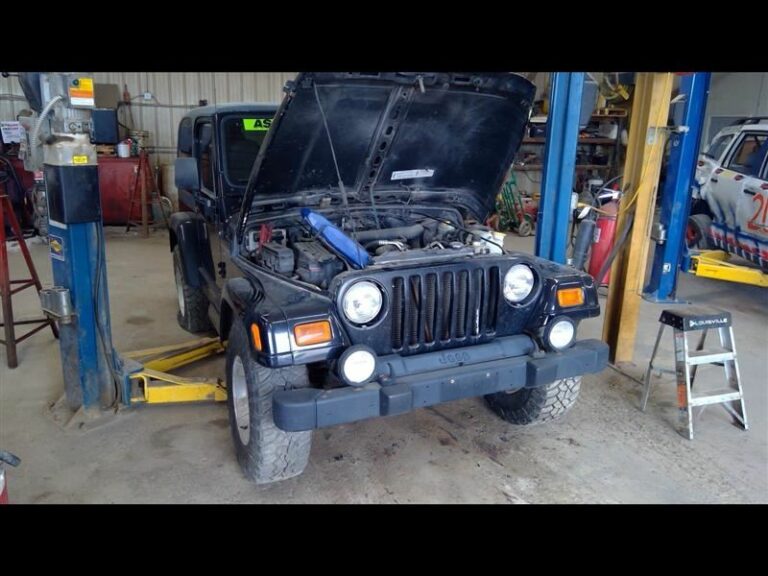

Jeep Cherokee Lease Specials Los Angeles: Your Ultimate Guide to Driving More for Less

Jeep Cherokee Lease Specials Los Angeles: Your Ultimate Guide to Driving More for Less jeeps.truckstrend.com

The allure of the open road, the promise of adventure, and the practical demands of city life converge perfectly in the Jeep Cherokee. For residents of Los Angeles, a city synonymous with diverse landscapes and dynamic lifestyles, the Jeep Cherokee stands out as an ideal companion. It’s a vehicle that effortlessly transitions from navigating the bustling freeways of the 405 to exploring the scenic trails of Malibu Canyon, or simply handling the daily commute with comfort and style. But owning a new car, especially in a market as competitive as LA, often comes with a significant financial commitment. This is where Jeep Cherokee Lease Specials Los Angeles enters the picture – offering a compelling alternative that allows you to enjoy the latest models with potentially lower monthly payments and greater flexibility.

Leasing a vehicle, particularly in a vibrant automotive market like Los Angeles, isn’t just about getting behind the wheel of a new car; it’s about smart financial planning, adapting to evolving needs, and ensuring you always have access to the latest automotive technology and safety features. This comprehensive guide will delve deep into the world of Jeep Cherokee lease specials in the City of Angels, providing you with all the insights, tips, and practical advice needed to secure the best deal and embark on your next adventure with confidence.

Jeep Cherokee Lease Specials Los Angeles: Your Ultimate Guide to Driving More for Less

Understanding the Allure of the Jeep Cherokee in Los Angeles

The Jeep Cherokee embodies a unique blend of rugged capability and refined urbanity, making it exceptionally well-suited for the multifaceted demands of Los Angeles life. Its compact yet spacious design, coupled with Jeep’s legendary off-road DNA, offers a versatility that few other SUVs can match.

- Urban Agility Meets Off-Road Prowess: Whether you’re navigating tight city streets or escaping to the Angeles National Forest for a weekend hike, the Cherokee’s nimble handling and available 4×4 systems (like Active Drive I, Active Drive II, or the Trailhawk’s Active Drive Lock) provide confidence in any environment.

- Comfort and Connectivity: Modern Cherokees boast a comfortable interior, intuitive Uconnect infotainment systems with Apple CarPlay and Android Auto, and a suite of advanced safety features like Adaptive Cruise Control, LaneSense Lane Departure Warning, and Blind Spot Monitoring. These features are highly valued in traffic-heavy Los Angeles.

