Jeep Grand Cherokee Lease Deals New Jersey

Jeep Grand Cherokee Lease Deals New Jersey jeeps.truckstrend.com

The open roads of New Jersey, from the bustling turnpike to the scenic Parkway, demand a vehicle that offers both comfort and capability. For many, the Jeep Grand Cherokee stands as an iconic choice, perfectly blending rugged performance with refined luxury. But what if you desire the prestige and power of a Grand Cherokee without the long-term commitment of a purchase? Enter the world of Jeep Grand Cherokee Lease Deals New Jersey.

Leasing has become an increasingly popular option for savvy consumers in the Garden State, offering a flexible and often more affordable pathway to driving a new vehicle every few years. This comprehensive guide will navigate the intricacies of leasing a Jeep Grand Cherokee in New Jersey, providing you with the knowledge and tools to secure a deal that perfectly aligns with your lifestyle and budget.

Jeep Grand Cherokee Lease Deals New Jersey

Why Lease a Jeep Grand Cherokee in New Jersey? The Allure of Flexibility and Freedom

Leasing a vehicle, particularly a premium SUV like the Jeep Grand Cherokee, offers a distinct set of advantages that resonate with many New Jersey drivers. It’s not just about getting behind the wheel of a new car; it’s about optimizing your automotive experience.

1. Lower Monthly Payments: One of the most compelling reasons to lease is the significantly lower monthly payment compared to financing a purchase. When you lease, you’re only paying for the depreciation of the vehicle over the lease term, rather than its full purchase price. This frees up cash flow for other expenses or allows you to afford a higher trim level than you might otherwise consider.

2. Drive a New Vehicle More Often: Imagine upgrading to the latest model, with the newest technology and safety features, every two to four years. Leasing makes this a reality. For those who love staying current with automotive innovations, leasing is an ideal solution.

3. Comprehensive Warranty Coverage: Lease terms typically align with the manufacturer’s bumper-to-bumper warranty. This means that for the duration of your lease, most major repairs are covered, minimizing unexpected out-of-pocket expenses and providing peace of mind.

4. Less Hassle at Trade-In Time: At the end of your lease, you simply return the vehicle to the dealership (assuming it meets mileage and wear-and-tear guidelines). There’s no need to worry about selling a used car, negotiating trade-in values, or dealing with depreciation in the used car market.

5. Tax Advantages (NJ Specific): In New Jersey, sales tax on leased vehicles is typically applied to the monthly payment, rather than the full capitalized cost of the vehicle upfront. This can result in a more manageable initial outlay compared to purchasing.

6. Experience the Grand Cherokee’s Evolution: The Jeep Grand Cherokee itself is a testament to evolving automotive excellence, offering a blend of off-road capability, on-road comfort, and sophisticated technology. From the luxurious interior of the Summit Reserve to the rugged appeal of the Trailhawk, or the eco-conscious power of the 4xe hybrid, leasing allows you to experience these diverse trims and features without a long-term commitment to one specific model.

![]()

Understanding the Anatomy of a Jeep Grand Cherokee Lease Deal

To truly grasp a lease deal, you need to dissect its core components. Each element plays a crucial role in determining your monthly payment and overall lease cost.

- MSRP (Manufacturer’s Suggested Retail Price): The sticker price of the vehicle. While you don’t pay this, it’s the starting point for negotiations.

- Capitalized Cost (Cap Cost): This is the negotiated price of the vehicle, similar to the selling price if you were buying. This is the most crucial figure to negotiate. Any down payment, trade-in equity, or rebates reduce the cap cost.

- Residual Value: The estimated value of the vehicle at the end of the lease term. It’s expressed as a percentage of the MSRP. A higher residual value generally leads to lower monthly payments because the depreciation (the amount you pay for) is less.

- Money Factor: This is the equivalent of an interest rate on a lease. It’s expressed as a very small decimal (e.g., 0.00180). To convert it to an approximate annual percentage rate (APR), multiply by 2400 (0.00180 x 2400 = 4.32% APR). A lower money factor means lower finance charges.

