How Much To Lease a 2019 Jeep Wrangler: A Comprehensive Guide

How Much To Lease a 2019 Jeep Wrangler: A Comprehensive Guide jeeps.truckstrend.com

The Jeep Wrangler, an icon of adventure and rugged capability, has consistently captivated drivers with its distinctive design and off-road prowess. For many, the allure of owning a Wrangler is strong, but the upfront cost or commitment of purchasing can be a barrier. This is where leasing comes into play, offering a potentially more accessible path to experiencing the open-air freedom and go-anywhere spirit of this legendary vehicle.

While leasing a brand-new vehicle is a common practice, exploring the option of leasing a specific older model, like the 2019 Jeep Wrangler (the JL generation), presents unique considerations. This comprehensive guide will delve into the intricacies of how much it costs to lease a 2019 Jeep Wrangler, exploring the factors that influence pricing, the feasibility of such a lease today, and practical advice for navigating the process.

How Much To Lease a 2019 Jeep Wrangler: A Comprehensive Guide

Understanding the Basics of Leasing a 2019 Jeep Wrangler

Leasing, at its core, is paying for the depreciation of a vehicle over a set period, plus interest (known as the money factor) and various fees. Unlike buying, you don’t own the vehicle at the end of the term; you return it or have the option to purchase it at a predetermined residual value. For a 2019 Jeep Wrangler, which is now a used vehicle, the leasing landscape differs significantly from a traditional new-car lease.

Key Lease Components to Consider:

- Capitalized Cost (Cap Cost): This is essentially the "selling price" of the vehicle for lease calculation purposes. For a used 2019 Wrangler, it’s its current market value. Negotiating this is crucial.

- Residual Value: The projected value of the vehicle at the end of the lease term. A higher residual value means less depreciation, which translates to lower monthly payments. Jeeps are known for strong resale values, which generally bodes well for leasing.

