Jeep Cherokee Leasehackr: Mastering the Art of the Unbeatable Lease Deal

Jeep Cherokee Leasehackr: Mastering the Art of the Unbeatable Lease Deal jeeps.truckstrend.com

In the dynamic world of automotive finance, the term "Leasehackr" has become synonymous with smart, savvy leasing. It represents a community and a methodology dedicated to dissecting lease agreements, understanding the underlying numbers, and ultimately, securing the best possible deals on new vehicles. For prospective Jeep Cherokee owners, embracing the Leasehackr philosophy isn’t just about saving money; it’s about empowerment, transforming a potentially opaque process into a transparent, strategic pursuit of value. This comprehensive guide will delve into the intricacies of "Jeep Cherokee Leasehackr," equipping you with the knowledge and tools to drive away in your dream Cherokee at an astonishingly low monthly payment.

What is Leasehackr and How Does It Apply to the Jeep Cherokee?

Jeep Cherokee Leasehackr: Mastering the Art of the Unbeatable Lease Deal

At its core, Leasehackr refers to the practice of optimizing a car lease by understanding and manipulating the key variables that determine the monthly payment. It’s a movement born from the popular website Leasehackr.com, which provides a powerful calculator, a vibrant forum for sharing deals, and a platform for lease brokers. For the Jeep Cherokee, a popular SUV known for its blend of capability, comfort, and style, "Leasehackr" means meticulously researching market conditions, leveraging manufacturer incentives, and expertly negotiating with dealerships to achieve a monthly payment that might seem impossible to the uninitiated.

The importance of this approach for the Jeep Cherokee is multifaceted:

- Market Volatility: The automotive market, including the Jeep Cherokee segment, experiences fluctuating incentives, residual values, and money factors. Leasehackr allows you to capitalize on favorable conditions.

- Complexity of Leases: Lease agreements are often dense with jargon. Leasehackr demystifies terms like "money factor," "residual value," and "capitalized cost reduction," giving you control.

- High MSRPs: While appealing, the Cherokee’s MSRP can be substantial. Hacking a lease helps mitigate the financial burden by focusing on the depreciating asset rather than the full purchase price.

- Community Wisdom: The Leasehackr community shares real-world deals, providing benchmarks and strategies that are invaluable for negotiations.

By adopting a Leasehackr mindset, you transform from a passive consumer into an informed negotiator, ready to unlock the true potential of a Jeep Cherokee lease.

Understanding the Lease Equation: Key Factors for a Jeep Cherokee Leasehackr Deal

To truly "hack" a Jeep Cherokee lease, you must first master the fundamental components that dictate your monthly payment. These are the levers you’ll learn to push and pull to your advantage:

