Jeep Grand Cherokee Leasehackr: Unlocking Elite Lease Deals

Jeep Grand Cherokee Leasehackr: Unlocking Elite Lease Deals jeeps.truckstrend.com

The allure of a Jeep Grand Cherokee is undeniable. Its blend of rugged capability, luxurious comfort, and iconic styling makes it a top choice for families, adventurers, and urban explorers alike. However, acquiring a new Grand Cherokee often comes with a hefty price tag. This is where the concept of "Leasehackr" steps in, transforming the often-opaque world of automotive leasing into a transparent, strategic game. "Jeep Grand Cherokee Leasehackr" isn’t just about getting a good deal; it’s about mastering the art of the lease, dissecting every component, and leveraging market inefficiencies to secure an elite lease on your dream Grand Cherokee, often saving thousands over the lease term. It’s a community-driven, data-backed approach to ensuring you pay the absolute minimum for maximum value.

Understanding the Leasehackr Philosophy for the Grand Cherokee

Jeep Grand Cherokee Leasehackr: Unlocking Elite Lease Deals

At its core, the Leasehackr philosophy is about demystifying the leasing process and taking control. Instead of focusing solely on the monthly payment – a figure easily manipulated by dealers – a Leasehackr dissects the underlying metrics that truly determine the cost of your lease. For a vehicle as popular and widely available as the Jeep Grand Cherokee, this granular understanding is your most powerful negotiation tool.

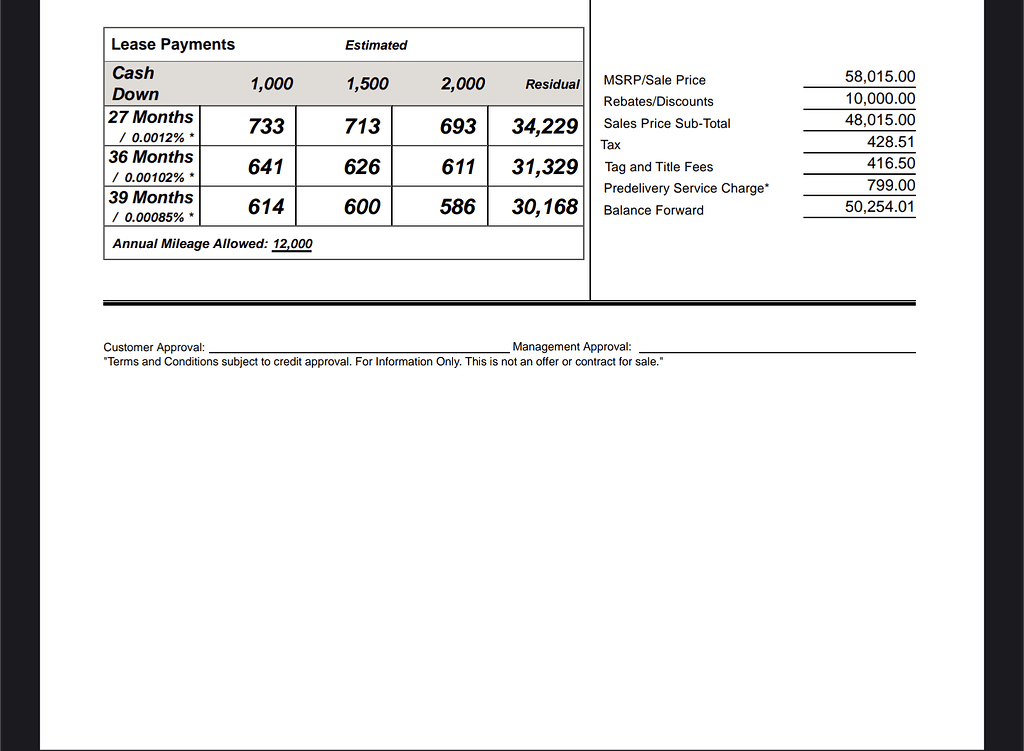

The fundamental premise is that a lease payment is a mathematical equation, not a mystical number. By understanding each variable in this equation, you can optimize them to your advantage. This means knowing the fair market value of the vehicle, understanding manufacturer incentives, and being aware of the finance terms (money factor and residual value) offered by the leasing company. The Grand Cherokee, with its frequent incentives and often competitive residual values, presents fertile ground for applying these "hacking" strategies.

