How Much Is Jeep Wrangler Lease: A Comprehensive Guide

How Much Is Jeep Wrangler Lease: A Comprehensive Guide jeeps.truckstrend.com

The Jeep Wrangler stands as an icon of adventure, freedom, and rugged capability. For many, owning a Wrangler is a dream, but the upfront cost and long-term commitment of purchasing can be daunting. This is where leasing enters the picture, offering a flexible and often more affordable pathway to getting behind the wheel of this legendary off-roader. But how much does it truly cost to lease a Jeep Wrangler? This comprehensive guide will break down the complexities of Wrangler leasing, from understanding the core components of a lease payment to navigating the various factors that influence your monthly outlay, ensuring you’re well-equipped to make an informed decision.

Understanding the Fundamentals of a Jeep Wrangler Lease

How Much Is Jeep Wrangler Lease: A Comprehensive Guide

Leasing a vehicle is essentially paying for its depreciation over a set period, plus interest and fees. Unlike buying, you don’t own the car at the end of the term, but you enjoy lower monthly payments and the ability to drive a new vehicle every few years. To grasp "How Much Is Jeep Wrangler Lease," it’s crucial to understand the key terms that dictate your monthly payment:

- MSRP (Manufacturer’s Suggested Retail Price) / Capitalized Cost: This is the starting price of the vehicle, similar to its purchase price. Negotiating this down, even on a lease, can significantly lower your payments.

- Residual Value: This is the estimated value of the Jeep Wrangler at the end of the lease term, expressed as a percentage of the MSRP. Wranglers are known for their strong residual values due to high demand and slower depreciation, which is a major advantage for leasing them. A higher residual value means you pay for less depreciation, resulting in lower monthly payments.

