Jeep Cherokee Lease Cost: Your Comprehensive Guide to Driving Home a Legend

Jeep Cherokee Lease Cost: Your Comprehensive Guide to Driving Home a Legend jeeps.truckstrend.com

The allure of a Jeep Cherokee is undeniable. Its iconic design, rugged capability, and comfortable interior make it a popular choice for families, adventurers, and daily commuters alike. While purchasing a new vehicle outright or financing it are common routes, leasing has emerged as an increasingly attractive option for many. Understanding the Jeep Cherokee lease cost is paramount to making an informed decision that aligns with your lifestyle and financial goals. This comprehensive guide will break down every facet of leasing a Jeep Cherokee, from the foundational terms to practical tips for securing the best deal.

Understanding the Fundamentals of a Lease

Jeep Cherokee Lease Cost: Your Comprehensive Guide to Driving Home a Legend

Before diving into the specifics of the Jeep Cherokee, it’s essential to grasp the core components that dictate any lease agreement. Unlike purchasing, where you pay for the entire value of the car, leasing means you are essentially paying for the depreciation of the vehicle over a set period, plus interest and fees.

Key terms you’ll encounter include:

- MSRP (Manufacturer’s Suggested Retail Price): This is the sticker price of the vehicle, serving as the starting point for negotiations.

- Capitalized Cost (Cap Cost): This is the agreed-upon price of the vehicle that the lease is based on. It’s similar to the selling price in a purchase and is highly negotiable. Lowering the cap cost directly reduces your monthly payment.

- Residual Value: This is the estimated value of the vehicle at the end of the lease term. It’s expressed as a percentage of the MSRP and is set by the leasing company. A higher residual value means you pay for less depreciation, resulting in lower monthly payments.

- Money Factor (Lease Factor): This is the interest rate equivalent for a lease, expressed as a very small decimal (e.g., 0.0025). To convert it to an annual percentage rate (APR), multiply by 2400 (0.0025 x 2400 = 6%). A lower money factor means lower interest charges.

- Down Payment (Capitalized Cost Reduction): An upfront payment made at the lease signing to reduce the capitalized cost and, consequently, the monthly payments.

- Acquisition Fee: A fee charged by the leasing company for setting up the lease.

- Disposition Fee: A fee charged at the end of the lease for processing the vehicle’s return.

- Mileage Allowance: The maximum number of miles you are permitted to drive annually without incurring penalties. Common allowances are 10,000, 12,000, or 15,000 miles per year. Exceeding this limit results in per-mile charges (e.g., $0.15-$0.25 per mile).

- Lease Term: The duration of the lease, typically 24, 36, 39, or 48 months.

Factors Influencing Jeep Cherokee Lease Cost

The monthly payment for a Jeep Cherokee lease isn’t a fixed figure; it’s a dynamic sum influenced by several variables. Understanding these factors will empower you to navigate the leasing process effectively.

- Trim Level and Features: The Jeep Cherokee comes in various trims, from the entry-level Latitude to the adventurous Trailhawk and the luxurious Overland. Each trim has a different MSRP, directly impacting the capitalized cost and, thus, the lease payment. Higher trims with more features will naturally have higher lease costs.

- MSRP (Manufacturer’s Suggested Retail Price): The starting point for any lease calculation. While you negotiate the capitalized cost, the MSRP still plays a role in the residual value calculation.

- Residual Value: The Jeep Cherokee generally holds its value reasonably well, which can translate to favorable residual values for leasing. A higher residual percentage means you’re paying for less depreciation, leading to lower monthly payments. Newer models or popular trims tend to have better residuals.

- Money Factor (Lease Interest Rate): This is heavily influenced by your credit score. Lessees with excellent credit (typically 700+) will qualify for the lowest money factors, significantly reducing the interest portion of their monthly payment. A poor credit score will result in a higher money factor, making the lease more expensive.