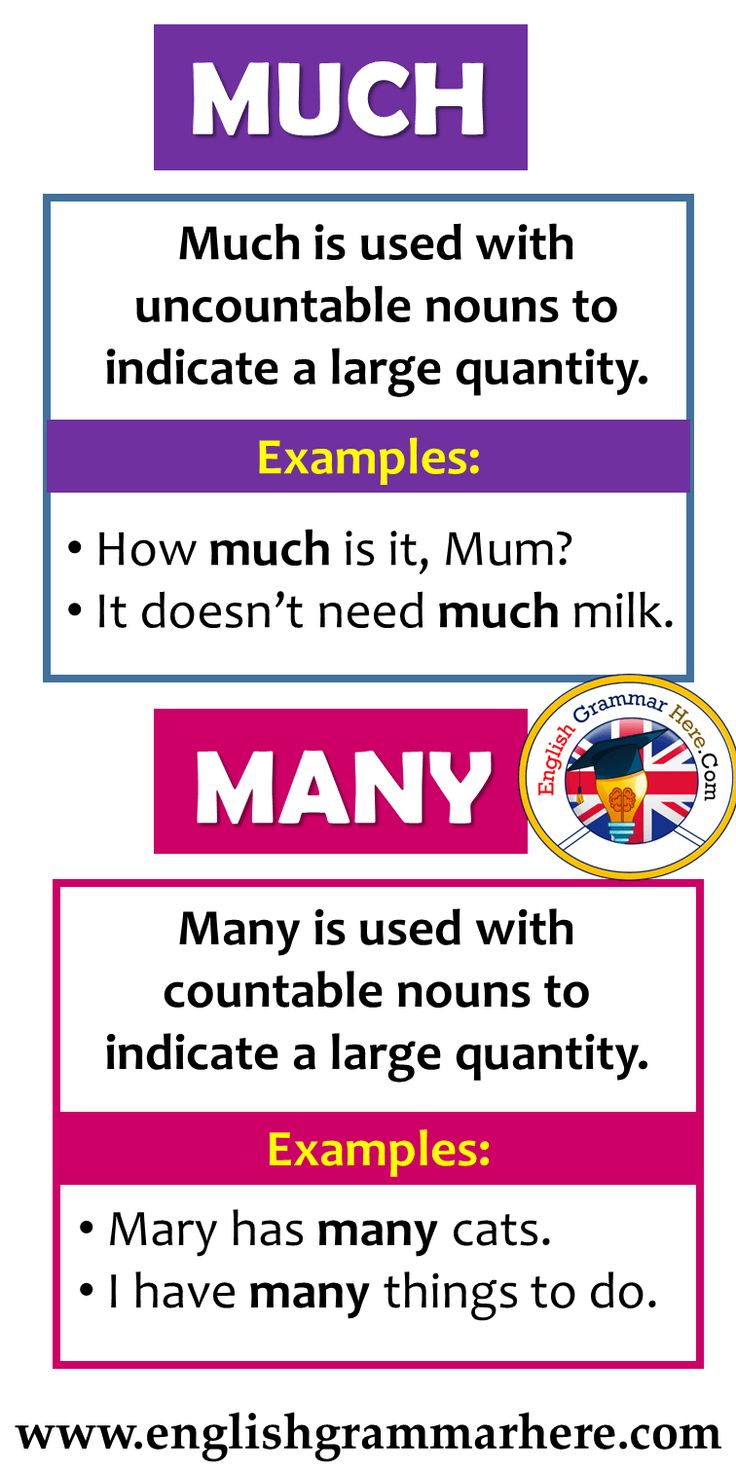

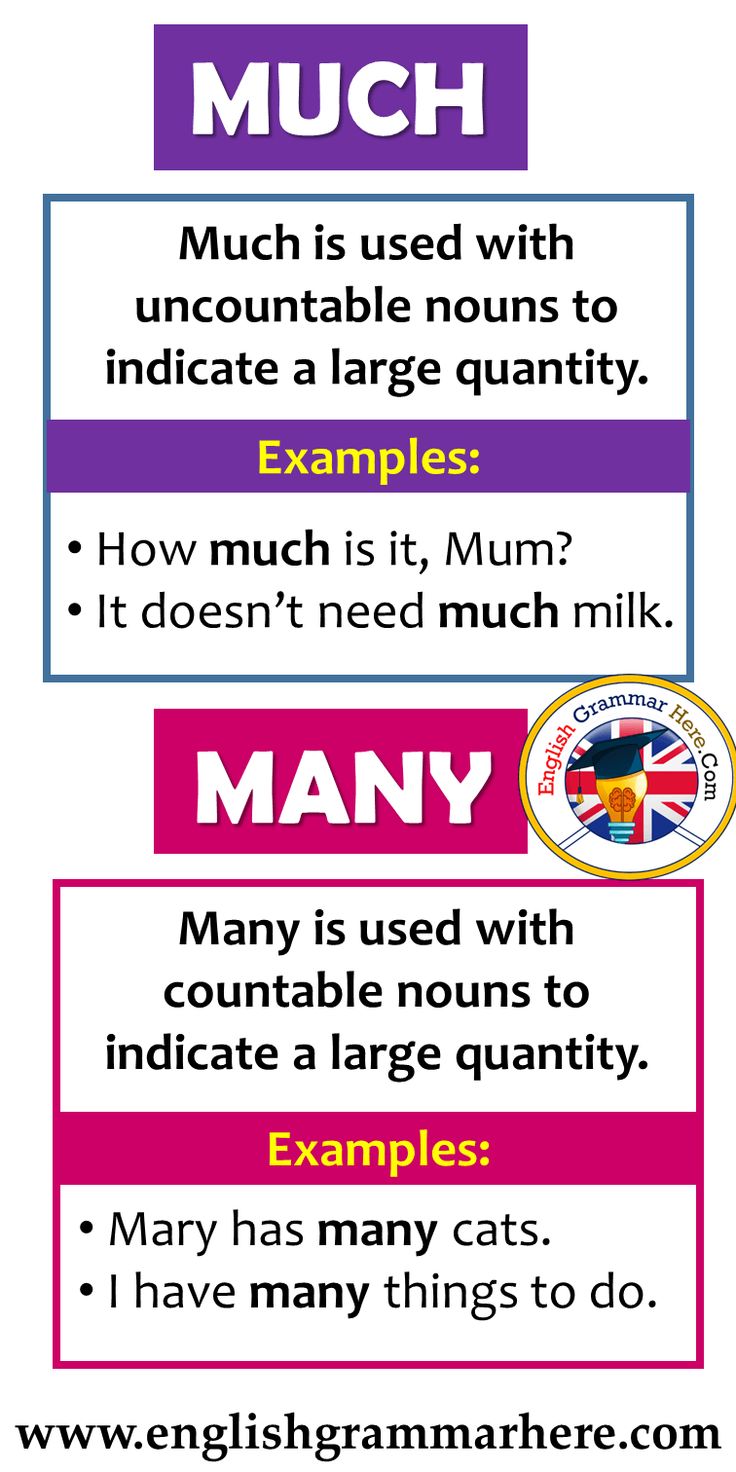

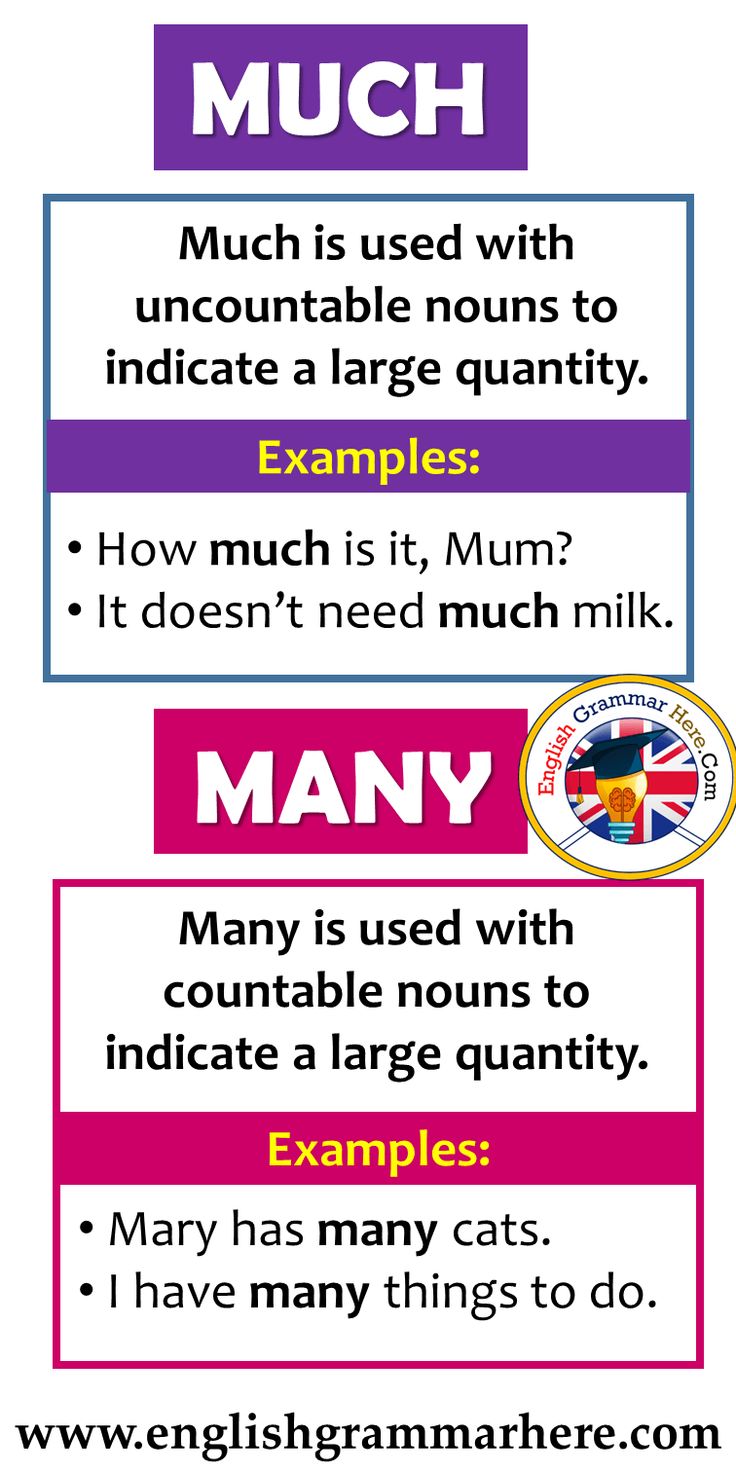

- Money Factor: This is the interest rate equivalent applied to your lease. It’s expressed as a small decimal (e.g., 0.00200) and is heavily influenced by your credit score.

- Lease Term: The duration of your lease, typically 24, 36, or 48 months. Shorter terms often have higher monthly payments but less overall depreciation.