- Lease Term: The duration of the lease, typically 24, 36, or 48 months. Shorter terms often have higher monthly payments but lower total depreciation costs.

- Mileage Allowance: The maximum number of miles you’re allowed to drive annually without incurring penalties (e.g., 10,000, 12,000, 15,000 miles per year). Exceeding this limit results in per-mile charges (e.g., $0.25-$0.30 per mile).

- Acquisition Fee: An administrative fee charged by the leasing company for setting up the lease (usually $595-$995).

- Disposition Fee: A fee charged at the end of the lease when you return the vehicle, covering the cost of preparing it for resale (usually $300-$500). This fee is often waived if you lease another vehicle from the same manufacturer.

- Down Payment/Drive-Off Costs: Any upfront money paid at signing, which includes the first month’s payment, acquisition fee, registration, plate fees, and sometimes a security deposit. While a large down payment lowers monthly payments, it’s generally advised to keep it minimal, as you lose that money if the vehicle is totaled.

Navigating the New Jersey Market: Finding the Best Deals

New Jersey’s competitive automotive market can work to your advantage when seeking a Jeep Grand Cherokee lease.

1. Research Dealerships Aggressively:

- Online Search: Use search terms like "Jeep Grand Cherokee lease deals NJ," "best Grand Cherokee lease New Jersey," or "Jeep dealerships near [Your NJ town]."

- Multiple Quotes: Contact several dealerships, both local and slightly further afield. Dealerships often compete fiercely for business.

- Reputation Check: Read online reviews (Google, Yelp, DealerRater) to gauge customer service and transparency.

2. Monitor Manufacturer and Dealership Websites:

- Jeep often runs national lease incentives that dealerships in NJ will honor. Check Jeep’s official website for current offers.

- Individual dealerships may also have their own special promotions, especially towards the end of the month or quarter when they’re trying to meet sales targets.

3. Explore Lease Aggregators and Brokers:

- Websites like LeaseHackr or local NJ-based auto brokers can provide insights into current market trends and sometimes even pre-negotiated deals. Brokers can be particularly useful for those who dislike direct negotiation.

4. Timing is Key:

- End of the Month/Quarter/Year: Dealerships are often more motivated to close deals to meet quotas.

- New Model Year Release: When a new model year is introduced, dealerships are keen to move out the previous year’s inventory, often leading to more aggressive lease incentives on the outgoing models.

- Holidays: Major holidays like Memorial Day, Labor Day, and Black Friday can bring special promotions.

5. Know Your Credit Score: Your credit score is paramount. A higher credit score (typically 700+) will qualify you for the lowest money factor, significantly reducing your monthly payments. Obtain a free credit report before you start shopping.

The Lease Process: A Step-by-Step Guide for NJ Buyers

Ready to lease your Grand Cherokee? Follow these steps to ensure a smooth and informed experience:

-

Define Your Needs and Budget:

- Which Grand Cherokee trim level appeals to you (Laredo, Limited, Overland, Summit, 4xe)?

- What’s your comfortable monthly payment range?

- How many miles do you typically drive per year? Be realistic to avoid overage fees.

-

Get Pre-Approved: Many dealerships offer online pre-approval. This gives you an idea of your eligible money factor and helps streamline the process.

-

Test Drive and Finalize Choice: Visit dealerships to test drive your preferred Grand Cherokee trims. Ensure the vehicle meets your expectations in terms of comfort, features, and driving dynamics.

-

Negotiate the Capitalized Cost (Sales Price): This is where you can save the most money. Negotiate the price of the car as if you were buying it outright. A lower cap cost directly translates to lower monthly payments. Don’t focus solely on the monthly payment; understand all components.

-

Review the Lease Agreement Meticulously:

- Verify all numbers: Cap cost, residual value, money factor, lease term, mileage allowance.

- Understand all fees: Acquisition, disposition, registration, taxes.

- Early Termination Clause: Know the penalties if you need to end the lease early.

