Jeep Grand Cherokee En Leasing: Your Comprehensive Guide to Driving America’s Premium SUV

Jeep Grand Cherokee En Leasing: Your Comprehensive Guide to Driving America’s Premium SUV jeeps.truckstrend.com

The allure of a Jeep Grand Cherokee is undeniable. With its iconic design, luxurious interior, legendary capability, and advanced technology, it stands as a quintessential American SUV. For many, the dream of parking a new Grand Cherokee in their driveway becomes a reality not through outright purchase, but "en leasing" – or through a lease agreement. Leasing offers a flexible and often more affordable pathway to experience the latest models, making it an increasingly popular choice for discerning drivers.

This comprehensive guide delves into everything you need to know about leasing a Jeep Grand Cherokee. We’ll explore the benefits, walk you through the process, highlight crucial considerations, and provide actionable tips to secure the best deal. Whether you’re a first-time leaser or looking to upgrade, understanding the nuances of Jeep Grand Cherokee leasing can unlock a world of possibilities.

Jeep Grand Cherokee En Leasing: Your Comprehensive Guide to Driving America’s Premium SUV

Understanding Jeep Grand Cherokee Leasing: The Basics

At its core, leasing a vehicle is similar to a long-term rental agreement. Instead of purchasing the vehicle outright or financing its full price, you pay for the depreciation of the vehicle over a set period. This distinction is fundamental to understanding why leasing often results in lower monthly payments compared to a traditional car loan.

Here are the key terms you’ll encounter in a Grand Cherokee lease agreement:

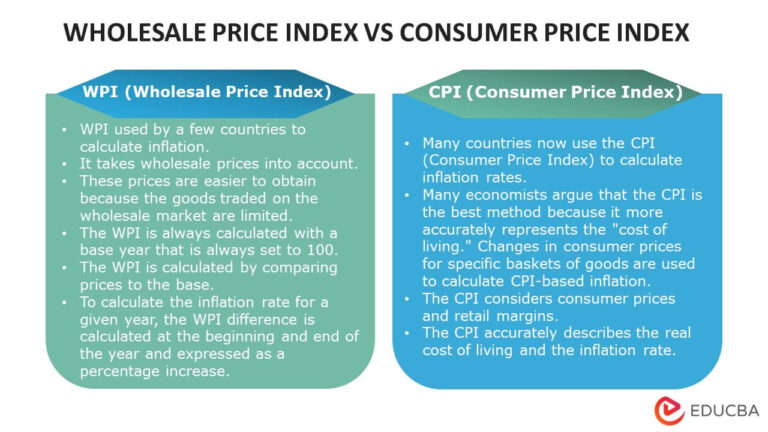

- MSRP (Manufacturer’s Suggested Retail Price): The sticker price of the vehicle. This is your starting point for negotiation, as a lower negotiated price (the "capitalized cost") directly impacts your monthly payment.

- Capitalized Cost: The agreed-upon price of the vehicle, including any fees, that the lease is based on. This is the equivalent of the purchase price in a finance deal.

- Residual Value: The estimated value of the vehicle at the end of the lease term. This is determined by the leasing company and is a percentage of the MSRP. A higher residual value generally leads to lower monthly payments because the depreciation you’re paying for is less.

- Money Factor: This is the interest rate equivalent on a lease. It’s usually expressed as a very small decimal (e.g., 0.00200). To convert it to an annual percentage rate (APR), multiply by 2400 (0.00200 x 2400 = 4.8% APR). A lower money factor means lower finance charges.

- Lease Term: The duration of the lease, typically 24, 36, or 48 months.

- Mileage Allowance: The maximum number of miles you are permitted to drive the vehicle annually (e.g., 10,000, 12,000, or 15,000 miles per year). Exceeding this limit results in per-mile charges (e.g., $0.20-$0.30 per mile).

- Acquisition Fee: A fee charged by the leasing company for setting up the lease.

- Disposition Fee: A fee charged at the end of the lease when you return the vehicle, covering costs like cleaning and reselling.

Why Lease a Jeep Grand Cherokee? Benefits Galore

Leasing a Jeep Grand Cherokee offers a compelling array of advantages, making it an attractive option for a wide range of drivers:

- Lower Monthly Payments: This is arguably the biggest draw. Since you’re only paying for the vehicle’s depreciation during your lease term, monthly payments are typically significantly lower than financing the full purchase price of the same Grand Cherokee.