- Diverse Trim Levels: From the value-packed Latitude to the luxurious Limited, the adventurous Trailhawk, or the sporty Altitude, there’s a Cherokee trim to fit every LA lifestyle and budget. Each offers distinct features and aesthetic touches.

- Fuel Efficiency Options: With available 2.4L Tigershark MultiAir 2 I4 and 3.2L Pentastar V6 engines, drivers can choose between maximizing fuel efficiency for long commutes or optimizing power for towing and spirited driving.

For LA residents who appreciate both practicality and the spirit of adventure, the Jeep Cherokee represents a balanced and compelling choice.

The Fundamentals of Leasing a Jeep Cherokee: What You Need to Know

Before diving into specials, it’s crucial to grasp the core concepts of leasing. Unlike buying, where you finance the entire purchase price of the vehicle, leasing involves paying for the depreciation of the vehicle over a set period, plus interest and fees.

Key Lease Terms Explained:

- MSRP (Manufacturer’s Suggested Retail Price): The sticker price of the vehicle.

- Capitalized Cost (Cap Cost): The negotiated selling price of the vehicle for the lease. This is the starting point for calculating depreciation. Lowering the Cap Cost is your primary negotiation goal.

- Residual Value: The estimated value of the vehicle at the end of the lease term. This is determined by the leasing company and is a percentage of the MSRP. A higher residual value generally leads to lower monthly payments.

- Money Factor: This is essentially the interest rate on a lease, expressed as a small decimal (e.g., 0.00125). To convert it to an annual percentage rate (APR), multiply by 2400 (e.g., 0.00125 * 2400 = 3% APR).

- Lease Term: The duration of the lease, typically 24, 36, or 48 months. Shorter terms usually mean higher monthly payments but less time committed.

- Mileage Allowance: The maximum number of miles you can drive annually without incurring penalties. Common allowances are 10,000, 12,000, or 15,000 miles per year. Exceeding this limit results in per-mile charges (e.g., $0.15-$0.25 per mile).

- Down Payment/Cap Cost Reduction: An upfront payment that reduces the capitalized cost, thereby lowering your monthly payments. While it reduces monthly costs, it’s generally advisable to put as little down as possible on a lease, as this money is lost if the vehicle is totaled.

- Monthly Payment: The sum of depreciation, money factor charges, and taxes, divided by the lease term.

- Acquisition Fee: An administrative fee charged by the leasing company at the beginning of the lease.

- Disposition Fee: A fee charged at the end of the lease if you return the vehicle.

Benefits of Leasing:

- Lower Monthly Payments: Often significantly lower than loan payments for the same vehicle.

- Drive New Cars More Often: Typically every 2-4 years, allowing you to always have the latest features and technology.

- Warranty Coverage: The vehicle is usually under warranty for the entire lease term, minimizing repair costs.

- Less Hassle: No trade-in worries at the end of the term; simply return the car.

- Tax Advantages: In some cases, business users can deduct lease payments.

Drawbacks of Leasing:

- No Ownership Equity: You don’t build equity in the vehicle.

- Mileage Restrictions: Going over your allotted miles can be expensive.

- Wear and Tear Charges: Excessive wear and tear can result in fees at lease end.

- Early Termination Penalties: Getting out of a lease early can be very costly.

- Customization Limitations: Modifications are generally not permitted.

Why Seek Lease Specials in Los Angeles? The Competitive Edge

Los Angeles is one of the most competitive automotive markets in the world. This high level of competition, combined with a large consumer base and strategic importance for manufacturers, creates fertile ground for exceptional lease specials.

- Manufacturer Incentives: Automakers frequently offer regional lease incentives to boost sales in key markets like LA. These can include reduced money factors, higher residual values, or lease cash bonuses.