- Down Payment: While a larger down payment reduces your monthly outlay, it’s generally advised to put down as little as possible on a lease. If the vehicle is totaled, you might lose the entirety of your down payment. Often, a "sign and drive" lease with zero down (excluding first month’s payment, taxes, and fees) is preferred for safety, though it results in higher monthly payments.

- Lease Term Length: Shorter lease terms (e.g., 24-36 months) often have higher monthly payments because the depreciation is condensed into a shorter period. However, they also expose you to fewer maintenance costs outside the warranty. Longer terms (e.g., 48 months) can offer lower monthly payments but mean you pay more in total interest and may face maintenance costs as the warranty expires.

- Mileage Allowance: Your driving habits directly impact your lease cost. If you drive more, you’ll need a higher mileage allowance (12k or 15k miles/year), which increases your monthly payment. Opting for a lower mileage allowance (10k miles/year) will reduce your monthly cost but carries the risk of expensive overage fees if exceeded.

- Location, Taxes, and Fees: State and local taxes on leases vary significantly. Some states tax the entire vehicle price upfront, while others tax only the monthly payment. Registration fees, title fees, and dealer documentation fees also add to the drive-off costs.

- Current Promotions and Incentives: Manufacturers frequently offer special lease deals, low money factors, or capitalized cost reductions on specific models or trims. These incentives can dramatically lower your effective monthly payment. Always check Jeep’s official website and local dealer specials.

Calculating Your Jeep Cherokee Lease Payment

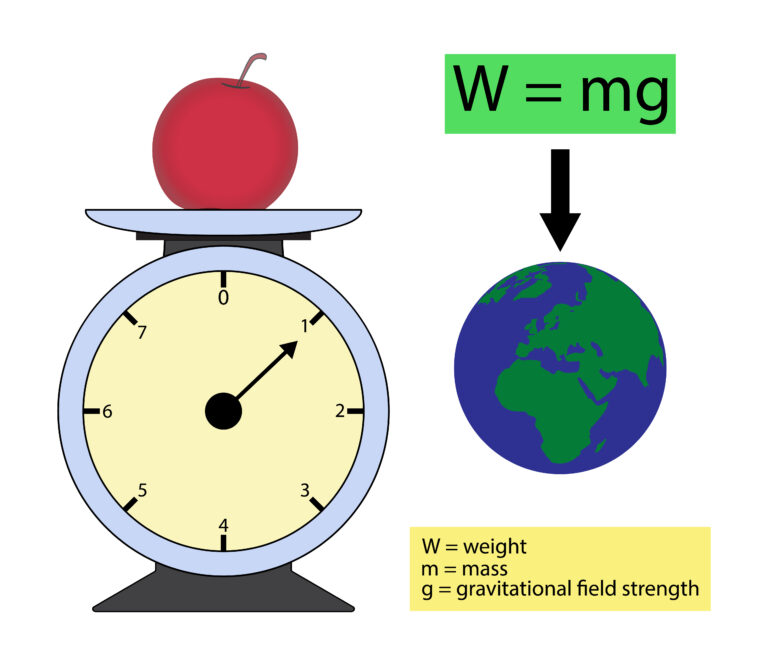

While complex formulas exist, a simplified way to understand your monthly lease payment is:

Monthly Depreciation + Monthly Finance Charge + Taxes/Fees = Monthly Payment

Let’s break it down:

- Monthly Depreciation: (Capitalized Cost – Residual Value) / Lease Term (in months)

- Monthly Finance Charge: (Capitalized Cost + Residual Value) x Money Factor

- Taxes/Fees: Varies by state and specific fees.

Example (Hypothetical):

- Jeep Cherokee Latitude Lux MSRP: $34,000

- Negotiated Capitalized Cost: $32,000

- Residual Value (55% of MSRP): $18,700 (0.55 * $34,000)

- Lease Term: 36 months

- Money Factor: 0.0020 (equivalent to 4.8% APR)

- Monthly Depreciation: ($32,000 – $18,700) / 36 = $13,300 / 36 = $369.44

- Monthly Finance Charge: ($32,000 + $18,700) 0.0020 = $50,700 0.0020 = $101.40

- Base Monthly Payment (before taxes/fees): $369.44 + $101.40 = $470.84

Add applicable sales tax (e.g., 7% of monthly payment) and any prorated fees. This example demonstrates how each component contributes to your final payment. The key takeaway: negotiate the capitalized cost as if you were buying the car, as this is the biggest lever you have.

