Jeep Grand Cherokee Lease Deals Near Me: Your Ultimate Guide to Driving Home a Legend

Jeep Grand Cherokee Lease Deals Near Me: Your Ultimate Guide to Driving Home a Legend jeeps.truckstrend.com

The Jeep Grand Cherokee has long stood as a beacon of American automotive prowess, blending rugged capability with luxurious comfort and advanced technology. It’s a vehicle that commands respect on the road and offers unparalleled versatility, whether you’re navigating urban jungles, embarking on family road trips, or exploring off-the-beaten-path adventures. For many, the dream of owning such a prestigious SUV might seem financially out of reach, but that’s where Jeep Grand Cherokee Lease Deals Near Me come into play.

Leasing a vehicle, particularly a high-value one like the Grand Cherokee, offers a compelling alternative to traditional financing. It allows you to experience the thrill of a brand-new model, complete with the latest features and warranty coverage, often with lower monthly payments and less long-term commitment than purchasing. This comprehensive guide will walk you through everything you need to know about finding, understanding, and securing the best Jeep Grand Cherokee lease deals in your local area, transforming your aspiration into a tangible reality.

Jeep Grand Cherokee Lease Deals Near Me: Your Ultimate Guide to Driving Home a Legend

Understanding Jeep Grand Cherokee Lease Deals

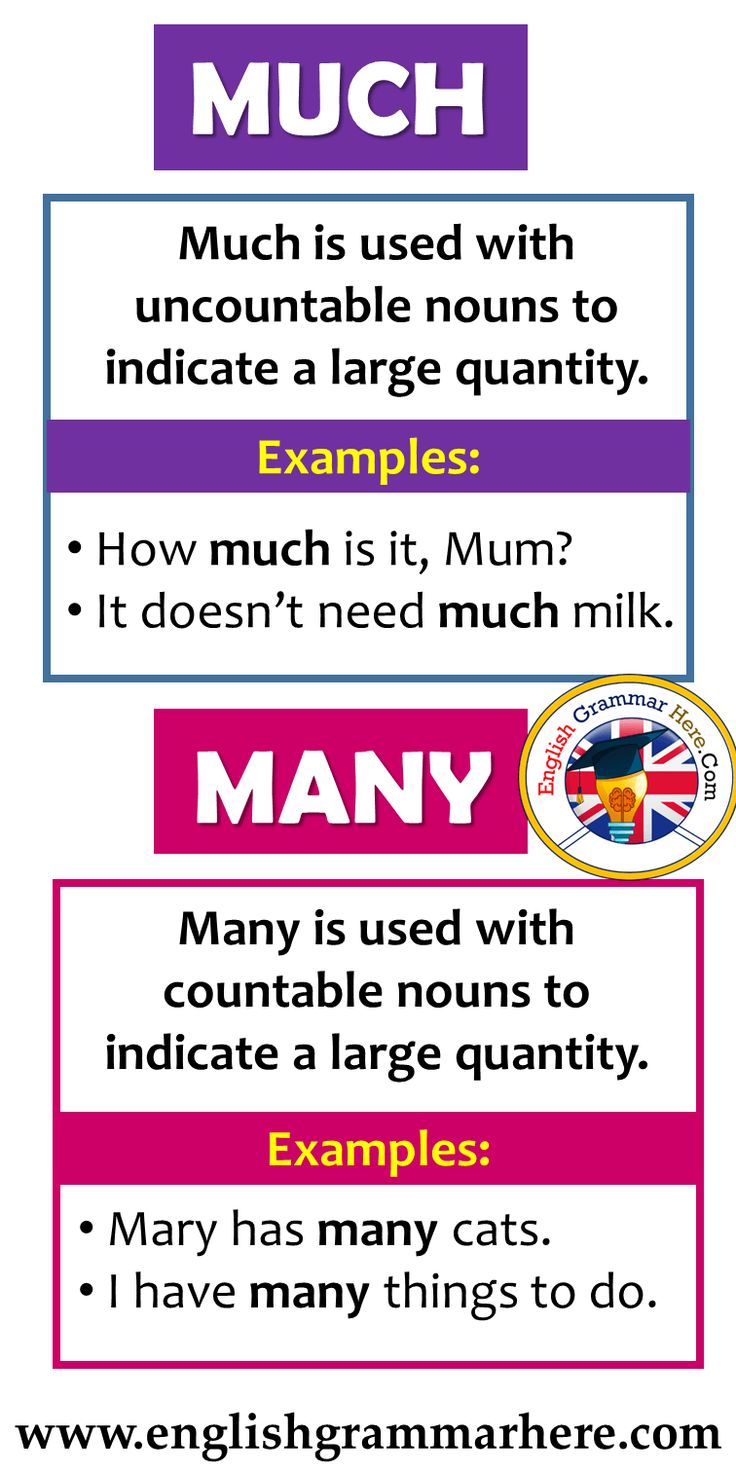

At its core, leasing a vehicle is akin to long-term renting. Instead of paying for the entire purchase price of the car, you pay for the depreciation of the vehicle over a set period, typically 24, 36, or 48 months. This fundamental difference is why monthly lease payments are generally lower than loan payments for the same vehicle.

When you look for "Jeep Grand Cherokee Lease Deals Near Me," you’re essentially searching for offers from local dealerships that package together a specific term, mileage allowance, and monthly payment based on current market conditions, manufacturer incentives, and the vehicle’s residual value. These deals are designed to be attractive and accessible, making it easier for you to get behind the wheel of your desired Grand Cherokee trim.

Why Lease a Jeep Grand Cherokee? The Benefits Unveiled

Leasing offers a unique set of advantages that make it an attractive option for many drivers:

- Lower Monthly Payments: This is often the primary draw. Because you’re only paying for depreciation, not the full cost of the vehicle, your monthly out-of-pocket expense is significantly reduced compared to financing a purchase.

- Drive a Newer Model More Often: Lease terms are typically short, allowing you to upgrade to a brand-new Grand Cherokee with the latest technology, safety features, and design every few years. You’re always driving a car under warranty, minimizing unexpected repair costs.

- Lower Upfront Costs: While some leases require a down payment (capitalized cost reduction), many attractive deals require minimal or no money down, making it easier to drive off the lot.