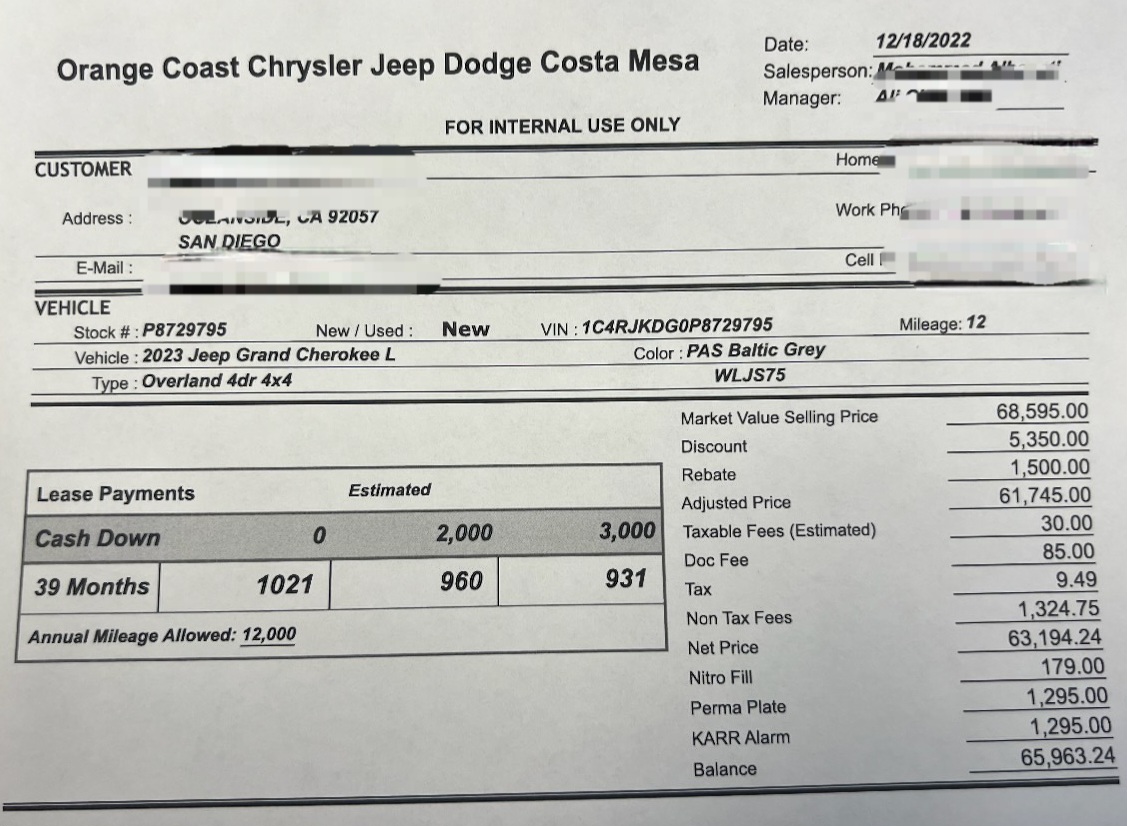

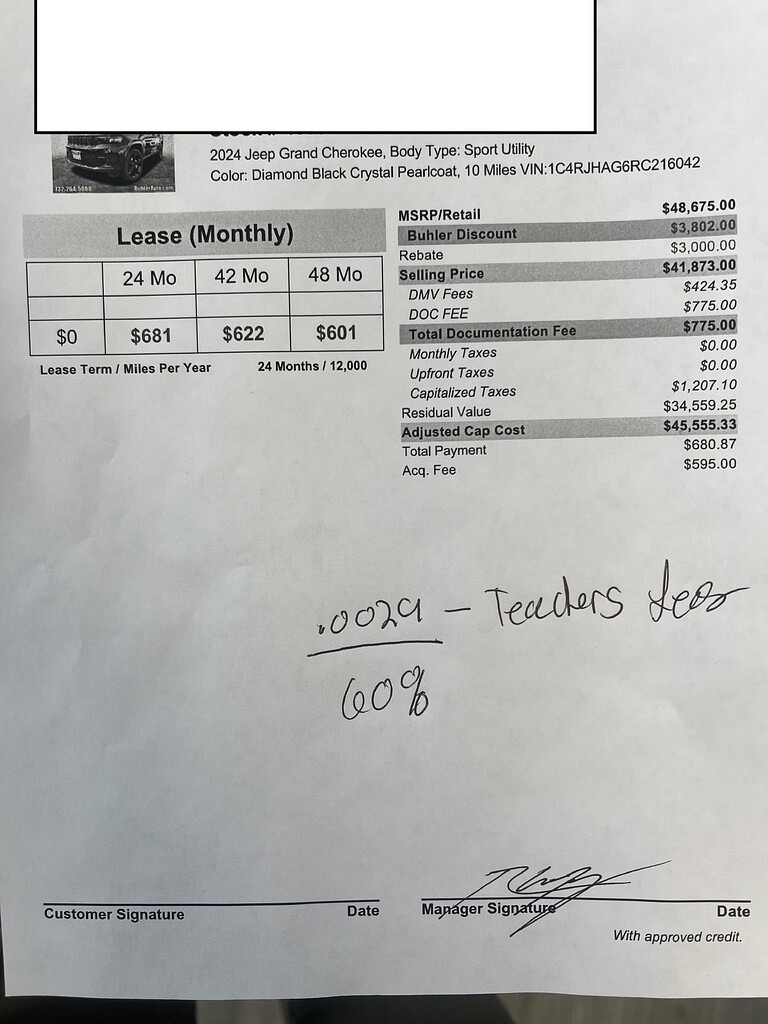

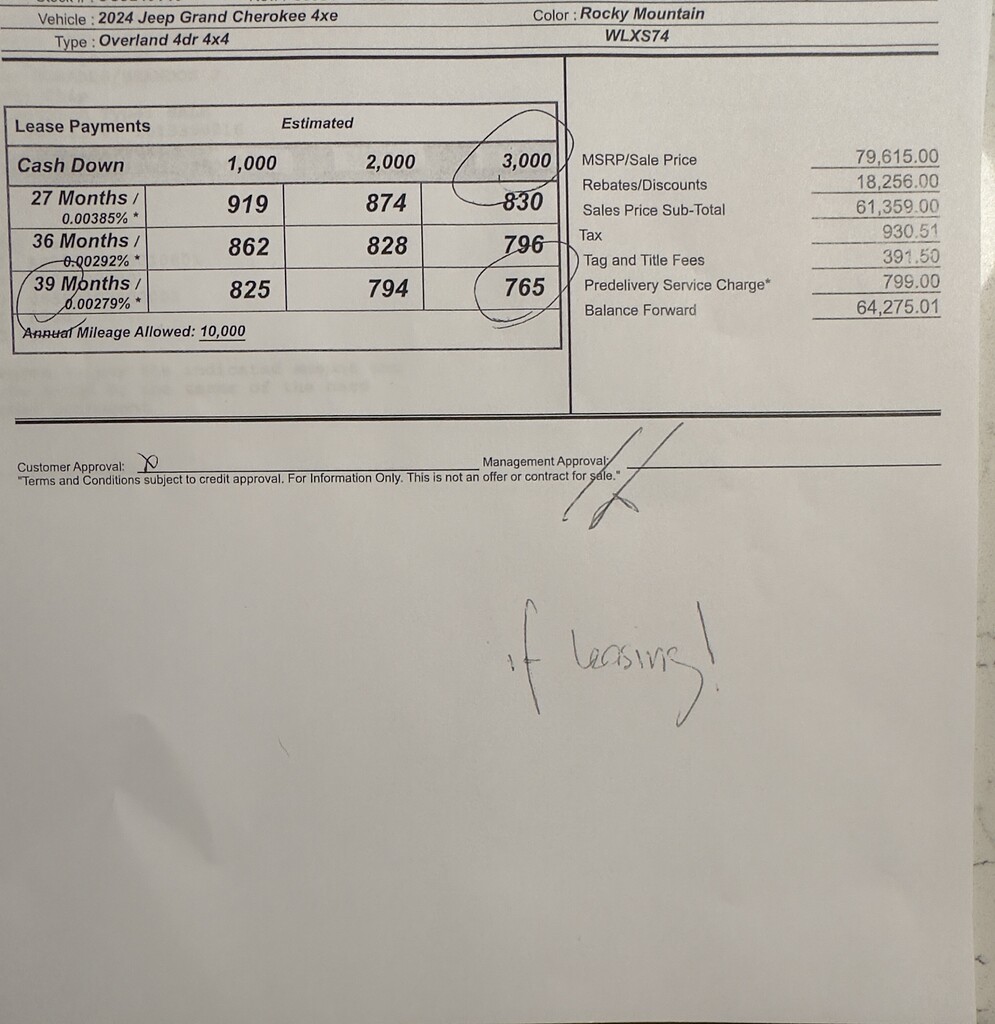

- MSRP (Manufacturer’s Suggested Retail Price): This is the starting point, the sticker price of the vehicle. Your goal is to negotiate a significant discount off this price, as this forms your negotiated selling price or net capitalized cost. A lower net cap cost directly translates to a lower monthly payment.