Benefits of Leasing a Jeep Cherokee

Leasing a Jeep Cherokee offers several compelling advantages:

- Lower Monthly Payments: Compared to financing the same vehicle for the same term, lease payments are typically significantly lower because you’re only paying for depreciation, not the full purchase price.

- New Car Every Few Years: Leasing allows you to drive the latest models with the newest technology and safety features more frequently.

- Warranty Coverage: Most lease terms (e.g., 36 months) align with the factory bumper-to-bumper warranty, meaning most unexpected repairs are covered, saving you from major out-of-pocket expenses.

- Less Hassle at End of Term: At the end of the lease, you simply return the vehicle to the dealership. You avoid the complexities of selling a used car or negotiating a trade-in value.

- Potential Tax Benefits for Businesses: For business owners, lease payments can often be deducted as a business expense, offering tax advantages.

Potential Challenges and Solutions

While leasing offers benefits, it’s crucial to be aware of potential pitfalls:

- Mileage Overage Fees: Exceeding your agreed-upon mileage allowance can be costly (e.g., $0.15-$0.25 per mile).

- Solution: Accurately estimate your annual mileage upfront. If you find yourself driving more than expected, consider buying additional miles from the leasing company before your lease ends, as it’s often cheaper than the penalty.

- Excessive Wear and Tear: Damage beyond "normal wear and tear" (e.g., large dents, deep scratches, stained interior) will incur charges.

- Solution: Take good care of the vehicle. Address minor damage before returning the car; sometimes, independent repair shops can fix issues for less than the dealer charges.

- Early Termination Fees: Getting out of a lease early is often very expensive, as you’re typically responsible for the remaining payments and additional fees.

- Solution: Only lease if you are confident you can commit to the full term. Explore lease transfer services if circumstances change, though finding someone to take over your lease can be challenging.

- Limited Customization: Modifying a leased vehicle is generally prohibited, as you don’t own it.

- Solution: If customization is a priority, purchasing might be a better option.

Tips for Getting the Best Jeep Cherokee Lease Deal

Securing an optimal lease deal requires research and negotiation:

- Research Current Incentives: Check Jeep’s official website and local dealership sites for ongoing lease specials, low money factor offers, or capitalized cost reductions.

- Negotiate the Capitalized Cost (Selling Price): This is the most crucial step. Treat the lease negotiation like a purchase negotiation. Aim for a price below MSRP.

- Shop Around: Get quotes from multiple dealerships. Competition can drive down prices.

- Understand All Fees: Ask for a clear breakdown of all fees: acquisition, disposition, documentation, and government fees.

- Focus on the Money Factor and Residual Value: While you can’t directly negotiate the residual, knowing it helps you assess the deal. Always ask for the money factor and compare it.

- Know Your Credit Score: A strong credit score is your best asset for securing a low money factor.

- Don’t Be Afraid to Walk Away: If the deal doesn’t feel right, be prepared to leave. There will always be another opportunity.

- Consider a "Sign and Drive" Lease: While it results in higher monthly payments, it minimizes your upfront out-of-pocket expense and reduces your risk if the car is totaled.