- Dealership Competition: With numerous Jeep dealerships across the greater Los Angeles area (from Santa Monica to Glendale, Long Beach to the San Fernando Valley), dealerships are constantly vying for your business. This often translates into aggressive pricing and special offers to move inventory or meet sales targets.

- High Volume Sales: The sheer volume of sales in LA means dealerships can afford to offer more attractive deals, as they make up for lower per-unit profit with higher sales numbers.

- Timing is Everything: Lease specials are often tied to specific periods:

- End of the Month/Quarter/Year: Dealerships are motivated to hit sales quotas.

- New Model Year Releases: As new models arrive, dealerships want to clear out current year inventory.

- Holidays: Major holidays often bring special promotions.

By understanding these dynamics, you can strategically position yourself to take advantage of the best Jeep Cherokee lease specials available in the Los Angeles market.

Navigating the Los Angeles Jeep Cherokee Lease Market: A Step-by-Step Guide

Securing a great lease deal requires preparation, research, and negotiation. Follow these steps to maximize your chances of success in the LA market:

Step 1: Define Your Needs and Budget

- Trim Level & Features: Which Cherokee trim best suits your lifestyle (e.g., Latitude for value, Limited for luxury, Trailhawk for adventure)? What essential features do you need (e.g., navigation, sunroof, advanced safety)?

- Mileage: Be realistic about your annual driving habits. Most leases offer 10k, 12k, or 15k miles per year. Opting for too few miles to save a little upfront can cost you dearly in overage fees.

- Budget: Determine your comfortable monthly payment range and how much you’re willing to put down (due at signing). Remember, less money down is generally safer for a lease.

Step 2: Research Manufacturer & Dealership Offers

- Jeep.com: Start by checking the official Jeep website for national and regional lease offers. These provide a baseline.

- Local Dealership Websites: Browse the websites of multiple Jeep dealerships in and around Los Angeles (e.g., Cerritos Dodge Chrysler Jeep Ram, Glendale Chrysler Dodge Jeep Ram, Santa Monica Chrysler Dodge Jeep Ram, etc.). Look for "specials" or "lease offers" pages.

- Third-Party Lease Aggregators: Websites like Leasehackr, Edmunds Forums, or Honcker can provide insights into current deals and allow you to compare offers.

Step 3: Contact Multiple Dealerships for Quotes

- Cast a Wide Net: Don’t limit yourself to one or two dealerships. Contact at least 3-5 in the LA area.

- Request Specific Information: When asking for a quote, be precise. Specify the exact trim, options, lease term (e.g., 36 months), and desired annual mileage. Ask for:

- Capitalized Cost

- Residual Value

- Money Factor

- Monthly Payment (excluding tax)

- Total Due at Signing (broken down: first month’s payment, down payment, acquisition fee, doc fees, license/registration)

- Get it in Writing: Always ask for an email or written breakdown of the quote.

Step 4: Understand and Compare the Numbers

- Don’t just look at the monthly payment. A low monthly payment might hide a large down payment or high fees.

- Compare the Capitalized Cost, Money Factor, and Residual Value across different offers. A lower Cap Cost and Money Factor, combined with a higher Residual, are the ingredients for a great lease.

Step 5: Negotiate Smartly

- Negotiate the Cap Cost First: Treat it like negotiating the purchase price of the car. The lower the Cap Cost, the less you’ll pay in depreciation.

- Address the Money Factor: If your credit is excellent, ask if the money factor can be lowered. Some dealers mark it up.

- Be Prepared to Walk Away: If a deal doesn’t feel right, or if a dealership isn’t transparent, be ready to move on. There are plenty of options in LA.

- Leverage Competition: Let dealerships know you’re getting quotes from others. This often encourages them to offer better terms.

Step 6: Read the Fine Print Meticulously

- Before signing, thoroughly review every clause of the lease agreement.

- Pay close attention to mileage overage charges, wear and tear guidelines, early termination penalties, and required insurance coverage.