- Manufacturer Warranty Coverage: Throughout the entire lease term, your Grand Cherokee will almost certainly be covered by the factory warranty, providing peace of mind against mechanical issues.

- No Resale Hassle: At the end of the lease, you simply return the vehicle to the dealership. You avoid the complexities and potential financial loss associated with selling a used car.

- Access to Premium Trims: Lower monthly payments might enable you to afford a higher trim level (e.g., Summit Reserve, Overland, or even the 4xe hybrid) that would be out of budget if purchased outright.

- Predictable Budgeting: With fixed monthly payments and warranty coverage, your automotive expenses are highly predictable, barring excess wear and tear or mileage overages.

Navigating the Search: Finding "Jeep Grand Cherokee Lease Deals Near Me"

Finding the best lease deal requires a systematic approach. Here’s how to effectively search for offers in your vicinity:

- Online Dealership Websites: Start with the official websites of Jeep dealerships in your area. Most will have a dedicated "Specials" or "Lease Offers" section showcasing their current deals on various Grand Cherokee trims.

- Manufacturer Websites: Visit the official Jeep website (Jeep.com) and use their "Build & Price" or "Offers & Incentives" sections. You can often input your ZIP code to see regional lease specials directly from the manufacturer.

- Third-Party Auto Aggregators: Websites like Edmunds, Leasehackr, TrueCar, and Cars.com often list lease deals from multiple dealerships, allowing you to compare offers side-by-side. Leasehackr, in particular, is excellent for understanding the nitty-gritty of lease calculations and finding community-sourced deals.

- Local Advertisements: Keep an eye on local newspaper ads, radio commercials, and direct mailers from dealerships, especially around holiday weekends or end-of-month/quarter periods when dealers are pushing to meet sales quotas.

- Visit Dealerships: Once you’ve identified a few promising deals online, don’t hesitate to visit the dealerships in person. This allows you to test drive the vehicle, assess its condition, and begin the negotiation process face-to-face.

Key Elements of a Jeep Grand Cherokee Lease Agreement

Understanding the components of a lease is crucial for making an informed decision:

- MSRP (Manufacturer’s Suggested Retail Price): The sticker price of the vehicle. While you don’t pay this directly, it’s the basis for the lease calculation.

- Capitalized Cost (Cap Cost): This is the agreed-upon price of the vehicle that the lease is based on. It can be lower than MSRP if you negotiate effectively or if there are dealer discounts/incentives.

- Capitalized Cost Reduction (Cap Cost Reduction): This is essentially your "down payment." The more you put down, the lower your monthly payments, but it’s often advisable to put down as little as possible.