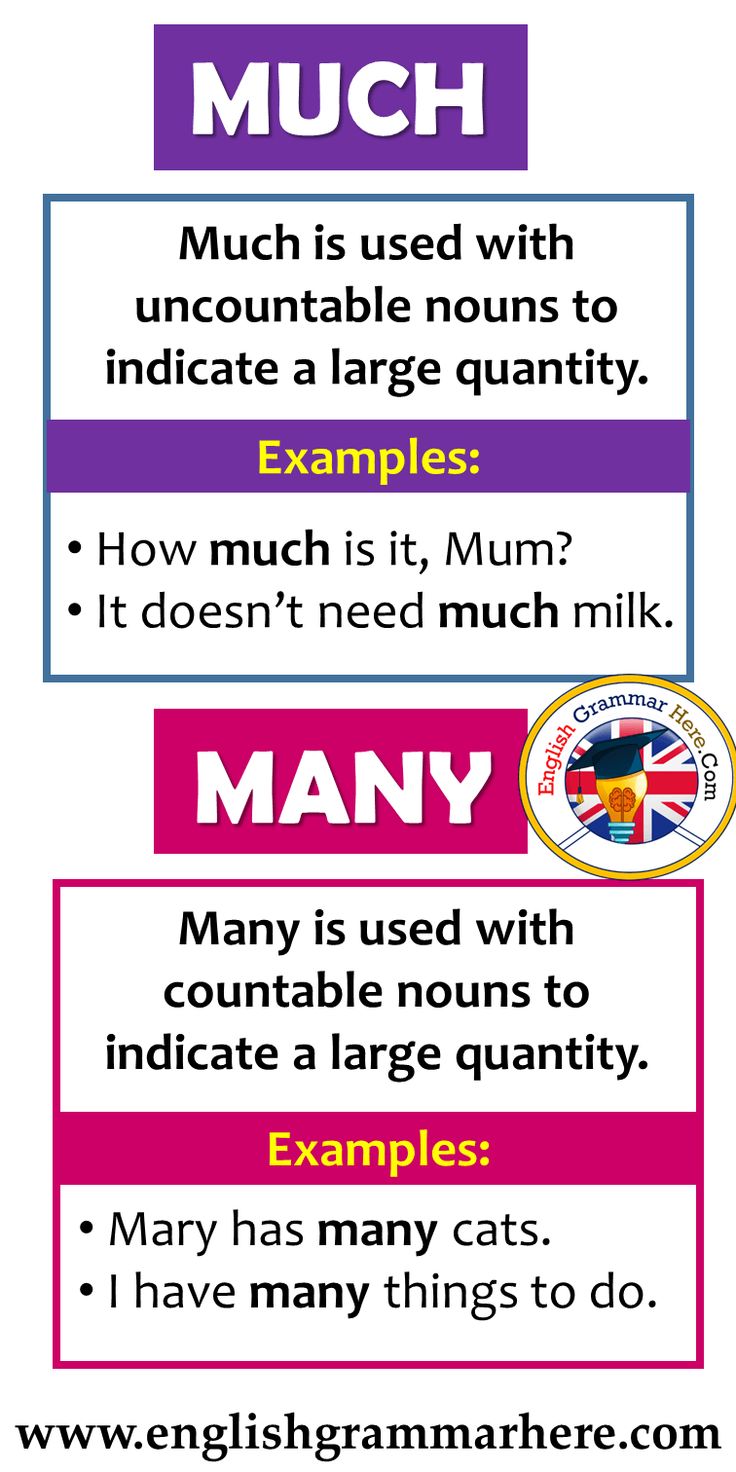

- Money Factor: This is the lease equivalent of an interest rate. It’s a very small decimal (e.g., 0.00200), which you can convert to an annual percentage rate (APR) by multiplying by 2400 (0.00200 x 2400 = 4.8% APR). A lower money factor means lower interest costs.

- Lease Term: The duration of your lease agreement, typically 24, 36, or 48 months. Shorter terms often have higher monthly payments but less total depreciation paid for, while longer terms spread out the cost, potentially lowering monthly payments.

- Mileage Allowance: The maximum number of miles you’re permitted to drive annually (e.g., 10,000, 12,000, or 15,000 miles). Exceeding this limit incurs per-mile penalties (e.g., $0.20-$0.25 per mile).

- Upfront Costs: These typically include the first month’s payment, an acquisition fee (charged by the leasing company), a security deposit (often refundable), dealer fees, registration, and sales tax. A "down payment" or "capitalized cost reduction" can lower your monthly payment but means more money out of pocket upfront.

- Disposition Fee: A fee charged at the end of the lease when you return the vehicle, covering reconditioning and administrative costs.

Factors Influencing Your Jeep Wrangler Lease Payment

The answer to "How Much Is Jeep Wrangler Lease" is rarely a single number, as it’s a dynamic figure influenced by several variables:

- Model and Trim Level: The Wrangler lineup is diverse, from the entry-level Sport to the luxurious High Altitude and the powerful Rubicon. Each trim comes with a different MSRP, directly impacting the capitalized cost and, consequently, your lease payment. The 4xe hybrid models, with their higher MSRP, will naturally have higher payments, though potential tax credits or incentives might offset some of the cost.

- MSRP (Negotiated Price): While it’s a lease, you can still negotiate the vehicle’s sale price (capitalized cost) with the dealer. A lower negotiated price directly reduces the amount you’re financing and thus your monthly payment.

- Residual Value: As mentioned, Wranglers have historically strong residual values. A 36-month lease on a popular trim might have a residual value in the 60-70% range, meaning you’re only paying for 30-40% of the vehicle’s value plus interest. This is a significant advantage compared to vehicles with lower residuals.

- Money Factor (Your Credit Score): Your creditworthiness plays a pivotal role. Lessees with excellent credit scores (typically 700+) will qualify for the lowest money factors, significantly reducing the interest portion of their monthly payment. A lower credit score will result in a higher money factor and thus higher monthly payments.

- Lease Term: Shorter terms (24-36 months) often have higher monthly payments because you’re paying off the depreciation over a shorter period. Longer terms (39-48 months) can lower your monthly payment but mean you pay more total interest over the life of the lease and are responsible for maintenance longer.

- Annual Mileage Allowance: Opting for a higher mileage allowance (e.g., 15,000 miles/year vs. 10,000 miles/year) will increase your monthly payment because the vehicle is expected to depreciate more. Choose an allowance that realistically reflects your driving habits to avoid hefty over-mileage penalties.

- Down Payment / Cap Cost Reduction: While a down payment lowers your monthly payment, it’s generally advised to put as little money down as possible on a lease. If the vehicle is totaled, you could lose that upfront cash. Instead, use a security deposit (often refundable) or roll upfront fees into the monthly payment if possible.