- Mileage Allowance: The maximum number of miles you can drive annually without incurring penalties. Common allowances are 10,000, 12,000, or 15,000 miles per year. Exceeding this can cost $0.15-$0.25 per mile.

- Taxes and Fees: These include acquisition fees, documentation fees, registration, and sales tax, which vary by state and dealership.

The Reality of Leasing a 2019 Model Today:

It’s important to clarify that you cannot obtain a new-car lease on a 2019 Jeep Wrangler from a dealership today (in 2024). Traditional new-car leases are reserved for current or very recent model years. However, there are two primary ways one might "lease" a 2019 Wrangler now:

- Used Car Lease: Some specialized financial institutions, banks, or credit unions offer leases on used vehicles. These are less common than new car leases and often come with different terms (e.g., shorter terms, potentially higher money factors).

- Lease Takeover/Assumption: This involves taking over the existing lease agreement from someone who wants to get out of their current 2019 Wrangler lease early. This can often be a great way to get into a used vehicle with potentially favorable terms, as the initial depreciation period has already been covered by the original lessee.

Our discussion on "How Much To Lease" will consider both the historical context of what a new 2019 Wrangler lease would have cost and the current realities of leasing a used 2019 model.

Factors Influencing Your 2019 Jeep Wrangler Lease Cost

Several variables play a significant role in determining your monthly lease payment for a 2019 Jeep Wrangler:

- Original MSRP and Trim Level (Historical): When the 2019 Wrangler was new, its sticker price and specific trim (Sport, Sport S, Sahara, Rubicon, Moab) directly impacted the capitalized cost. Higher trims with more features meant higher payments.

- Current Market Value (Used Lease): For a used 2019 Wrangler lease, the current fair market value of the specific vehicle (influenced by mileage, condition, and trim) becomes the capitalized cost. This varies significantly.

- Residual Value (Then & Now): Jeep Wranglers generally boast excellent resale values, which translates to strong residual values. A higher residual percentage (e.g., 60% vs. 50% of the Cap Cost) means less depreciation to pay for, resulting in lower monthly payments.

- Money Factor (Interest Rate): Your credit score is paramount here. An excellent credit score (typically 700+) will secure the lowest money factor, leading to lower interest charges over the lease term. Used car leases might have higher money factors than new car leases.

- Lease Term: A 36-month lease is common. Shorter terms (24 months) usually have higher monthly payments because depreciation is condensed, while longer terms (48 months) might have lower payments but you pay more interest over time and the car is older at lease end.

- Annual Mileage Allowance: Lower mileage allowances (e.g., 10,000 miles/year) result in lower monthly payments compared to higher allowances (e.g., 15,000 miles/year), as less depreciation is expected.

- Down Payment (Cap Cost Reduction): While a down payment lowers your monthly payment, it’s generally advised against in leasing, as it’s money you lose if the vehicle is totaled.

- Trade-in Value: If you have a trade-in, its value can be applied to reduce the capitalized cost, effectively lowering your monthly payment.

- Taxes and Fees: These upfront costs or amortized charges can add to the due-at-signing amount and the overall lease cost.

Estimating Lease Payments for a 2019 Jeep Wrangler

Providing exact figures for leasing a 2019 Jeep Wrangler today is challenging due to the variability of used car values, lender offerings for used car leases, and the rarity of active lease takeover opportunities. However, we can offer estimates based on historical data (for when it was new) and general market trends for used car leases.

Scenario 1: New Lease (If it were 2019-2020)

When the 2019 Jeep Wrangler JL was new, lease deals were competitive. Payments would have varied significantly by trim, options, and region. Here are approximate historical new lease payment ranges for a 36-month, 10,000-mile/year lease with excellent credit and $0 down (excluding taxes and fees due at signing):

- 2019 Jeep Wrangler Sport (2-door):

- Estimated MSRP: $28,000 – $32,000

- Estimated Monthly Payment: $280 – $350

- 2019 Jeep Wrangler Sport S (4-door Unlimited):

- Estimated MSRP: $34,000 – $38,000

- Estimated Monthly Payment: $350 – $420

- 2019 Jeep Wrangler Sahara Unlimited:

- Estimated MSRP: $40,000 – $45,000

- Estimated Monthly Payment: $420 – $500

- 2019 Jeep Wrangler Rubicon Unlimited:

- Estimated MSRP: $44,000 – $50,000+

- Estimated Monthly Payment: $480 – $600+

Scenario 2: Used Car Lease (Current – 2024)

Leasing a used 2019 Jeep Wrangler today will depend heavily on its current market value, which can range from $25,000 to $40,000+ depending on trim, mileage, and condition. Used car leases often have:

- Shorter Terms: Often 24-36 months.