- Residual Value: This is the projected value of the vehicle at the end of the lease term, expressed as a percentage of the MSRP. A higher residual value means less depreciation and, therefore, lower monthly payments. The Grand Cherokee generally holds its value well, which can lead to favorable lease terms.

- Money Factor: This is the equivalent of an interest rate in a lease, often expressed as a very small decimal (e.g., 0.00200). To convert it to an APR, multiply by 2400 (e.g., 0.00200 * 2400 = 4.8% APR). A lower money factor is better.

- Lease Term: The duration of the lease, typically 24, 36, or 48 months. Shorter terms often have higher monthly payments but lower overall depreciation costs.

- Mileage Allowance: The maximum number of miles you can drive annually without incurring penalties. Common allowances are 10,000, 12,000, or 15,000 miles per year. Exceeding this limit can result in fees of $0.15-$0.25 per mile.

- Acquisition Fee: A fee charged by the leasing company for setting up the lease.

- Disposition Fee: A fee charged at the end of the lease when you return the vehicle.

- Taxes and Fees: Sales tax (which can be paid upfront or rolled into monthly payments), registration fees, and other governmental charges.

Tips for Securing the Best Grand Cherokee Lease Deal

- Know Your Credit Score: A strong credit score (typically 700+) is essential for qualifying for the best lease rates (lowest money factor).

- Research Current Incentives: Manufacturers frequently offer special lease programs, low money factors, or lease cash incentives. Check Jeep’s official website.

- Negotiate the Capitalized Cost: Even though it’s a lease, you can still negotiate the selling price of the vehicle (the capitalized cost) before the lease calculations begin. Treat it like a car purchase negotiation.

- Understand the Money Factor: Ask for the money factor. If it seems high, ask if they can lower it or if you qualify for a better rate.

- Consider "Zero Down" vs. Down Payment: While a down payment lowers monthly payments, if the car is totaled, you might lose that upfront cash. Often, it’s better to invest that money elsewhere or keep it for emergencies.

- Assess Your Driving Habits: Choose a mileage allowance that accurately reflects your annual driving. Overestimating means you pay for unused miles; underestimating leads to costly overage fees.

- Shop Around: Get quotes from at least 3-4 different dealerships, even if they’re not precisely "near me" but within a reasonable driving distance. Competition drives better deals.

- Time Your Lease: End-of-month, end-of-quarter, and year-end are often prime times for deals as dealerships push to meet sales targets. Black Friday, Memorial Day, and Labor Day sales also feature strong incentives.

- Read the Fine Print: Before signing, meticulously review every line of the lease agreement. Understand all fees, terms, and conditions.

Potential Challenges and Solutions

While leasing offers many benefits, it’s important to be aware of potential challenges:

- Mileage Overage Fees: Solution: Be realistic about your driving. If you anticipate exceeding your allowance, negotiate a higher mileage limit upfront, which is cheaper than paying penalties at the end.

- Excessive Wear and Tear: Solution: Maintain the vehicle meticulously. Understand what constitutes "normal wear and tear" according to your lease agreement. Consider purchasing excess wear and tear protection if offered, especially if you have kids or pets.

- Early Termination Penalties: Solution: Only lease if you are confident you’ll keep the car for the full term. Early termination can be very expensive, often requiring you to pay the remaining payments and additional fees. In some cases, a lease transfer service might be an option.

- Not Building Equity: Solution: Understand that leasing is not about ownership. If building equity and long-term ownership are your primary goals, buying might be a better fit.

Understanding Grand Cherokee Trims and Their Lease Implications

The Jeep Grand Cherokee lineup is diverse, from the well-equipped Laredo to the ultra-luxurious Summit Reserve and the efficient 4xe plug-in hybrid. Each trim level will have different MSRPs, affecting the capitalized cost and, consequently, the lease payment. Higher trims generally have higher residual values (as a percentage), but their higher starting price means higher overall payments.

- Laredo/Altitude: Entry-level, great value, typically the most aggressive lease offers.

- Limited/Overland: Popular mid-range trims with more features and comfort, offering a good balance of value and luxury.

- Summit/Summit Reserve: Top-tier luxury, higher payments, but you get premium features and materials.

- 4xe (Plug-in Hybrid): Offers impressive fuel economy and instant torque. Often eligible for federal tax credits (though these usually apply to purchases, some may affect the capitalized cost for leases indirectly) and state incentives, potentially making lease deals more attractive.

When looking for "Jeep Grand Cherokee Lease Deals Near Me," specify the trim you’re interested in, as deals often vary significantly by model.

