Jeep Cherokee Trackhawk Lease: Unleash the Beast Without the Full Burden

Jeep Cherokee Trackhawk Lease: Unleash the Beast Without the Full Burden jeeps.truckstrend.com

The automotive landscape is filled with powerful machines, but few command attention quite like the Jeep Grand Cherokee Trackhawk. This isn’t just an SUV; it’s a supercharged, 707-horsepower behemoth wrapped in a surprisingly luxurious and practical package. For many, the dream of owning such a high-performance vehicle remains just that – a dream, often thwarted by its substantial price tag. This is where the concept of a Jeep Cherokee Trackhawk Lease steps in, offering a compelling alternative to outright ownership.

Leasing a vehicle, in essence, means paying for its depreciation and your usage over a set period, rather than purchasing the entire asset. For a specialized, high-value vehicle like the Trackhawk, leasing can unlock access to its thrilling performance and cutting-edge technology without the long-term commitment and significant upfront capital required for a purchase. It’s about experiencing the roar of that supercharged Hellcat engine, the blistering acceleration, and the opulent interior for a defined term, then gracefully moving on to the next automotive adventure.

Jeep Cherokee Trackhawk Lease: Unleash the Beast Without the Full Burden

This comprehensive guide will delve into every facet of leasing a Jeep Cherokee Trackhawk, from understanding the financial mechanics to securing the best deal and navigating the lease-end process. Whether you’re a performance enthusiast, a luxury seeker, or simply curious about driving one of the fastest SUVs on the planet, leasing offers a unique pathway to the Trackhawk experience.

What Makes the Trackhawk a Unique Leasing Proposition?

The Jeep Grand Cherokee Trackhawk stands in a league of its own. It’s not just an SUV; it’s a high-performance monster designed to dominate both the drag strip and the daily commute. Understanding its core attributes is key to appreciating why leasing it presents a distinct opportunity:

- Unrivaled Power: At its heart lies the supercharged 6.2-liter HEMI V8 engine, borrowed from Dodge’s Hellcat lineup, churning out a staggering 707 horsepower and 645 lb-ft of torque. This translates to a 0-60 mph sprint in a mind-bending 3.5 seconds, making it one of the quickest SUVs ever produced.

- Performance Engineering: Beyond the engine, the Trackhawk features performance-tuned suspension, Brembo brakes, and a robust all-wheel-drive system designed to handle its immense power. These specialized components contribute to its higher MSRP but also to its unique driving dynamics.

- Luxury and Technology: Despite its performance focus, the Trackhawk doesn’t skimp on luxury. It boasts premium leather interiors, advanced infotainment systems, sophisticated driver-assistance features, and a comfortable ride for everyday use.

- Niche Appeal and Exclusivity: The Trackhawk caters to a very specific market segment. Its blend of SUV practicality and supercar performance makes it a highly desirable, albeit limited, vehicle. This exclusivity can sometimes influence its residual value, which is a critical component in lease calculations. Its high demand can also mean less aggressive discounting, making a strong negotiation even more crucial.

Leasing a Trackhawk means experiencing this potent blend of power, luxury, and exclusivity for a manageable period, often aligning with the vehicle’s warranty coverage and the latest technological cycles.

Understanding the Basics of Leasing a Trackhawk

Before diving into lease deals, it’s essential to grasp the fundamental components that determine your monthly payments and overall lease cost:

- MSRP (Manufacturer’s Suggested Retail Price): This is the sticker price of the vehicle, serving as the starting point for negotiations. For a Trackhawk, this is typically in the high five to low six-figure range.

- Capitalized Cost: This is the negotiated selling price of the vehicle, similar to the purchase price if you were buying. This is the most crucial figure to negotiate down, as every dollar saved here directly reduces your monthly payment.

- Residual Value: This is the estimated value of the vehicle at the end of the lease term, expressed as a percentage of the MSRP. A higher residual value is beneficial for leasing, as you’re paying for a smaller portion of the car’s depreciation. Performance vehicles can sometimes hold their value better, potentially leading to favorable residuals.