- Wear and Tear Policy: Understand what constitutes "excessive" wear and tear.

-

Insurance Requirements in NJ: New Jersey mandates specific minimum liability insurance coverage. Your leasing company will also have their own requirements, typically requiring comprehensive and collision coverage with specific deductibles. Factor these costs into your budget.

-

Sign and Drive: Once you’re satisfied with all terms, sign the paperwork and drive off in your new Jeep Grand Cherokee!

Important Considerations and Potential Pitfalls

While leasing offers many benefits, it’s crucial to be aware of potential downsides:

- Mileage Overages: This is the most common additional charge. If you consistently exceed your mileage allowance, the per-mile penalty can add up quickly. Consider a higher mileage allowance upfront if you anticipate driving more, even if it slightly increases your monthly payment.

- Excessive Wear and Tear: Dings, dents, significant scratches, torn upholstery, or damaged tires beyond "normal wear" will result in charges at lease end. Consider purchasing excess wear and tear protection if available and if you’re concerned.

- Early Termination Fees: Life happens, but breaking a lease early can be very expensive. The fees can be substantial, often equaling several months’ payments or even the remaining balance of the lease.

- Insurance Costs: While warranty covers mechanical issues, you are responsible for maintaining full coverage insurance throughout the lease term, which can be significant, especially in certain parts of New Jersey.

- No Equity Build-Up: Unlike purchasing, you don’t build equity in a leased vehicle. At the end of the term, you own nothing unless you choose to buy it out.

- Hidden Fees: Always ask for a full breakdown of all fees. Be wary of vague "administrative" or "processing" fees not clearly defined.

Popular Jeep Grand Cherokee Trims for Leasing in NJ

The Grand Cherokee lineup offers a range of trims, each catering to different preferences and budgets. Your choice of trim will significantly impact your monthly lease payment.

- Laredo: The entry-level trim, offering strong value with essential features.

- Limited: A popular choice, adding more comfort and tech features like leather seats and larger infotainment screens.

- Overland: Elevates luxury with premium materials, advanced off-road capabilities (like air suspension), and more driver-assistance features.

- Summit/Summit Reserve: The pinnacle of luxury, featuring premium leather, massaging seats, and the most advanced tech and safety systems.

- Trailhawk: Designed for serious off-road enthusiasts, with specialized suspension and terrain management systems.

- Grand Cherokee 4xe: The plug-in hybrid variant, offering impressive fuel economy and powerful performance, often eligible for specific incentives.

Higher trims will naturally have higher MSRPs, leading to higher capitalized costs and thus higher monthly lease payments. However, sometimes manufacturer incentives are stronger on specific trims, so it’s worth comparing.

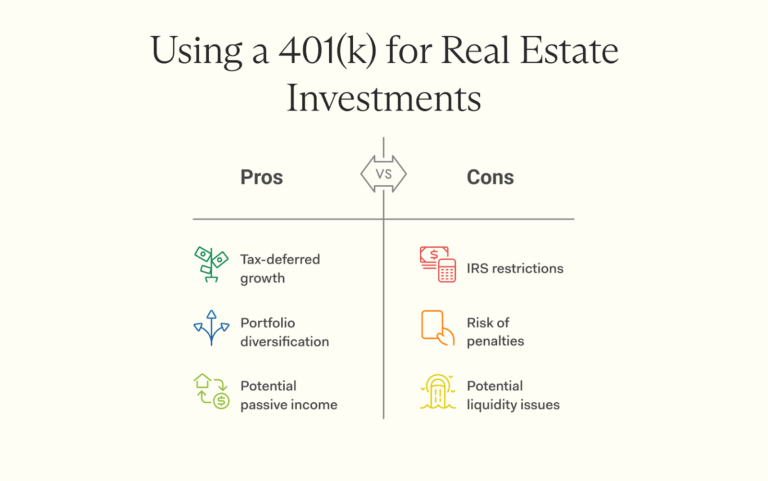

Sample Jeep Grand Cherokee Lease Deal in New Jersey (Illustrative Example)