Key Metrics and How They Impact Your Grand Cherokee Lease

To truly "hack" a Grand Cherokee lease, you must become fluent in the language of leasing. Each of these components plays a critical role in your monthly payment:

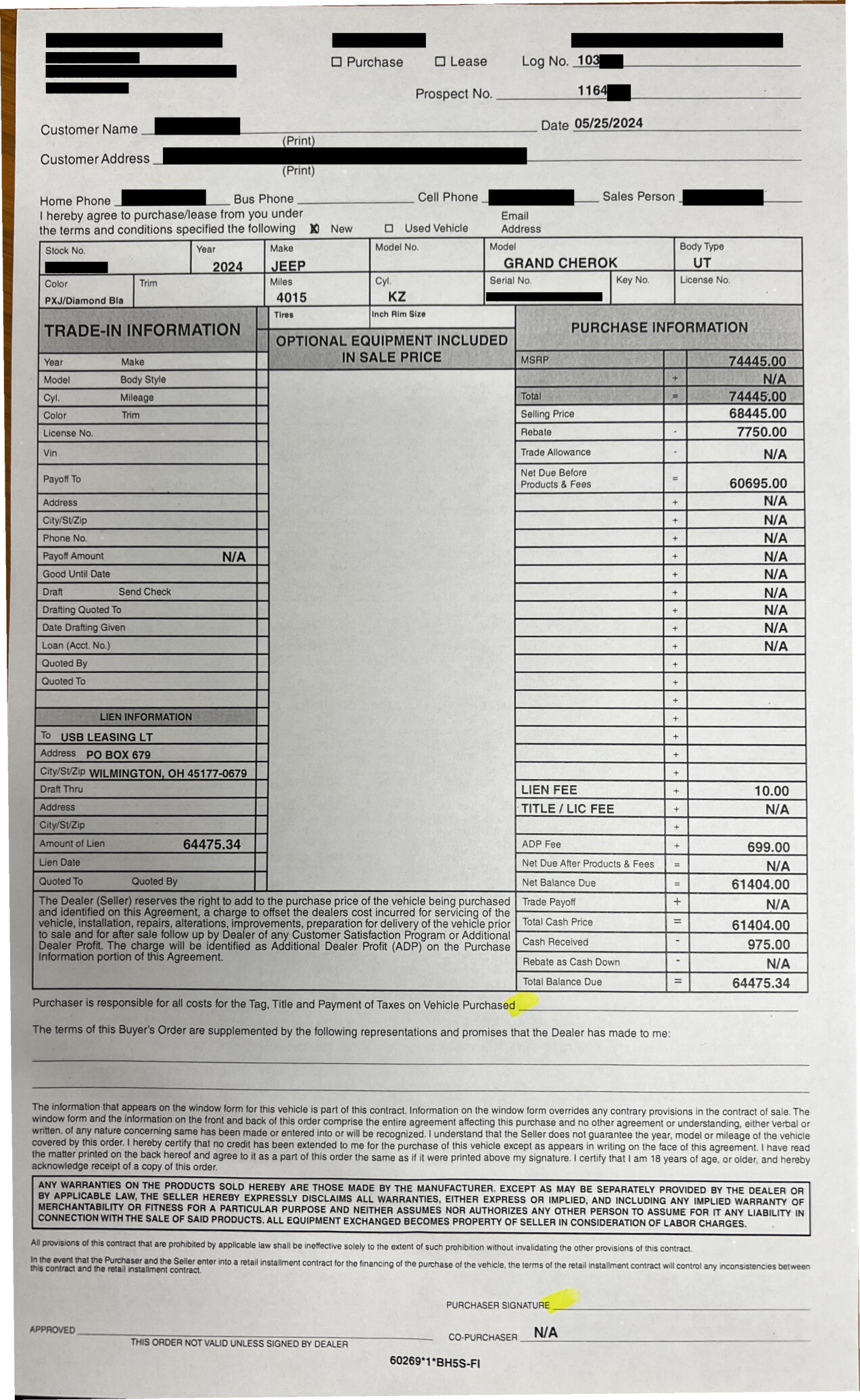

- MSRP (Manufacturer’s Suggested Retail Price): This is the sticker price. While it’s the starting point, a Leasehackr never pays MSRP. Your goal is to negotiate a significant discount off this price. For a Grand Cherokee, aiming for 8-12% off MSRP before incentives is often a good target, though this can vary by trim, demand, and time of year.

- Capitalized Cost (Cap Cost): This is the agreed-upon price of the vehicle that the lease is based on. It’s the MSRP minus any negotiated discounts, plus any added fees (like acquisition fees or accessories), and potentially reduced by a trade-in or down payment (though a Leasehackr typically advises against large down payments on leases). A lower Cap Cost directly translates to a lower monthly payment.

- Residual Value: This is the projected value of the vehicle at the end of the lease term, expressed as a percentage of the MSRP. A higher residual value is always better for leasing because you are only paying for the depreciation between