- Access to New Models & Latest Technology: Leasing allows you to drive a brand-new Grand Cherokee every few years, ensuring you always have the latest safety features, infotainment systems, and performance enhancements. This is particularly appealing with the rapid advancements in automotive technology, including the new Grand Cherokee 4xe plug-in hybrid.

- Consistent Warranty Coverage: Your leased Grand Cherokee will almost always be under its factory warranty for the entire lease term. This means most major repairs are covered, significantly reducing unexpected maintenance costs and providing peace of mind.

- Predictable Costs: Beyond your fixed monthly payment, your primary out-of-pocket expenses are fuel, insurance, and routine maintenance (oil changes, tire rotations). You avoid the financial uncertainty of unexpected major repairs common with older, out-of-warranty vehicles.

- Less Hassle at Trade-in: At the end of your lease, you simply return the vehicle to the dealership. There’s no need to worry about selling it, negotiating trade-in values, or dealing with depreciation.

- Potential Tax Advantages for Businesses: For business owners or self-employed individuals, a portion of lease payments may be tax-deductible, offering a significant financial incentive. Consult with a tax professional for specific advice.

The Jeep Grand Cherokee Lineup: Which Model to Lease?

The Jeep Grand Cherokee comes in a variety of trims, each offering a distinct level of luxury, technology, and capability. Your choice of trim will significantly impact your lease payment, as higher trims have higher MSRPs and thus higher depreciation.

- Grand Cherokee Laredo/Altitude: The entry-level trims, offering solid features and capability at a more accessible price point.

- Grand Cherokee Limited/Overland: These mid-range trims introduce more premium features, enhanced interiors, and often more advanced off-road capabilities.

- Grand Cherokee Summit/Summit Reserve: The pinnacle of luxury and technology, featuring exquisite materials, cutting-edge tech, and the most comprehensive safety suites.

- Grand Cherokee 4xe (Limited, Overland, Summit Reserve): The revolutionary plug-in hybrid variant, offering impressive fuel efficiency, electric-only range, and potential federal tax credits (check eligibility). Leasing a 4xe can be particularly attractive due to these incentives and its eco-friendly appeal.

Consider your budget, desired features, and how you plan to use the vehicle when selecting a trim. Test driving a few different options is highly recommended.

The Leasing Process: A Step-by-Step Guide

Leasing a Grand Cherokee can seem daunting, but breaking it down into manageable steps makes the process straightforward:

-

Step 1: Research and Budgeting:

- Identify Your Needs: Determine which Grand Cherokee trim and features are essential for you.

- Assess Your Budget: Figure out a comfortable monthly payment range. Remember to factor in insurance costs, which can be higher on leased vehicles.

- Estimate Mileage: Be realistic about how many miles you drive annually. Choose a mileage allowance that comfortably covers your needs to avoid costly overage fees.

-

Step 2: Understand Lease Terms:

- Decide on your preferred lease term (e.g., 36 months is common).

- Consider how much you’re willing to put down at signing (often just the first month’s payment and fees, though more can lower monthly costs).

-

Step 3: Get Multiple Quotes:

- Contact several Jeep dealerships (both local and potentially a bit further out).

- Request detailed lease quotes for your desired Grand Cherokee trim, specifying the lease term and mileage allowance. Compare not just the monthly payment but also the money factor, capitalized cost, and fees.

- Utilize online lease calculators and forums to get a general idea of current deals.

-

Step 4: Negotiate the Deal:

- Negotiate the Capitalized Cost (Price of the Car): This is the most crucial negotiation point. Treat it as if you’re buying the car. The lower the capitalized cost, the lower your monthly payment.

- Negotiate the Money Factor: While often set by the bank, some dealers might mark it up. Ask if it’s negotiable.

- Review All Fees: Understand what each fee entails (acquisition, disposition, documentation, etc.).

-

Step 5: Test Drive & Finalize:

- Take the exact Grand Cherokee you plan to lease for a thorough test drive. Ensure it meets all your expectations.

- Read the Lease Agreement Meticulously: Before signing, go through every line item. Confirm the capitalized cost, residual value, money factor, monthly payment, mileage allowance, and all fees. Don’t hesitate to ask questions if anything is unclear.

-

Step 6: Lease End Options:

- Return the Vehicle: The most common option. Simply return the Grand Cherokee and potentially lease a new one.

- Buy Out the Vehicle: If you love the car and the buyout price (residual value + purchase option fee) is favorable, you can buy it.