Estimated Jeep Cherokee Lease Cost Table (Hypothetical)

Please note: These figures are estimates based on general market trends and hypothetical conditions. Actual lease costs will vary significantly based on your location, credit score, current incentives, dealership negotiation, and specific vehicle configuration. Always get a personalized quote.

| Trim Level | Lease Term (Months) | Annual Mileage (Miles) | Estimated Monthly Payment (Excluding Tax/Fees) | Estimated Down Payment (Drive-Off) | Estimated Drive-Off Includes: |

|---|---|---|---|---|---|

| Latitude | 36 | 10,000 | $360 – $420 | $1,999 – $2,999 | 1st month, Acquisition, Doc, Tags |

| Latitude Plus | 36 | 12,000 | $390 – $450 | $1,999 – $2,999 | 1st month, Acquisition, Doc, Tags |

| Limited | 36 | 10,000 | $430 – $500 | $2,499 – $3,499 | 1st month, Acquisition, Doc, Tags |

| Limited | 39 | 12,000 | $420 – $480 | $2,499 – $3,499 | 1st month, Acquisition, Doc, Tags |

| Trailhawk | 36 | 10,000 | $470 – $550 | $2,999 – $3,999 | 1st month, Acquisition, Doc, Tags |

| Overland | 36 | 12,000 | $520 – $620 | $3,499 – $4,499 | 1st month, Acquisition, Doc, Tags |

| Latitude (Zero Down) | 36 | 10,000 | $420 – $480 | $0 (Plus 1st month, fees) | 1st month, Acquisition, Doc, Tags |

Note: "Estimated Down Payment (Drive-Off)" typically covers the first month’s payment, acquisition fee, dealer documentation fee, and government fees (tags/title). "Zero Down" means no capitalized cost reduction, but you still pay the first month’s payment and upfront fees at signing.

Frequently Asked Questions (FAQ) about Jeep Cherokee Lease Cost

Q1: Is leasing a Jeep Cherokee cheaper than buying?

A1: Monthly lease payments are typically lower than finance payments for the same vehicle, as you’re only paying for depreciation. However, over the long term, purchasing and keeping a vehicle often costs less than continually leasing new cars.

Q2: What credit score do I need to lease a Jeep Cherokee?

A2: While specific requirements vary, generally, a good to excellent credit score (700+) is needed to qualify for the best lease rates (lowest money factor). Scores below 650 may result in higher money factors or require a co-signer.

Q3: Can I negotiate the lease price of a Jeep Cherokee?

A3: Absolutely. The most significant negotiation point is the capitalized cost (the selling price of the car). Negotiate this as if you were buying the vehicle outright; a lower capitalized cost directly reduces your monthly payment. You can also negotiate the money factor and sometimes the acquisition fee.

Q4: What happens at the end of a Jeep Cherokee lease?

A4: At lease end, you typically have three options:

- Return the vehicle: Pay any disposition fees, mileage overages, or excessive wear and tear charges.

- Buy the vehicle: You can purchase the car for its residual value plus any applicable fees.

- Lease a new Jeep (or other vehicle): Many lessees choose to trade in their current lease for a new one.

Q5: Are there hidden fees in a lease?

A5: While reputable dealers disclose all fees, some common ones that can surprise lessees if not clarified upfront include acquisition fees, disposition fees, early termination penalties, mileage overage charges, and excessive wear and tear charges. Always ask for a detailed breakdown of all costs.

Q6: Can I buy out my Jeep Cherokee lease early?

A6: Yes, most lease agreements allow for early buyout. However, it can be expensive as you’ll typically owe the remaining payments, the residual value, and sometimes an early termination fee. Calculate this carefully before proceeding.

Q7: Is a higher mileage allowance worth the extra cost?

A7: If you anticipate driving more than 10,000-12,000 miles per year, opting for a higher mileage allowance upfront (e.g., 15,000 miles) is almost always cheaper than paying per-mile overage charges at the end of the lease.

Conclusion

The Jeep Cherokee lease cost is a multifaceted equation influenced by vehicle specifics, market conditions, and personal financial standing. By thoroughly understanding terms like capitalized cost, residual value, and money factor, and by applying savvy negotiation tactics, you can secure a lease deal that provides the rugged capability and comfort of a Jeep Cherokee without breaking the bank. Leasing offers a compelling pathway to driving a new vehicle every few years with lower monthly payments and minimal ownership hassle. Evaluate your driving habits, financial goals, and desired flexibility to determine if leasing a Jeep Cherokee is the smart choice for your next adventure.