- Ask questions about anything you don’t understand.

Step 7: Test Drive and Inspect

- Always test drive the specific vehicle you intend to lease to ensure it meets your expectations.

- Before taking delivery, do a thorough walk-around and interior inspection for any pre-existing damage.

Key Considerations for Your Jeep Cherokee Lease in Los Angeles

Beyond the numbers, several practical considerations will impact your leasing experience.

- Mileage Needs vs. Lifestyle: LA drivers cover a lot of ground. If you commute long distances or frequently take weekend trips out of the city, ensure your mileage allowance is sufficient. Overages are expensive, typically $0.15-$0.25 per mile.

- Wear and Tear Guidelines: Understand what constitutes "normal wear and tear" versus "excessive wear and tear." Dings, dents, scratches, tire wear, and interior damage beyond normal use can result in charges at lease end. Consider a "wear and tear waiver" if offered, though weigh its cost against potential savings.

- Insurance Requirements: Lease agreements often mandate specific, higher levels of collision and comprehensive insurance coverage than what you might typically carry. Factor these increased premiums into your monthly budget.

- Lease-End Options: Know your choices as the lease approaches its end:

- Return the Vehicle: The most common option. Schedule an inspection, return the keys, and pay any excess mileage or wear-and-tear charges, plus the disposition fee.

- Buy Out the Lease: Purchase the vehicle for its residual value plus any remaining payments and fees. This is a good option if you love the car and its market value is higher than the residual.

- Extend the Lease: Some leasing companies allow short extensions, often month-to-month.

- Trade-in for a New Lease: Many lessees roll into a new lease with the same brand, potentially avoiding disposition fees and leveraging loyalty programs.

- Credit Score Impact: Your credit score is paramount. An excellent credit score (typically 700+) will qualify you for the lowest money factors and best lease specials. If your credit is lower, you might face higher money factors or require a larger down payment.

Types of Jeep Cherokee Lease Specials to Look For

Lease specials come in various forms, each designed to appeal to different financial situations or preferences:

- Low Down Payment / "Sign-and-Drive" Deals: These deals require very little (or sometimes nothing) due at signing, often just the first month’s payment and government fees. While appealing, they typically result in higher monthly payments.

- Low Monthly Payment Deals: These are often achieved with a higher down payment or through aggressive manufacturer incentives that boost the residual value or reduce the money factor.

- Specific Trim Level Promotions: Dealerships or manufacturers might offer particularly attractive leases on certain Cherokee trim levels (e.g., a special on the Latitude Lux or the Trailhawk) to clear inventory or promote a particular model.

- Loyalty or Conquest Programs: If you currently lease or own another Jeep vehicle (loyalty) or a competitor’s vehicle (conquest), you might qualify for additional rebates that lower your monthly payment.

- End-of-Year Clearances: As new model years arrive (typically late summer/fall), dealerships often heavily discount outgoing models to make space, leading to excellent lease opportunities.

Sample Jeep Cherokee Lease Specials Los Angeles – Illustrative Pricing Table

Please note: The following table provides illustrative examples of potential lease specials for the Jeep Cherokee in Los Angeles. Actual lease offers fluctuate constantly based on manufacturer incentives, dealership inventory, market demand, creditworthiness, and time of year. These figures are estimates only and should not be considered current, live offers. Always contact multiple local dealerships for precise, up-to-date quotes.