the Cap Cost and the Residual Value. Grand Cherokees tend to hold their value reasonably well, especially popular trims, leading to competitive residual values. This is a non-negotiable factor set by the leasing company, so choosing trims with strong residuals is key.

- Money Factor (MF): This is essentially the interest rate on your lease, expressed as a very small decimal (e.g., 0.00080). To convert it to an equivalent APR, multiply by 2400 (0.00080 * 2400 = 1.92% APR). A lower money factor means less interest paid over the lease term. Dealers often mark up the money factor, so verifying the "buy rate" (the lowest rate) is crucial. You can sometimes lower the MF further by utilizing Multiple Security Deposits (MSDs).

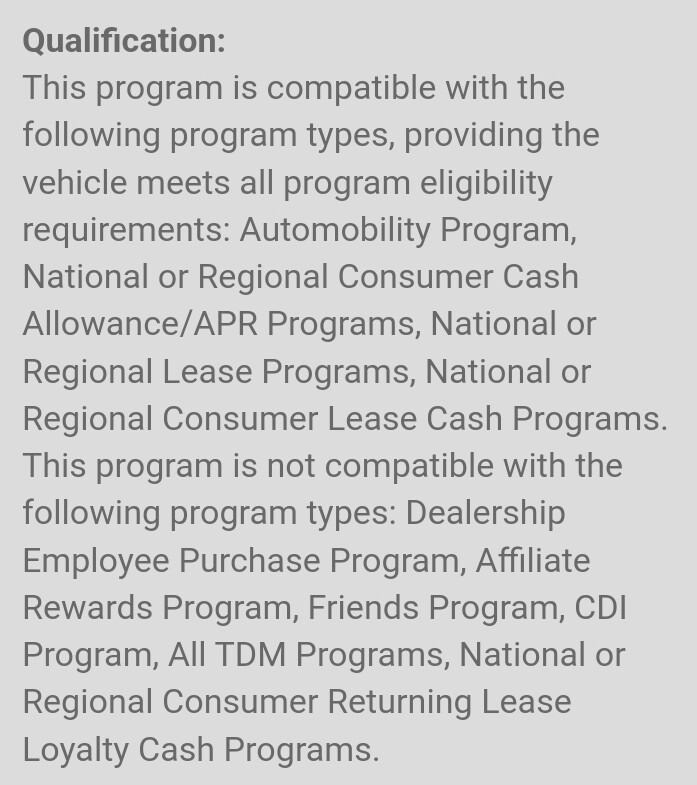

- Lease Incentives & Rebates: These are direct cash offers from the manufacturer to reduce the Cap Cost or the effective monthly payment. They can be regional, loyalty-based (for returning Jeep customers), conquest-based (for switching from a competitor), or specific to certain models/trims. These are gold for Leasehackrs and can significantly drop your payment. Jeep often runs attractive lease incentives on the Grand Cherokee, especially towards the end of a model year or quarter.