Please note: The figures in this table are illustrative examples only and do not represent current, actual lease offers. Lease deals are highly dynamic and depend on market conditions, manufacturer incentives, dealership specific promotions, your credit score, and negotiation.

| Feature | Jeep Grand Cherokee Limited 4×2 (Illustrative) | Jeep Grand Cherokee Overland 4×4 (Illustrative) |

|---|---|---|

| MSRP | $43,000 | $58,000 |

| Negotiated Cap Cost | $40,500 | $54,500 |

| Lease Term | 36 Months | 36 Months |

| Annual Mileage | 10,000 miles | 12,000 miles |

| Residual Value | 60% of MSRP ($25,800) | 58% of MSRP ($33,640) |

| Money Factor | 0.00190 (approx. 4.56% APR) | 0.00175 (approx. 4.20% APR) |

| Down Payment | $2,999 (plus first month, fees) | $3,999 (plus first month, fees) |

| Illustrative Monthly Payment | $439/month (Excludes NJ sales tax, fees) | $629/month (Excludes NJ sales tax, fees) |

| Acquisition Fee | $695 | $695 |

| Disposition Fee | $395 | $395 |

| Excess Mileage Charge | $0.25/mile | $0.30/mile |

Disclaimer: This table is for conceptual understanding. Real-world deals will vary based on numerous factors. Always obtain a detailed, personalized quote from a certified dealership.

Frequently Asked Questions (FAQ) about Jeep Grand Cherokee Lease Deals New Jersey

Q1: What credit score do I need to get a good lease deal on a Grand Cherokee in NJ?

A1: Generally, a credit score of 700 or higher is considered "tier 1" and will qualify you for the best money factors and most favorable lease terms. Scores below 650 may still qualify but will likely result in a higher money factor and thus higher monthly payments.

Q2: Can I negotiate the lease price of a Jeep Grand Cherokee?

A2: Absolutely! You should always negotiate the capitalized cost (the price of the vehicle) just as if you were buying it. This is the biggest factor in determining your monthly payment. You can also try to negotiate the money factor, though it’s often set by the leasing company.

Q3: What happens if I go over my mileage limit in my lease?

A3: You will incur a per-mile charge for every mile exceeding your allowance, typically ranging from $0.20 to $0.30 per mile for a Grand Cherokee. These charges can add up quickly, so accurately estimate your annual driving habits upfront.

Q4: What are my options at the end of my Jeep Grand Cherokee lease?

A4: You typically have several options:

- Return the vehicle: Simply turn it in (subject to mileage and wear-and-tear inspection).

- Buy the vehicle: Purchase the Grand Cherokee for its residual value (plus any fees).

- Lease a new Jeep: Often, the dealership will waive the disposition fee if you lease another vehicle from them.

- Extend the lease: Some leasing companies allow short-term extensions.

Q5: Are there special taxes for leasing a car in New Jersey?

A5: Yes, in New Jersey, sales tax is applied to your monthly lease payments, rather than the full price of the vehicle upfront. This is generally beneficial for cash flow compared to purchasing.

Q6: Can I get a Grand Cherokee lease with bad credit in NJ?

A6: It’s more challenging, but not impossible. You may need a larger down payment, accept a higher money factor (interest rate), or consider a co-signer. Exploring dealerships that specialize in credit challenges might be an option, but expect less favorable terms.

Conclusion

Leasing a Jeep Grand Cherokee in New Jersey offers an appealing blend of luxury, capability, and financial flexibility. By understanding the core components of a lease deal, diligently researching the market, and negotiating effectively, you can secure a favorable agreement that puts you behind the wheel of this iconic SUV. Remember to be pragmatic about your mileage needs, vigilant about wear and tear, and always read the fine print. With the right approach, your Jeep Grand Cherokee lease deal in New Jersey can be a seamless and rewarding experience, allowing you to enjoy the thrill of driving a premium vehicle without the long-term ownership commitment. Happy leasing!