- Money Factor (Interest Rate): This is the equivalent of an interest rate on a loan, but for a lease. It’s usually a very small decimal (e.g., 0.00250). To convert it to an approximate annual percentage rate (APR), multiply it by 2400 (0.00250 x 2400 = 6%). A lower money factor means lower finance charges.

- Lease Term: The duration of your lease, typically 24, 36, or 48 months. Shorter terms usually mean higher monthly payments but less time committed to the vehicle. For a Trackhawk, a 24 or 36-month term is popular to always have the latest tech and avoid major out-of-warranty repairs.

- Mileage Allowance: The maximum number of miles you’re allowed to drive annually without incurring penalties. Common allowances are 10,000, 12,000, or 15,000 miles per year. Given the Trackhawk’s performance capabilities, it’s easy to exceed these limits, making this a critical consideration. Excess mileage charges can range from $0.15 to $0.30 or more per mile.

- Lease Payments: Calculated based on the depreciation (Capitalized Cost – Residual Value) plus the finance charge (Money Factor x (Capitalized Cost + Residual Value)).

- Acquisition Fee: An administrative fee charged by the leasing company at the beginning of the lease.

- Disposition Fee: A fee charged at the end of the lease when you return the vehicle, covering cleaning and reconditioning costs.

Benefits of Leasing a Jeep Cherokee Trackhawk

Leasing a high-performance SUV like the Trackhawk offers several compelling advantages:

- Lower Monthly Payments: Compared to financing the full purchase price, leasing typically results in significantly lower monthly outlays, making a high-MSRP vehicle more accessible.

- Access to High-End Performance: You get to drive a top-tier, high-performance vehicle that might otherwise be out of reach financially for a purchase.

- Always Drive a New Car: Lease terms often align with new model introductions, allowing you to upgrade to the latest technology and features every few years without the hassle of selling your old car.

- Warranty Coverage: Most lease terms (especially 24 or 36 months) fall entirely within the manufacturer’s bumper-to-bumper warranty period, minimizing your exposure to unexpected repair costs.

- Tax Advantages (for Businesses): If used for business, a portion of lease payments may be tax-deductible, offering a financial benefit not available with purchased vehicles. Consult a tax professional for details.

- Avoiding Depreciation Risk: You’re not responsible for the long-term depreciation of the vehicle. At the end of the lease, you simply return it, avoiding the potential headache of resale values.

- Minimal Down Payment: While a down payment can lower monthly payments, many leases require little to no money down, freeing up your capital.

Important Considerations Before Leasing

While attractive, leasing a Trackhawk also comes with specific considerations you must weigh carefully:

- High MSRP Impact: Even with lower monthly payments, the Trackhawk’s high initial price means the total cost over the lease term can still be substantial.

- Mileage Limitations: This is perhaps the biggest drawback for a performance vehicle. If you anticipate driving more than 10,000-15,000 miles annually, the excess mileage penalties can quickly erode the financial benefits of leasing.

- Wear and Tear Charges: Leasing companies expect the vehicle to be returned in good condition, commensurate with its age and mileage. Excessive dents, scratches, tire wear, or interior damage can result in costly penalties at lease end.

- Insurance Costs: Insuring a high-performance, high-value vehicle like the Trackhawk will be significantly more expensive than a standard SUV. Factor this into your total monthly budget.

- Early Termination Penalties: Breaking a lease early is almost always very expensive. If your circumstances change and you need to get out of the lease before the term ends, you could face penalties equivalent to several months of payments or more.

- Maintenance: While warranty covers major repairs, routine maintenance (oil changes, tire rotations) and consumables (premium fuel, performance tires, brakes) for a Trackhawk will be more expensive than for a regular SUV.

- Limited Availability: Trackhawks are not mass-produced, and finding one, let alone a specific configuration, might be challenging, potentially limiting your negotiation power.