The Leasehackr Process: A Step-by-Step Guide for Grand Cherokee

Hacking a Grand Cherokee lease requires preparation, patience, and persistence. Follow these steps for the best chance at an elite deal:

Step 1: Research & Target Your Grand Cherokee

- Identify Your Ideal Trim: Decide on the specific Grand Cherokee trim, engine, and options you want. More popular trims often have better residuals and more incentives.

- Check Market Data: Use sites like Edmunds forums (for MF and Residuals by zip code), Leasehackr forums (for recent Grand Cherokee deals), and TrueCar/KBB (for local selling price averages). This gives you a baseline for what constitutes a "good deal."

- Review Past Deals: Search the Leasehackr forum specifically for "Jeep Grand Cherokee" deals. Pay attention to the discount percentage off MSRP, the money factor, and the incentives applied. This sets your realistic expectations.

Step 2: Calculate Your Target Deal

- Utilize the Leasehackr Calculator: This invaluable tool allows you to input your target Cap Cost (MSRP minus your desired discount), residual value, money factor, and incentives. It will instantly show you an estimated monthly payment. Play with the numbers to understand their impact. Aim for a "target monthly payment" based on what others have achieved.

Step 3: Gather Dealer Quotes (The "Blind" Approach)

- Contact Multiple Dealers: Email or use online inquiry forms to contact 5-10 Jeep dealerships within a reasonable driving distance.

- Focus on the Selling Price First: Do not mention leasing initially. Ask for their "best out-the-door price" or "selling price" on the specific Grand Cherokee you’re targeting. This ensures you’re negotiating the discount on the vehicle itself, not just the monthly payment.

- Be Specific: Provide the VIN or stock number if you’ve found a specific vehicle, or the exact build details if ordering.

Step 4: Negotiate the Selling Price

- Leverage Competition: Once you have initial offers, pit dealers against each other. "Dealer A offered me X, can you beat it?"

- Aim High (for discounts): Push for that 8-12% off MSRP before incentives. Be prepared to walk away if they can’t meet your target.

Step 5: Uncover Grand Cherokee Incentives

- After securing a strong selling price, ask the dealer to list all applicable lease incentives for the Grand Cherokee. Cross-reference these with what you found on Edmunds or the Leasehackr forum. Ensure they are applying all available rebates.

Step 6: Confirm Money Factor & Residual

- Verify the MF: Ask the dealer for the exact money factor they are using. Compare it to the "buy rate" you found on Edmunds. If it’s marked up, politely ask them to use the buy rate.

- Confirm Residual: Ensure the residual value percentage matches what you found for your specific Grand Cherokee trim and lease term.

Step 7: Optimize with MSDs (Multiple Security Deposits)

- Consider MSDs: If the money factor is still higher than desired, ask about using Multiple Security Deposits. Each MSD (typically equivalent to one monthly payment, up to 7-10) reduces the money factor, effectively lowering your interest rate. These are fully refundable at the end of the lease, making them a wise investment if you have the cash upfront.

Step 8: Review the Lease Worksheet

- Demand a Detailed Breakdown: Before signing anything, get a full lease worksheet that clearly itemizes the Cap Cost, residual value, money factor, fees, and incentives.

- Verify Every Number: Compare each line item against your Leasehackr calculator and your target deal. Ensure there are no hidden fees or markups. If anything doesn’t match, ask for clarification and correction.

Grand Cherokee Specific Considerations for Leasing

- Trims and Options: While higher trims like Summit Reserve are appealing, often the lower-to-mid trims (e.g., Laredo, Limited, Overland) lease better due to their stronger residual value percentage relative to their MSRP. Heavily optioned vehicles can sometimes inflate the Cap Cost without proportionally increasing the residual.

- Timing is Everything: End of the month, end of the quarter, and especially end of the model year (when new Grand Cherokees are arriving) are prime times for deals. Dealers are motivated to hit sales targets, and manufacturers may offer increased incentives to clear out inventory.