- Higher Money Factors: Interest rates tend to be higher for used vehicle leases.

- Lower Residual Percentage (of current value): Though the Wrangler holds value well, the depreciation calculation starts from its current, already depreciated value.

Given these variables, providing precise monthly payments is difficult without a specific vehicle and lender. However, a rough estimate for a used 2019 Wrangler lease (e.g., a Sport S with a current market value of $30,000) might be in the range of $400 – $600+ per month for a 36-month, 10,000-mile lease with good credit and minimal money down. This higher cost reflects the less favorable terms of used car leasing compared to new car programs.

Tips for Getting the Best Lease Deal on a 2019 Jeep Wrangler (Used or Takeover)

- Negotiate the Capitalized Cost: Even with a used car lease, the "selling price" of the vehicle is negotiable. Treat it like a purchase and aim for the lowest possible price.

- Shop Around for Lenders: Not all financial institutions offer used car leases. Research banks and credit unions known for them (e.g., Ally, US Bank, Chase often have used car lease programs).

- Explore Lease Takeovers: Websites like Swapalease.com or LeaseTrader.com allow you to find individuals looking to transfer their existing leases. This can often be the most cost-effective way to get into a 2019 Wrangler, potentially with lower payments or shorter terms than a new used car lease.

- Know Your Credit Score: A strong credit score is your biggest asset for securing a favorable money factor.

- Understand All Fees: Scrutinize acquisition fees, documentation fees, and any other charges.

- Avoid Large Down Payments: Put as little money down as possible. If the vehicle is totaled, you lose that money. Consider refundable security deposits if offered, which can sometimes lower the money factor.

Challenges and Considerations When Leasing a 2019 Jeep Wrangler

- Limited Availability of Leasing Options: As mentioned, traditional new leases are out. Used car leases are niche, and lease takeovers depend on market availability.

- Higher Money Factors for Used Leases: Expect to pay a higher interest rate equivalent compared to new car lease programs.

- Mileage and Wear & Tear: Wranglers are often used for adventure. Be mindful of mileage limits and the condition of the vehicle at lease end. Off-roading can lead to "excessive wear and tear" beyond normal use, incurring penalties.

- Modifications: Leasing agreements typically restrict modifications. For a Jeep Wrangler, known for its aftermarket customization, this can be a significant limitation. Any modifications must be removed before returning the vehicle, or you may face charges.

- Insurance Costs: Wranglers can have higher insurance premiums due to their popularity and perceived risk. Factor this into your total monthly cost.

Comprehensive Lease Price Table: 2019 Jeep Wrangler

This table provides estimated lease information for the 2019 Jeep Wrangler, differentiating between a historical new lease (when the car was new) and a current used lease (today, 2024). All figures are estimates and can vary significantly based on location, credit score, specific vehicle condition, and lender.

| Lease Scenario & Trim Level | Original MSRP (New) / Current Market Value (Used) | Lease Term | Annual Mileage | Estimated Residual Value (Percentage) | Estimated Money Factor (APR Equivalent) | Estimated Monthly Payment ($0 Down, excl. tax/fees) | Estimated Due at Signing (First month, fees, excl. tax) |

|---|---|---|---|---|---|---|---|

| New Lease (circa 2019-2020) | |||||||

| 2019 Wrangler Sport (2-Door) | ~$28,000 – $32,000 | 36 Months | 10,000 Miles | 60% – 65% | 0.00120 – 0.00180 (2.9% – 4.3%) | $280 – $350 | $700 – $1,200 |

| 2019 Wrangler Sport S (4-Door) | ~$34,000 – $38,000 | 36 Months | 10,000 Miles | 58% – 63% | 0.00120 – 0.00180 (2.9% – 4.3%) | $350 – $420 | $800 – $1,500 |

| 2019 Wrangler Sahara (4-Door) | ~$40,000 – $45,000 | 36 Months | 10,000 Miles | 57% – 62% | 0.00130 – 0.00190 (3.1% – 4.6%) | $420 – $500 | $900 – $1,800 |

