,000 can make a noticeable difference in your monthly payment and total interest.

- Improve Your Credit Score: Pay down existing debts, make all payments on time, and avoid new credit inquiries in the months leading up to your purchase.

- Shop Around for Financing: Don’t just rely on the dealership’s financing. Get pre-approved by your bank, credit union, or online lenders. This gives you leverage during negotiations.

- Negotiate the Purchase Price: Always try to negotiate the vehicle’s price below MSRP. Every dollar saved here directly reduces your loan amount.

- Choose a Lower Trim Level or Fewer Options: Do you truly need the premium leather seats or the most advanced off-road package? Opting for a Sport S over a Rubicon can save tens of thousands of dollars.

- Consider a Used or Certified Pre-Owned (CPO) Wrangler: Used Wranglers typically have lower purchase prices, though interest rates might be slightly higher for older models. CPO vehicles offer a balance of lower price and a manufacturer-backed warranty.

- Extend the Loan Term (with Caution): While a longer term lowers your monthly payment, remember the trade-off in total interest paid. Use this only if absolutely necessary and you plan to pay it off early.

New vs. Used Jeep Wrangler: Car Note Implications

-

New Wrangler:

- Pros: Latest features, full factory warranty, often eligible for manufacturer incentives (low APR, cash back), no prior wear and tear.

- Cons: Higher initial purchase price, rapid depreciation in the first few years, higher sales tax.

- Car Note Impact: Generally higher monthly payments due to higher principal, but potentially lower interest rates if you qualify for promotional financing.

-

Used Wrangler:

- Pros: Lower purchase price, less depreciation impact, wider selection of modified vehicles (if that’s your preference).

- Cons: No factory warranty (unless CPO), potential for more maintenance/repair costs, higher interest rates (especially if older), unknown vehicle history.

- Car Note Impact: Lower principal, which can lead to lower monthly payments, but potentially higher interest rates might offset some of those savings.

Beyond the Car Note: Total Cost of Ownership

Remember that your car note is only one part of owning a Jeep Wrangler. You must also budget for:

- Insurance: Wranglers can be expensive to insure due to their higher theft rates and repair costs. Get quotes before you buy.

- Fuel: Wranglers are not known for their fuel efficiency, especially the V6 and V8 models. Factor in regular gas expenses.

- Maintenance & Repairs: While generally reliable, off-road enthusiasts might incur additional wear and tear. Regular maintenance is crucial.

- Modifications: A significant portion of Wrangler owners customize their vehicles. Lift kits, larger tires, winches, and other accessories can be very expensive, and some might even be financed into your loan, increasing your note.

Estimated Jeep Wrangler Car Note Scenarios

Below is a table illustrating various estimated car notes for different Jeep Wrangler scenarios. These are estimates and actual payments will vary based on current interest rates, specific dealership fees, and individual credit profiles.

| Vehicle Type/Trim | Est. Vehicle Price | Down Payment (10%) | Loan Amount (approx.) | Est. Interest Rate (APR) | Loan Term (Months) | Est. Monthly Payment | Total Interest Paid (Est.) |

|---|---|---|---|---|---|---|---|

| New Wrangler Sport S (4-door) | $40,000 | $4,000 | $37,000 | 5.0% | 60 | $698 | $4,880 |

| $40,000 | $4,000 | $37,000 | 9.0% | 60 | $769 | $9,140 | |

| $40,000 | $4,000 | $37,000 | 5.0% | 72 | $594 | $5,770 | |

| New Wrangler Rubicon (4-door) | $58,000 | $5,800 | $54,000 | 4.5% | 60 | $1,009 | $6,540 |

| $58,000 | $5,800 | $54,000 | 8.0% | 72 | $978 | $16,400 | |

| New Wrangler 4xe Sahara | $62,000 | $6,200 | $58,000 | 4.0% | 60 | $1,073 | $6,380 |

| Used Wrangler (3-5 years old) | $30,000 | $3,000 | $28,000 | 7.0% | 48 | $670 | $4,160 |

| $30,000 | $3,000 | $28,000 | 12.0% | 60 | $623 | $9,380 |

Note: Loan amounts include an estimated $1,000 for taxes and fees for illustration purposes. APRs are subject to change based on market conditions and borrower creditworthiness.

Frequently Asked Questions (FAQ) About Jeep Wrangler Car Notes

Q1: What is a good credit score to get a low interest rate on a Jeep Wrangler?

A1: Generally, a credit score of 720 or higher is considered excellent and will qualify you for the most competitive interest rates. Scores above 750 are typically in the top tier.

Q2: How much down payment should I put on a Jeep Wrangler?

A2: While there’s no hard rule, a 10-20% down payment is often recommended. This reduces your loan amount, lowers your monthly payment, and helps you avoid being "upside down" on your loan.

Q3: Can I get a Jeep Wrangler with bad credit?

A3: Yes, it’s possible, but you will likely face significantly higher interest rates, which will dramatically increase your monthly payment and the total cost of the vehicle. You might also need a larger down payment or a co-signer.

Q4: Is it better to have a longer or shorter loan term for my Wrangler?

A4: A shorter loan term (e.g., 36-48 months) means higher monthly payments but significantly less total interest paid. A longer term (e.g., 72-84 months) offers lower monthly payments but results in much more interest paid over the life of the loan. Choose a term that balances affordability with minimizing interest costs.

Q5: Does the Jeep Wrangler 4xe have a different car note structure?

A5: The 4xe’s higher MSRP generally means a higher loan amount and thus a higher car note. However, depending on government incentives (like federal tax credits for EVs/PHEVs), these could effectively lower your out-of-pocket cost and thus the net amount financed, indirectly impacting your true cost of ownership. Consult a tax professional for eligibility.

Q6: What other costs should I budget for besides the car note?

A6: Don’t forget insurance (Wranglers can be costly to insure), fuel (they aren’t the most fuel-efficient), routine maintenance, and potential modifications or accessories that many Wrangler owners enjoy adding.

Conclusion

Understanding "How Much Is A Jeep Wrangler Car Note" is a multi-faceted endeavor that goes beyond simply looking at the sticker price. It involves a thorough evaluation of the vehicle’s cost, your financial health (especially your credit score), and the specific terms of your loan. By meticulously researching trim levels, saving for a substantial down payment, improving your credit score, and diligently shopping for the best financing rates, you can significantly influence your monthly payment.

Owning a Jeep Wrangler is an aspiration for many, promising unparalleled adventure and a vibrant community. By approaching the purchase with careful planning and a clear understanding of all the financial components, you can ensure that your journey into the world of Wrangler ownership is not only thrilling but also financially sound and sustainable. Happy trails!