- Extend the Lease: Some lessors allow short-term extensions.

- Trade-in for a New Lease/Purchase: Sometimes, the vehicle’s market value exceeds its residual value, allowing for positive equity that can be used towards a new vehicle.

Key Considerations for Leasing a Grand Cherokee

While leasing offers many advantages, it’s crucial to be aware of potential pitfalls and plan accordingly:

- Mileage Limits: This is perhaps the biggest consideration. If you consistently drive more than your allotted miles, the overage fees can quickly add up. Be honest about your driving habits and choose a higher mileage allowance if necessary, even if it slightly increases your monthly payment.

- Wear and Tear: Lease agreements define "normal" vs. "excessive" wear and tear. Minor dents, scratches, and tire wear beyond normal limits can result in charges at lease end. Consider investing in a wear-and-tear protection plan if offered, or be diligent about keeping the vehicle in good condition.

- Insurance Requirements: Lessors typically require higher insurance coverage (e.g., higher liability limits, comprehensive, and collision with lower deductibles) than you might carry on an owned vehicle. Factor this into your monthly budget.

- Early Termination Penalties: Breaking a lease early can be extremely expensive. You are typically responsible for the remaining payments, fees, and the difference between the vehicle’s current market value and its residual value. Only consider early termination in extreme circumstances, or explore lease swap options.

- Down Payment Strategy: While a larger down payment lowers your monthly payment, it’s often advised to keep your down payment low on a lease. If the vehicle is stolen or totaled early in the lease, you could lose that upfront money. Consider using a Multiple Security Deposit (MSD) if available, which can lower your money factor without being a "lost" payment.

- Maintenance: You are responsible for all routine maintenance as per the manufacturer’s schedule. Adhering to this is vital, as failure to do so can result in penalties at lease end or voided warranty claims.

Optimizing Your Jeep Grand Cherokee Lease Deal: Tips and Strategies

Securing a great lease deal requires savvy negotiation and strategic thinking:

- Negotiate the Capitalized Cost First: This is the most impactful lever. Treat it as if you’re buying the car outright. Get the best possible "selling price" before discussing lease terms.

- Shop Around for the Best Money Factor: Different lenders (banks, credit unions) and even different dealerships might offer varying money factors. Don’t settle for the first one.

- Look for Manufacturer Incentives: Jeep often offers special lease incentives, such as reduced money factors, lease cash, or higher residual values, particularly on outgoing models or during sales events. Check Jeep’s official website and local dealer promotions.

- Consider Different Lease Terms: A 36-month lease often strikes the best balance between low monthly payments and being under warranty for the entire term. Longer terms (48 months) might offer lower payments but risk going out of warranty. Shorter terms (24 months) mean higher payments but more frequent new vehicles.

- Avoid Unnecessary Add-ons: Be wary of dealer add-ons like paint protection, extended warranties (beyond factory), or window tinting rolled into the capitalized cost unless you truly want and need them.

- Boost Your Credit Score: A higher credit score (Tier 1 or Tier 1+) will qualify you for the lowest money factor, significantly reducing your finance charges.

Potential Challenges and Solutions

Even with careful planning, some challenges can arise during a lease. Here’s how to address them:

- Excess Mileage:

- Solution: Plan ahead. If you anticipate exceeding your allowance, consider buying extra miles upfront, which is often cheaper than paying overage fees at lease end. Alternatively, if you’re only slightly over, weigh the cost of the overage against potentially buying the car at lease end.

- Excessive Wear and Tear:

- Solution: Before returning the vehicle, conduct a thorough inspection. Address minor issues like small dents or scratches at an independent body shop, which can be cheaper than dealer charges. Consider a pre-inspection from the leasing company (if offered) to know exactly what they’ll charge for.

- Early Termination:

- Solution: This is best avoided. However, if unavoidable, explore a lease transfer or "lease swap" service. These platforms connect you with individuals willing to take over your lease, potentially saving you thousands in penalties.

- Unexpected Insurance Costs:

- Solution: Shop multiple insurance providers before signing your lease. Get quotes for the specific Grand Cherokee model and the required coverage limits to avoid surprises.