- Residual Value (RV): This is the estimated value of the vehicle at the end of the lease term, expressed as a percentage of the MSRP. Set by the leasing company, a higher residual value is better for you, as you’re only paying for the depreciation between the net cap cost and the residual value. Jeep Cherokees typically have competitive residual values, especially for shorter lease terms (e.g., 24-36 months).

- Money Factor (MF): This is essentially the interest rate on your lease, expressed as a small decimal (e.g., 0.00070). To convert it to an approximate Annual Percentage Rate (APR), multiply by 2400 (0.00070 * 2400 = 1.68% APR). A lower money factor means less interest paid over the lease term. Your credit score significantly impacts the money factor you qualify for.

- Lease Term: Typically 24, 36, or 39 months. Shorter terms often have higher residual values but may result in slightly higher monthly payments if other factors aren’t optimized. Longer terms might have lower monthly payments but also lower residuals.

- Incentives and Rebates: These are crucial. Manufacturers and dealerships often offer various incentives (e.g., lease cash, conquest rebates, loyalty bonuses, regional specific offers) that directly reduce your net capitalized cost or provide lease credits. These can sometimes be thousands of dollars, making a significant difference in your monthly payment.

- Sales Tax and Fees: Don’t forget these. Sales tax is typically applied to the monthly payment in most states, while various fees (acquisition fee, dealer documentation fee, registration, license plates) are usually part of your "drive-off" amount.

The Art of Negotiation: Strategies for Hacking Your Jeep Cherokee Lease

This is where the rubber meets the road. Successful Leasehackr deals are forged through meticulous preparation and strategic negotiation:

-

Do Your Homework (Before the Dealer):

- Target Discount: Research recent Jeep Cherokee sales on sites like TrueCar or Edmunds to understand a realistic selling price below MSRP (aim for 8-12% off MSRP before incentives).

- Identify RV and MF: Crucially, get the current residual value and money factor for your desired Jeep Cherokee trim, lease term, and mileage allowance from resources like the Leasehackr forums (Edmunds forum is also excellent for this).

- Uncover Incentives: Check manufacturer websites, dealer sites, and Leasehackr forums for all available lease cash, loyalty, or conquest rebates applicable to your region and situation.

-

Go Wide with Your Net (Email/Phone Negotiations):

- Contact multiple dealerships (5-10 minimum) via email or phone. Do not walk into a dealership until you have a solid quote.

- Provide them with the exact VIN or stock number of the Jeep Cherokee you want, or the precise build specifications.

- Request a detailed lease quote, itemizing the MSRP, negotiated selling price, all incentives, residual value, money factor, and all fees. Be explicit that you want the "breakdown."

-

Focus on the Net Capitalized Cost: Your primary negotiation point is the selling price of the car before incentives. Get the biggest discount off MSRP you can. Once you have that, then layer on the incentives.

-

Leverage Competing Offers: Use quotes from one dealer to get a better offer from another. Be polite but firm. "Dealer X offered me Y selling price on this exact vehicle. Can you beat it?"

-

Be Aware of "Bundling": Dealers might try to obscure the numbers by giving you only a monthly payment. Insist on the full breakdown to ensure they aren’t inflating the money factor or hiding fees.

-

The Leasehackr Calculator is Your Co-Pilot: Input all the numbers you get from dealers into the Leasehackr calculator. It will show you the exact monthly payment and, critically, your "Leasehackr Score." A higher score (typically above 8-10 years of effective monthly payment per $1,000 of MSRP) indicates a good deal.

-

Consider a Lease Broker: If negotiation isn’t your strong suit or you lack time, a reputable lease broker (often found on Leasehackr.com) can be an excellent resource. They pre-negotiate deals with dealerships, often securing rates better than what an individual could achieve, and charge a flat fee.

Calculating Your Deal: Tools and Resources for Jeep Cherokee Leasehackr

The Leasehackr Calculator is your most powerful ally in this process. It allows you to:

- Verify Dealer Quotes: Plug in the dealer’s numbers to see if they match your calculations and if the deal is truly competitive.

- Model Different Scenarios: Adjust the MSRP discount, incentives, or lease term to see how it impacts your monthly payment.