- Current Incentives and Promotions: Manufacturers and dealerships frequently offer special lease deals, including lower money factors, increased residual values, or cash rebates. These incentives can significantly reduce your monthly payment.

Typical Jeep Wrangler Lease Costs: A Breakdown

While precise figures fluctuate daily based on market conditions, inventory, and promotions, we can provide a general range for "How Much Is Jeep Wrangler Lease" across popular trims. These estimates assume a 36-month lease with 10,000 miles per year and good credit.

Estimated Monthly Lease Payments for Popular Jeep Wrangler Trims (36 Months / 10,000 Miles Per Year):

| Model/Trim | Approx. MSRP (2-door/4-door) | Est. Monthly Payment ($0 Down) | Est. Monthly Payment ($2,000 Down) | Est. Upfront Costs (Excl. 1st Mo. Payment) |

|---|---|---|---|---|

| Wrangler Sport | $32,000 – $37,000 | $390 – $480 | $330 – $420 | $1,500 – $2,500 |

| Wrangler Willys | $36,000 – $41,000 | $440 – $530 | $380 – $470 | $1,600 – $2,600 |

| Wrangler Sahara | $43,000 – $48,000 | $520 – $610 | $460 – $550 | $1,800 – $2,800 |

| Wrangler Rubicon | $46,000 – $52,000 | $560 – $650 | $500 – $590 | $1,900 – $3,000 |

| Wrangler High Alt. | $55,000 – $60,000 | $670 – $760 | $610 – $700 | $2,200 – $3,300 |

| Wrangler 4xe Sahara | $52,000 – $57,000 | $600 – $700 | $540 – $640 | $2,000 – $3,200 |

| Wrangler 4xe Rubicon | $60,000 – $65,000 | $700 – $800 | $640 – $740 | $2,400 – $3,600 |

Disclaimer: These figures are estimates and can vary significantly based on your specific location, dealership promotions, negotiation skills, credit score, current market demand, and the exact configuration of the vehicle. Always get a personalized quote from multiple dealerships. Upfront costs typically include acquisition fees, document fees, first month’s payment, registration, and taxes.

Strategies to Get a Better Jeep Wrangler Lease Deal

Navigating the leasing process can feel complex, but with the right approach, you can significantly improve your deal:

- Shop Around Extensively: Don’t settle for the first offer. Contact multiple Jeep dealerships (both local and potentially out-of-state) and compare their lease quotes. Pit them against each other to encourage competitive pricing.

- Negotiate the Capitalized Cost (Sales Price): Remember, even on a lease, the starting price of the vehicle matters. Negotiate the MSRP as if you were buying the car outright. Every dollar you shave off the cap cost translates to savings on your monthly payment.

- Know Your Money Factor and Residual Value: Before you step into the dealership, research the current money factor and residual value for the specific Wrangler trim and lease term you’re interested in. Websites like Edmunds Forums, Leasehackr, and Kelley Blue Book can provide this information. This knowledge gives you leverage in negotiations.

- Inquire About Current Lease Incentives: Ask the dealer about any manufacturer-to-consumer incentives, regional lease specials, or loyalty programs that might apply to the Wrangler. Sometimes, these aren’t automatically offered.

- Be Flexible with Trim and Features: If your budget is tight, consider a slightly lower trim level or fewer optional extras. The difference in MSRP can significantly impact your monthly payment.

- Consider the Timing: Lease deals often improve towards the end of the month, quarter, or year as dealerships try to meet sales quotas. New model year releases can also spur deals on outgoing models.

- Limit Your Down Payment: While a down payment lowers your monthly payment, it’s a risk. If the vehicle is stolen or totaled shortly after you lease it, your insurance will pay off the lease, but you won’t get your down payment back. It’s often better to pay a slightly higher monthly fee than a large lump sum upfront.

- Understand All Fees: Get a clear breakdown of all fees: acquisition fee, disposition fee, documentation fees, registration, and taxes. Some fees are negotiable, others are not, but knowing them prevents surprises.

Important Considerations Before Leasing a Jeep Wrangler

While leasing offers many advantages, it’s not for everyone, especially with a vehicle like the Wrangler.