How to Secure the Best Trackhawk Lease Deal

Finding the optimal lease deal requires strategy and negotiation. Don’t just accept the first offer:

- Research Current Incentives: Manufacturers and dealerships often offer special lease programs (lower money factors, higher residuals, or capitalized cost reductions) that can significantly improve a deal. Check Jeep’s official website and local dealer promotions.

- Negotiate the Capitalized Cost: This is paramount. Treat the capitalized cost as if you’re buying the car outright. Aim for a price below MSRP. A lower capitalized cost directly translates to lower monthly payments.

- Improve Your Credit Score: A strong credit score (typically 700+) will qualify you for the lowest money factor, significantly reducing the finance charge component of your lease payment.

- Shop Around: Get quotes from multiple dealerships, even if they are a bit further away. Competition drives better deals.

- Consider Shorter Terms: Sometimes, 24-month leases offer competitive residuals and money factors, especially if you prioritize always having the latest model. However, monthly payments will be higher.

- Understand Residual Value: While you can’t negotiate the residual value (it’s set by the leasing company), knowing if a particular model year or trim has a strong residual can help you identify a good lease candidate.

- Review All Fees: Don’t forget to account for acquisition fees, disposition fees, documentation fees, and any taxes or registration costs. Factor them into the total cost analysis.

- Calculate Total Lease Cost: Don’t just focus on the monthly payment. Multiply the monthly payment by the lease term, add any down payment, acquisition fees, and estimated disposition fees to get a clear picture of the total cost of the lease.

Lease End Options for Your Trackhawk

As your lease term approaches its conclusion, you’ll have several options:

- Return the Vehicle: The most common option. Schedule a pre-inspection to identify any potential excess wear and tear charges. Address minor issues beforehand to avoid higher fees. Pay the disposition fee and walk away.

- Purchase the Vehicle: If you’ve fallen in love with your Trackhawk and its residual value is favorable (i.e., the market value is higher than the residual), you can buy it out. This avoids disposition fees and potential wear-and-tear charges.

- Trade-in/Lease Another Vehicle: If your Trackhawk’s market value is significantly higher than its residual value, you might have "lease equity." You can use this equity as a down payment or capitalized cost reduction on a new lease or purchase. This is less common for performance vehicles but worth investigating.

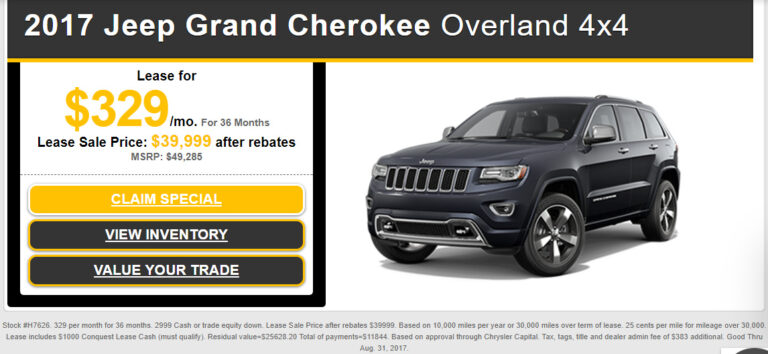

Example Lease Price Table: Jeep Grand Cherokee Trackhawk

Please Note: These figures are illustrative examples only. Actual lease prices for a Jeep Grand Cherokee Trackhawk can vary wildly based on MSRP, current incentives, dealer discounts, regional taxes, money factor, and individual credit scores. Always obtain personalized quotes from multiple dealerships.