Example Lease Deal Information Table

Please Note: The following table provides hypothetical examples for illustrative purposes only. Actual lease deals are highly dynamic and depend on location, current incentives, credit score, specific dealership offers, and negotiation. Always verify current offers with local dealerships.

| Jeep Grand Cherokee Trim | MSRP (Est.) | Typical Down Payment (Cap Cost Reduction) | Est. Monthly Payment (36 Months/10k Miles) | Lease Term | Annual Mileage Allowance | Est. Residual Value (End of Lease) |

|---|---|---|---|---|---|---|

| Laredo | $40,000 | $2,500 | $450 – $550 | 36 Months | 10,000 miles | 60% – 62% ($24,000 – $24,800) |

| Limited | $47,000 | $2,800 | $520 – $620 | 36 Months | 10,000 miles | 59% – 61% ($27,730 – $28,670) |

| Overland | $57,000 | $3,000 | $650 – $780 | 36 Months | 10,000 miles | 58% – 60% ($33,060 – $34,200) |

| Summit | $63,000 | $3,500 | $750 – $890 | 36 Months | 10,000 miles | 57% – 59% ($35,910 – $37,170) |

| 4xe (Limited) | $60,000 | $3,000 | $690 – $820 | 36 Months | 10,000 miles | 59% – 61% ($35,400 – $36,600) |

| Zero Down Options | (Varies) | $0 | Add $50-$100 to above estimates | 36 Months | 10,000 miles | (Varies) |

Note on Down Payment: A typical down payment often includes the first month’s payment, acquisition fee, and sometimes a small capitalized cost reduction. "Zero Down" deals roll these costs into the monthly payment or require only the first month’s payment upfront.

Frequently Asked Questions (FAQ) About Jeep Grand Cherokee Lease Deals

Q1: What credit score do I need for a good Grand Cherokee lease deal?

A1: Generally, a FICO score of 700 or above is considered "Tier 1" or "Super Preferred" and will qualify you for the best money factors (lowest interest rates). Scores below this may still qualify but with higher monthly payments.

Q2: Can I negotiate a lease deal?

A2: Absolutely! Everything is negotiable, from the capitalized cost (the selling price of the car for the lease) to the money factor, and even the mileage allowance. Don’t be afraid to haggle.

Q3: What happens at the end of a Jeep Grand Cherokee lease?

A3: You typically have three options:

- Return the vehicle: Simply hand over the keys, pay any excess mileage or wear-and-tear fees, and the disposition fee.

- Purchase the vehicle: If you love the car and the residual value is favorable, you can buy it out for the predetermined residual value.

- Lease a new Jeep: You can trade in your current leased Grand Cherokee for a new one, rolling any equity (if the car’s market value is higher than its residual) or remaining payments into the new lease.

Q4: Is it better to lease or buy a Jeep Grand Cherokee?

A4: This depends on your priorities:

- Lease if: You want lower monthly payments, drive a new car every few years, prefer predictable expenses, and don’t want the hassle of selling.

- Buy if: You plan to keep the car for more than 4-5 years, drive many miles annually, want to build equity, and customize your vehicle without restrictions.

Q5: What is the ideal lease term for a Grand Cherokee?

A5: 36 months is often considered the sweet spot. It allows you to upgrade relatively frequently, and the vehicle is typically still under the manufacturer’s bumper-to-bumper warranty for the entire term, minimizing repair costs.

Q6: What about insurance for a leased Grand Cherokee?

A6: Leasing companies require full comprehensive and collision insurance coverage, often with higher liability limits than what you might carry for an owned vehicle. Factor these costs into your budget.

Conclusion: Driving Your Dream Grand Cherokee

Finding the perfect Jeep Grand Cherokee Lease Deals Near Me is an achievable goal that can put you behind the wheel of one of America’s most iconic and capable SUVs. By understanding the intricacies of leasing, diligently researching available offers, and confidently negotiating terms, you can unlock the flexibility and financial advantages that leasing provides.

The Grand Cherokee offers a unique blend of rugged capability, refined luxury, and advanced technology that makes it a standout choice in the SUV segment. Whether you’re drawn to its legendary off-road prowess, its comfortable and spacious interior, or its powerful engine options, leasing provides an accessible pathway to experiencing all that this exceptional vehicle has to offer. So, start your research, compare the deals, and prepare to embark on your next adventure in a brand-new Jeep Grand Cherokee.