- Mileage Limitations: This is perhaps the most critical consideration. If you plan extensive off-roading adventures or long commutes, a standard 10,000 or 12,000-mile allowance might be too restrictive. Exceeding your limit can be costly (typically $0.20-$0.25 per mile).

- Wear and Tear: Jeeps are meant to be driven and enjoyed, but excessive wear and tear beyond "normal" can incur charges at lease end. Off-roading can lead to scratches, dents, and interior wear that might be deemed excessive. Understand the lease agreement’s definition of "normal wear and tear."

- Modifications: Leasing means you don’t own the vehicle, so significant modifications are generally not permitted or must be reversible without damage. If you plan major lifts, tire changes, or aftermarket accessories, leasing might not be the best option.

- Early Termination Penalties: Breaking a lease early is almost always very expensive, often requiring you to pay the remaining payments plus substantial fees. Ensure you can commit to the full lease term.

- Insurance Requirements: Lease agreements often require higher insurance coverage (e.g., higher liability limits, gap insurance) than you might carry if you owned the vehicle outright. Factor this into your budget.

Conclusion

Determining "How Much Is Jeep Wrangler Lease" is a multi-faceted inquiry, influenced by everything from the specific trim you desire to your credit score and the current market conditions. While monthly payments can range from under $400 for a basic Sport model to over $800 for a fully loaded Rubicon 4xe, the fundamental appeal of leasing a Wrangler lies in its lower monthly cost compared to financing, coupled with the flexibility of driving a new model every few years under warranty.

By thoroughly understanding the components of a lease, diligently researching current market values, and engaging in smart negotiation, you can secure a favorable deal that puts you in the driver’s seat of that iconic, adventure-ready machine. A Jeep Wrangler lease can be an excellent way to experience the legendary capabilities and unique lifestyle it offers without the long-term commitment of ownership, provided it aligns with your driving habits and financial goals.

Frequently Asked Questions (FAQ)

Q1: Is leasing a Jeep Wrangler cheaper than buying it?

A1: Typically, yes, the monthly payments for a lease are lower than loan payments for the same vehicle because you are only paying for the depreciation of the vehicle during your lease term, plus interest and fees, rather than the entire purchase price. However, over the long term, if you continuously lease, you will always have a car payment and won’t build equity.

Q2: Can I negotiate the lease price of a Jeep Wrangler?

A2: Absolutely. You can (and should) negotiate the capitalized cost (which is essentially the sale price of the vehicle) just as you would if you were buying. A lower capitalized cost directly translates to lower monthly payments. You can also try to negotiate the money factor and other fees, though these might be less flexible.

Q3: What happens if I go over my mileage limit on a leased Wrangler?

A3: If you exceed your annual mileage allowance, you will be charged an over-mileage penalty, typically ranging from $0.20 to $0.25 per mile. These charges can add up quickly, so it’s crucial to select a mileage allowance that accurately reflects your driving habits.

Q4: Can I modify my leased Jeep Wrangler?

A4: Generally, significant modifications are not permitted on a leased vehicle because you don’t own it. Any modifications must typically be reversible without causing damage to the vehicle. Customizations like lifts, larger tires, or drilling into the body may result in charges for excessive wear and tear or require you to return the vehicle to its original condition at your expense. Minor, easily reversible cosmetic changes might be acceptable.

Q5: What credit score do I need to lease a Jeep Wrangler?

A5: To qualify for the best lease rates (lowest money factor), you’ll generally need an excellent credit score, typically 700 FICO or higher. While you might be approved with a lower score, the money factor will be higher, leading to increased monthly payments.

Q6: Can I buy my Jeep Wrangler at the end of the lease?

A6: Yes, most lease agreements include a purchase option. The buyout price is usually the residual value stated in your lease contract, plus any applicable taxes and fees. If you love your Wrangler and its market value is higher than the residual value, buying it out can be a smart move.

Q7: Are there any hidden fees in a Jeep Wrangler lease?

A7: While not "hidden," some fees are often not included in the advertised monthly payment. These typically include an acquisition fee (charged at the beginning), a disposition fee (charged at the end if you return the car), documentation fees, registration, and sales tax. Always ask for a full breakdown of all upfront and end-of-lease costs.