| Lease Term (Months) | Annual Mileage | Estimated Capitalized Cost (Negotiated Price) | Estimated Residual Value (at Lease End) | Estimated Money Factor (APR Eq.) | Estimated Monthly Payment (Excl. Tax) | Estimated Total Lease Cost (Excl. Tax, Incl. Fees) | Estimated Down Payment (Cash Due at Signing) |

|---|---|---|---|---|---|---|---|

| 36 | 10,000 | $85,000 | $50,150 (59%) | 0.00200 (4.8%) | $985 | $35,460 + $995 (Acq) + $395 (Disp) = $36,850 | $0 |

| 36 | 12,000 | $85,000 | $48,450 (57%) | 0.00220 (5.28%) | $1,050 | $37,800 + $995 (Acq) + $395 (Disp) = $39,190 | $0 |

| 36 | 15,000 | $85,000 | $46,750 (55%) | 0.00240 (5.76%) | $1,115 | $40,140 + $995 (Acq) + $395 (Disp) = $41,530 | $0 |

| 24 | 10,000 | $85,000 | $55,250 (65%) | 0.00180 (4.32%) | $1,350 | $32,400 + $995 (Acq) + $395 (Disp) = $33,790 | $0 |

Assumptions:

- MSRP: ~$90,000

- Acquisition Fee: $995

- Disposition Fee: $395

- No trade-in equity applied.

- Excellent credit score assumed for lower money factors.

- Tax, title, and license fees are not included in the monthly payment or total cost estimates.

Frequently Asked Questions (FAQ) about Jeep Cherokee Trackhawk Lease

Q: Is leasing a Trackhawk cheaper than buying?

A: Monthly payments for a lease are typically lower than finance payments for a purchase of the same vehicle. However, over the long term, purchasing and keeping a vehicle often results in lower total cost if you drive it for many years beyond the finance term. Leasing is about accessing the vehicle for a defined period with lower monthly outlays, not necessarily lower overall cost.

Q: What’s a good mileage allowance for a Trackhawk lease?

A: This depends entirely on your driving habits. For a performance vehicle like the Trackhawk, it’s easy to put on miles quickly. 10,000-12,000 miles per year is standard. If you anticipate driving more, consider a higher mileage allowance upfront, even if it increases your monthly payment, as it will be cheaper than paying overage penalties.

Q: Can I modify my Trackhawk during the lease?

A: Generally, no. Leasing agreements typically prohibit significant modifications that cannot be easily reversed without damage. Any permanent changes could result in charges at lease end. Consult your lease agreement for specifics.

Q: What happens if I go over my mileage limit?

A: You will be charged an excess mileage fee for every mile over your contracted limit. This fee is usually outlined in your lease agreement and can range from $0.15 to $0.30 or more per mile.

Q: Is insurance more expensive for a leased Trackhawk?

A: Yes, insurance for a leased vehicle is often more expensive than for a purchased one, especially for a high-value, high-performance vehicle like the Trackhawk. Leasing companies typically require higher coverage limits (e.g., full comprehensive and collision coverage) to protect their asset.

Q: How does my credit score affect the lease?

A: Your credit score significantly impacts the "money factor" (the interest rate) of your lease. A higher credit score (excellent credit) will qualify you for the lowest money factor, resulting in lower monthly payments. Conversely, a lower credit score will lead to a higher money factor and higher payments.

Q: Can I get out of a Trackhawk lease early?

A: While possible, getting out of a lease early is usually very expensive. You’ll typically be responsible for the remaining lease payments, early termination fees, and potentially other charges. Options include transferring the lease (if allowed by the lessor and you find a qualified party) or buying out the lease.

Concluding Summary

The Jeep Grand Cherokee Trackhawk is an extraordinary machine, a true testament to American automotive engineering prowess. For those captivated by its monstrous power and undeniable presence, a Jeep Cherokee Trackhawk Lease offers a strategic and often more accessible path to experience this thrill. It allows enthusiasts to enjoy the cutting-edge performance and luxury of a brand-new Trackhawk without the long-term financial commitment, significant depreciation risk, or the burden of reselling.

However, a successful Trackhawk lease requires careful consideration of its unique characteristics: the high MSRP, the potential for rapid mileage accumulation, and the specialized maintenance needs. By understanding the financial components of a lease, diligently negotiating the capitalized cost, and planning for mileage and potential wear and tear, you can unlock a truly exhilarating driving experience. For the discerning individual who desires the apex of SUV performance for a defined period, leasing a Trackhawk isn’t just a transaction; it’s an opportunity to embrace the beast on your own terms.