| 2019 Wrangler Rubicon (4-Door) | ~$44,000 – $50,000+ | 36 Months | 10,000 Miles | 56% – 61% | 0.00130 – 0.00190 (3.1% – 4.6%) | $480 – $600+ | $1,000 – $2,000+ |

| Used Lease (Current – 2024) | |||||||

| 2019 Wrangler Sport (Good Cond.) | ~$25,000 – $30,000 | 24-36 Months | 10,000 Miles | 45% – 55% (of current value) | 0.00250 – 0.00400 (6.0% – 9.6%) | $400 – $550+ | Highly Variable: $1,500 – $3,000+ |

| 2019 Wrangler Sahara (Good Cond.) | ~$30,000 – $38,000 | 24-36 Months | 10,000 Miles | 45% – 55% (of current value) | 0.00250 – 0.00400 (6.0% – 9.6%) | $450 – $650+ | Highly Variable: $2,000 – $4,000+ |

| 2019 Wrangler Rubicon (Good Cond.) | ~$35,000 – $45,000+ | 24-36 Months | 10,000 Miles | 45% – 55% (of current value) | 0.00250 – 0.00400 (6.0% – 9.6%) | $500 – $750+ | Highly Variable: $2,500 – $5,000+ |

| Note: "Estimated Residual Value" for used leases refers to the percentage of the current market value at the lease start, not the original MSRP. Money factors for used leases are typically higher. "Due at Signing" typically includes first month’s payment, acquisition fee, and security deposit (if applicable). Taxes and local fees are extra. Lease takeovers will have their own unique, pre-determined terms. |

Frequently Asked Questions (FAQ) About Leasing a 2019 Jeep Wrangler

Q1: Can I lease a 2019 Jeep Wrangler as a new car today?

A1: No, a 2019 model is no longer considered "new." Traditional new car leases are for current or very recent model years.

Q2: Is it possible to lease a used 2019 Jeep Wrangler?

A2: Yes, but it’s less common than new car leasing. Some specialized financial institutions, banks, and credit unions offer used car leases. Your best bet might be a lease takeover.

Q3: What is a "lease takeover" and how does it relate to a 2019 Wrangler?

A3: A lease takeover (or assumption) is when you take over the remaining payments and terms of an existing lease from someone else. For a 2019 Wrangler, this means you’d be finishing someone else’s original lease. This can often lead to better terms than a new used car lease, as the initial, steepest depreciation has already occurred.

Q4: Do Jeep Wranglers hold their value well, which is good for leasing?

A4: Yes, Jeep Wranglers are known for their exceptional resale value. This generally results in higher residual values in leasing calculations, which translates to lower monthly payments (especially for new car leases).

Q5: What happens if I go over my mileage allowance on a leased Wrangler?

A5: You will incur a penalty for each mile over the limit, typically ranging from $0.15 to $0.25 per mile. These charges are collected at lease end.

Q6: Can I modify a leased 2019 Jeep Wrangler for off-roading?

A6: Generally, no. Lease agreements prohibit significant modifications that alter the vehicle’s original condition or value. You would be responsible for returning the vehicle to its original state or paying for the modifications at lease end. Minor, easily reversible cosmetic changes might be permissible, but always check your lease agreement.

Q7: What credit score do I need to lease a 2019 Jeep Wrangler?

A7: An excellent credit score (typically 700-740+) will qualify you for the best money factors and terms. Good credit (660-699) might still qualify but with slightly higher rates. Lower scores may make it difficult or impossible to get a favorable lease.

Conclusion

Leasing a 2019 Jeep Wrangler today presents a different set of challenges and opportunities compared to leasing a brand-new model. While the traditional new car lease programs for the 2019 model year are long gone, options like used car leases from specific lenders or, more commonly, lease takeovers, can provide a pathway to experiencing the iconic Wrangler without a full purchase commitment.

Understanding the core components of a lease – capitalized cost, residual value, and money factor – is crucial, especially when dealing with a used vehicle. Always negotiate the "selling price" of the car, shop around for the best money factor, and thoroughly read all terms and conditions, paying close attention to mileage limits and wear-and-tear policies. For a vehicle as unique and desirable as the Jeep Wrangler, making an informed decision ensures you get the best possible deal and enjoy your adventure to the fullest.