Sample Illustrative Lease Price Table for Jeep Grand Cherokee

Please Note: The prices in this table are illustrative estimates only and are subject to significant variation. Actual lease payments are highly dependent on current manufacturer incentives, regional offers, dealer discounts, individual credit score, chosen options, lease term, mileage allowance, and prevailing market conditions. Always consult with a certified Jeep dealership for personalized and accurate quotes. These figures do not include sales tax, registration fees, or local charges.

| Model/Trim | Illustrative MSRP | Lease Term | Mileage Allowance | Due at Signing (Est.)* | Estimated Monthly Payment (Est.)* |

|---|---|---|---|---|---|

| Grand Cherokee Laredo | $42,000 | 36 Months | 10,000 miles/year | $2,500 | $449 |

| Grand Cherokee Limited | $48,000 | 36 Months | 10,000 miles/year | $2,800 | $529 |

| Grand Cherokee Overland | $62,000 | 36 Months | 10,000 miles/year | $3,500 | $699 |

| Grand Cherokee Summit | $68,000 | 36 Months | 10,000 miles/year | $4,000 | $779 |

| Grand Cherokee 4xe Limited | $66,000 | 36 Months | 10,000 miles/year | $3,800 | $749 |

| Grand Cherokee 4xe Summit Reserve | $80,000 | 36 Months | 10,000 miles/year | $4,500 | $929 |

Due at Signing (Estimated) typically includes the first month’s payment, acquisition fee, documentation fee, and potentially a small capitalized cost reduction (down payment).

Estimated Monthly Payment excludes sales tax and any applicable local charges.

Frequently Asked Questions (FAQ) about Jeep Grand Cherokee Leasing

Q1: Is leasing a Jeep Grand Cherokee cheaper than buying one?

A1: In terms of monthly payments, leasing is almost always cheaper than financing the full purchase price of a new Grand Cherokee. However, over the long term, if you keep vehicles for many years, buying and paying off the loan can be more cost-effective as you eventually own the asset free and clear. Leasing is about maximizing usage for a fixed period.

Q2: What happens at the end of a Jeep Grand Cherokee lease?

A2: At the end of your lease, you typically have several options: return the vehicle and walk away, purchase the vehicle for its residual value, extend the lease, or trade it in for a new lease or purchase.

Q3: Can I buy my leased Grand Cherokee at the end of the term?

A3: Yes, you have the option to purchase your leased Grand Cherokee at the end of the lease term for its predetermined residual value, plus any purchase option fees.

Q4: What if I go over my mileage limit on my Grand Cherokee lease?

A4: You will be charged an overage fee per mile (e.g., $0.20-$0.30 per mile) for every mile exceeding your allowance. It’s crucial to estimate your annual mileage accurately before signing.

Q5: What is a "money factor" in a lease, and how does it relate to interest?

A5: The money factor is the finance charge on a lease, similar to an interest rate. To convert it to an approximate annual percentage rate (APR), multiply the money factor by 2400. A lower money factor means lower monthly payments.

Q6: Can I customize or modify my leased Grand Cherokee?

A6: Generally, no significant permanent modifications are allowed on a leased vehicle. You are expected to return the vehicle in its original condition, minus normal wear and tear. Minor, easily reversible changes like floor mats are usually fine, but always check your lease agreement.

Q7: Is a down payment required for a Jeep Grand Cherokee lease?

A7: While a down payment (capitalized cost reduction) is not always strictly required, putting some money down will lower your monthly payments. However, many experts advise against large down payments on leases, as that money could be lost if the vehicle is totaled early in the term. Often, only the first month’s payment and fees are due at signing.

Q8: What’s the best lease term for a Grand Cherokee?

A8: The most common and often recommended lease term is 36 months. This term usually balances lower monthly payments with ensuring the vehicle remains under its factory warranty for the entire lease period, minimizing unexpected repair costs.

Conclusion: Drive Your Dream Grand Cherokee "En Leasing"

Leasing a Jeep Grand Cherokee presents a compelling opportunity to enjoy one of the most capable and luxurious SUVs on the market with greater financial flexibility. It’s an ideal choice for those who appreciate driving a new vehicle every few years, desire lower monthly payments, and prefer the simplicity of returning a vehicle at lease end without the complexities of selling or trading in.

By understanding the key terms, navigating the process strategically, and being mindful of important considerations like mileage and wear and tear, you can unlock a truly rewarding driving experience. Before making a decision, always gather multiple quotes, read the fine print carefully, and ensure the lease agreement aligns perfectly with your lifestyle and budget. "En leasing" your next Jeep Grand Cherokee could be the smartest way to command the road in style and confidence.