- Understand the "Leasehackr Score": This proprietary score helps you compare deals across different vehicles and assess the overall value of your lease. A score of 8 or higher is generally considered good for a mainstream vehicle like the Cherokee.

Resources:

- Leasehackr.com Forums: Invaluable for finding current RV/MF information, discussing deals, and identifying brokers.

- Edmunds.com Forums: Similar to Leasehackr, often provides up-to-date RV/MF info for specific trims and zip codes.

- Manufacturer Websites: For current national incentives.

- Dealer Inventory Sites: To find specific vehicles and VINs.

Common Pitfalls and How to Avoid Them

Even seasoned Leasehackrs can fall prey to common traps. Be vigilant:

- "Zero Down" vs. "Zero Drive-Off": A dealer might advertise "zero down" but still require significant "drive-off" amounts (first month’s payment, fees, taxes). Aim for "zero drive-off" if possible, or understand exactly what you’re paying upfront. Generally, it’s better to pay minimal money upfront on a lease.

- Inflated Money Factor: Always verify the money factor. Dealers might mark it up from the buy rate.

- Unnecessary Add-ons: Resist pressure for extended warranties, protection packages, or accessories. These inflate your capitalized cost.

- Ignoring the Acquisition Fee: This fee (typically $595-$995) is charged by the leasing company. While often unavoidable, be aware of it.

- Excessive Mileage Penalties: Be realistic about your driving habits. Going over your mileage allowance can be costly (e.g., $0.20-$0.25 per mile).

- Early Termination Penalties: Breaking a lease early can be extremely expensive. Ensure your life circumstances align with the lease term.

- Wear and Tear: Understand what constitutes "excessive wear and tear" to avoid charges at lease end. Take photos of the vehicle at the start and end of the lease.

Best Times to Lease a Jeep Cherokee

Timing can significantly impact your Leasehackr success:

- End of the Month/Quarter/Year: Salespeople and dealerships have quotas to meet, making them more motivated to offer aggressive discounts.

- Holiday Sales Events: Memorial Day, Fourth of July, Labor Day, Black Friday, and year-end sales often bring increased incentives.

- New Model Year Releases: When a new model year of the Jeep Cherokee is released, dealerships are eager to clear out the previous year’s inventory, leading to deeper discounts and potentially better lease programs on the outgoing models.

- Slow-Selling Trims/Colors: Less popular configurations might sit on lots longer, making dealers more willing to deal.

Specific Jeep Cherokee Trims and Their Lease Appeal

The Jeep Cherokee comes in various trims, each with its own MSRP and potential lease appeal:

- Latitude / Latitude Plus / Latitude Lux: As the entry-level and mid-range trims, these often have lower MSRPs, which can translate to attractive monthly payments, especially when paired with good incentives. They are often the sweet spot for Leasehackr deals.

- Limited: Offering more premium features, the Limited trim might have a higher MSRP but can sometimes receive competitive incentives, making it a good target if you desire more amenities.

- Trailhawk: Designed for off-road enthusiasts, the Trailhawk has a higher MSRP due to its specialized equipment. While less common for Leasehackr deals due to its niche appeal, specific regional or off-road-focused incentives could make it viable.

- Overland: The most luxurious trim, the Overland has the highest MSRP. While it offers top-tier features, its higher initial cost can make it harder to achieve an ultra-low monthly payment compared to the lower trims, unless significant incentives are available.

Generally, the trims that offer the best balance of MSRP, demand, and manufacturer support (incentives, strong residuals) will be the easiest to "hack." Base and mid-range trims often fit this description best.