| Jeep Cherokee Trim | Estimated MSRP | Lease Term | Annual Mileage | Due at Signing (Est.) | Monthly Payment (Excl. Tax, Est.) | Estimated Money Factor | Estimated Residual Value |

|---|---|---|---|---|---|---|---|

| Latitude Lux 4×2 | $32,000 | 36 Months | 10,000 miles | $2,999 | $349 | 0.00150 (3.6% APR) | 58% ($18,560) |

| Altitude 4×2 | $34,500 | 36 Months | 10,000 miles | $3,299 | $379 | 0.00160 (3.84% APR) | 57% ($19,665) |

| Limited 4×4 | $38,000 | 36 Months | 12,000 miles | $3,499 | $429 | 0.00175 (4.2% APR) | 56% ($21,280) |

| Trailhawk 4×4 | $42,000 | 36 Months | 12,000 miles | $3,999 | $499 | 0.00180 (4.32% APR) | 55% ($23,100) |

| Overland 4×4 | $45,000 | 36 Months | 12,000 miles | $4,299 | $539 | 0.00190 (4.56% APR) | 54% ($24,300) |

Note: "Due at Signing" typically includes the first month’s payment, down payment (cap cost reduction), acquisition fee, and government fees (license, registration). Taxes on the monthly payment vary by locale.

Frequently Asked Questions (FAQ) About Jeep Cherokee Lease Specials Los Angeles

Q1: Is leasing a Jeep Cherokee better than buying one in Los Angeles?

A: It depends on your lifestyle and financial goals. Leasing offers lower monthly payments, allows you to drive a new car more often, and provides warranty coverage for the lease term. Buying builds equity and offers unlimited mileage, but comes with higher payments and potential depreciation concerns. For LA drivers who want the latest model without a long-term commitment, leasing is often preferred.

Q2: Can I negotiate the terms of a Jeep Cherokee lease special?

A: Absolutely! The capitalized cost (essentially the vehicle’s selling price for the lease) and the money factor (interest rate) are often negotiable. Don’t be afraid to compare offers from multiple dealerships and leverage competition to get a better deal.

Q3: What happens if I exceed my mileage limit on a leased Jeep Cherokee?

A: You will incur a per-mile charge for every mile over your agreed-upon limit. This charge typically ranges from $0.15 to $0.25 per mile. It’s crucial to estimate your annual mileage accurately before signing the lease.

Q4: What is a "money factor" and how does it affect my lease payment?

A: The money factor is the interest rate applied to your lease. A lower money factor means lower monthly interest charges and thus a lower monthly payment. It’s expressed as a small decimal (e.g., 0.00125). You can convert it to an approximate APR by multiplying by 2400.

Q5: Can I get out of my Jeep Cherokee lease early?

A: Yes, but it’s often costly. Early termination penalties can include remaining payments, disposition fees, and other charges. Options like lease transfers (if permitted by the leasing company) or negotiating a buyout with the dealership might be available but require careful consideration.

Q6: Do I need excellent credit to get the best lease specials?

A: Generally, yes. The lowest money factors and most attractive lease offers are reserved for customers with excellent credit scores (typically 700 or above). If your credit is lower, you may still qualify for a lease, but with a higher money factor or potentially a larger down payment requirement.

Q7: Are the "due at signing" costs negotiable?

A: While some fees (like government fees) are fixed, the "down payment" portion (capitalized cost reduction) is negotiable. You can often choose to pay more upfront to lower your monthly payments, or less upfront (even zero down) which will increase your monthly payments. Consider the trade-off carefully.

Conclusion: Driving Your Dream Jeep Cherokee in the City of Angels

Leasing a Jeep Cherokee in Los Angeles presents a compelling opportunity to experience the thrill of a new, capable SUV without the long-term financial commitment of ownership. By understanding the fundamentals of leasing, diligently researching available specials, and applying smart negotiation tactics, you can unlock exceptional value in this dynamic market.

Remember, the key to a successful lease is not just finding the lowest monthly payment, but understanding all the terms: the capitalized cost, money factor, residual value, and mileage allowance. Armed with this knowledge and the actionable insights provided in this guide, you are well-equipped to navigate the competitive landscape of Jeep Cherokee lease specials in Los Angeles. So, start your research, connect with local dealerships, and prepare to embark on your next adventure in a brand-new Jeep Cherokee, perfectly suited for the diverse roads and boundless spirit of LA.