Jeep Cherokee Leasehackr Hypothetical Deal Breakdown Table

This table illustrates a hypothetical Leasehackr-worthy deal for a Jeep Cherokee, demonstrating how all the elements come together. Please note: Actual deals vary wildly by location, current incentives, and market conditions.

| Lease Component | Value (Hypothetical Example) | Explanation |

|---|---|---|

| Vehicle | 2024 Jeep Cherokee Latitude Lux FWD | Mid-tier trim, good for balancing features and lease price. |

| MSRP | $36,500 | Sticker price. |

| Negotiated Selling Price | $32,000 | ~12.3% off MSRP – your primary goal in negotiation. |

| Manufacturer Incentives | $3,500 | Lease cash, conquest, or loyalty rebates. Crucial for a low cap cost. |

| Net Capitalized Cost | $28,500 | (Negotiated Selling Price – Incentives). This is what you’re effectively financing. |

| Lease Term | 36 Months | Common lease term, often with good residuals. |

| Annual Mileage | 10,000 Miles | Standard mileage allowance. |

| Residual Value (RV) | 60% of MSRP ($21,900) | The car’s projected value at lease end. Higher is better. |

| Money Factor (MF) | 0.00075 (1.8% APR equiv.) | Low interest rate, often tied to excellent credit. |

| Acquisition Fee | $895 | Fee from the leasing company. |

| Dealer Doc Fee | $299 | State-specific fee, can vary. |

| Government Fees/Tags | $350 | Registration, license plates, etc. |

| Total Drive-Off Amount | $2,100 | (First Month Payment + Acq. Fee + Doc Fee + Gov. Fees) – aim to minimize this. |

| Estimated Monthly Payment | $315 (pre-tax) | The magic number! (Based on the Leasehackr formula). |

| Leasehackr Score | 9.5 Years | Excellent score, indicates a strong deal. (Lower score is better). |

Frequently Asked Questions (FAQ) about Jeep Cherokee Leasehackr

Q1: Is it always better to lease a Jeep Cherokee than to buy it?

A1: Not necessarily. Leasing is ideal if you prefer lower monthly payments, want a new car every few years, don’t drive excessive miles, and prefer to avoid depreciation risk and major repair costs. Buying is better if you drive a lot, plan to keep the car for many years, or want full ownership and customization.

Q2: Can I negotiate the residual value of a Jeep Cherokee?

A2: No, the residual value is set by the leasing company (the bank) and is not negotiable. However, the residual percentage can vary by lease term and mileage allowance, so choosing the right term is important.

Q3: What’s a good Leasehackr score for a Jeep Cherokee?

A3: A Leasehackr score of 8 years or lower is generally considered a good deal for a mainstream vehicle like the Jeep Cherokee. A score of 6-7 years is excellent, and anything below 6 years is a "unicorn" deal.

Q4: Should I use a lease broker for a Jeep Cherokee?

A4: If you’re new to Leasehackr, don’t enjoy negotiation, or simply want to save time, a reputable lease broker can be invaluable. They often have access to pre-negotiated deals and can secure better terms than an individual might achieve, even after factoring in their fee.

Q5: What if my credit isn’t perfect? Can I still Leasehackr a Jeep Cherokee?

A5: A top-tier credit score (typically 700-740+) is usually required to qualify for the best money factors and incentives. If your credit isn’t perfect, you might still get approved, but with a higher money factor, which will increase your monthly payment. Focus on reducing the capitalized cost as much as possible.

Q6: What’s the difference between 24, 36, and 39-month leases for a Cherokee?

A6: Shorter leases (24 months) often have higher residual values (meaning less depreciation paid), but the monthly payment can sometimes be higher because you’re paying off the depreciation over a shorter period. 36 or 39 months are common and often hit a sweet spot for monthly payment and residual. Always check the specific RV/MF for each term.

Conclusion

Mastering the "Jeep Cherokee Leasehackr" approach is a journey of education, diligence, and strategic negotiation. It’s about empowering yourself with knowledge, understanding the mechanics of a lease, and leveraging every available tool and incentive to your advantage. By meticulously researching residual values and money factors, aggressively negotiating the selling price, and utilizing the Leasehackr calculator, you can transform the often-daunting process of leasing into an exciting hunt for an exceptional deal. Driving a new Jeep Cherokee at a monthly payment that leaves others wondering "How did they do that?" is not just a dream – it’s an achievable reality for the informed Leasehackr. Embrace the numbers, arm yourself with information, and prepare to hack your way to the perfect Jeep Cherokee lease.