- Dealer Relationships vs. Transactional: While a purely transactional approach (emailing multiple dealers) is effective, being polite and professional can sometimes yield better results. Remember, the internet sales manager is your ally in this process.

- Broker vs. DIY: If you’re short on time or uncomfortable with direct negotiation, consider a reputable lease broker found on Leasehackr. They often have pre-negotiated deals and access to inventory that can be highly competitive, especially for popular models like the Grand Cherokee. However, their fees should be factored into the overall cost.

Potential Challenges & Solutions

- Uncooperative Dealers: Some dealers are resistant to providing a full breakdown or negotiating on individual components.

- Solution: Move on. There are plenty of dealerships. Focus on those willing to work transparently.

- Misleading Quotes: Dealers may quote a low monthly payment without revealing a large down payment or inflated fees.

- Solution: Always ask for a full breakdown with zero money down (excluding first month’s payment and upfront fees). Insist on seeing the Cap Cost, Residual, MF, and incentives.

- Low Residuals for Desired Trim: Your dream Grand Cherokee trim might have a surprisingly low residual value.

- Solution: Re-evaluate. Is that specific trim worth the higher monthly payment? Consider a slightly lower trim or a different model year Grand Cherokee that might have better lease terms.

- Limited Incentives: Sometimes, Jeep’s incentives for the Grand Cherokee are not as strong.

- Solution: Be patient. Incentives change monthly. Broaden your search radius, or consider waiting for the next month’s programs.

Jeep Grand Cherokee Leasehackr: Example Deal Breakdown

This table illustrates a hypothetical Leasehackr-optimized deal for a Jeep Grand Cherokee, demonstrating how each component contributes to the monthly payment. Note: These are example values and will vary significantly based on trim, region, time, and specific incentives.

| Lease Component | Example Value/Percentage | Impact on Monthly Payment | Leasehackr Strategy |

|---|---|---|---|

| MSRP (Sticker Price) | $50,000 | Baseline for all calculations | Identify target Grand Cherokee model & options. |

| Negotiated Selling Price | $43,000 (14% off MSRP) | Significantly lowers Cap Cost, reducing depreciation cost | Aggressively negotiate via email with multiple dealers. Aim for 10%+ off MSRP. |

| Manufacturer Incentives | $3,000 | Direct Cap Cost reduction, lowering monthly payment | Research all applicable regional/loyalty/conquest incentives for Grand Cherokee. |

| Adjusted Capitalized Cost | $40,000 | The actual amount the lease is based on | Selling Price – Incentives + Fees. This is your core focus. |

| Residual Value (57%) | $28,500 ($50k MSRP * 0.57) | Higher residual means less depreciation paid by lessee | Choose trims/terms with strong residuals. Verify with Edmunds. |

| Depreciation Cost | $11,500 ($40k Cap – $28.5k Residual) | Total depreciation paid over lease term | Minimized by low Cap Cost & high Residual. |

| Money Factor (MF) | 0.00065 (1.56% APR) | Determines interest paid on remaining Cap Cost | Verify "buy rate" on Edmunds. Use MSDs to lower further. |

| Acquisition Fee | $895 | Standard fee from leasing company | Factor into calculations; sometimes waivable or discounted. |

| Documentation Fee | $300 | Dealer processing fee (varies by state) | Negotiate to lower or cap if possible. |

| Taxes (Varies by State) | ~$1,000 (on payment or Cap Cost) | State-specific sales tax on lease | Understand local tax laws; some states tax total Cap Cost. |

| Approx. Monthly Payment (36/10k) | ~$399 | Your target payment | Focus on all components, not just this number. |

| Due at Signing (DAS) | First month, fees, taxes | Minimal upfront cost preferred by Leasehackrs | Aim for only first month’s payment and essential fees. Avoid large down payments. |

Frequently Asked Questions (FAQ) about Jeep Grand Cherokee Leasehackr

Q1: Is leasing a Grand Cherokee always better than buying?

A1: Not always. Leasing is generally better if you prefer lower monthly payments, drive a new car every few years, want predictable maintenance costs (during warranty), and don’t want to deal with resale. Buying is better if you plan to keep the car for a long time (beyond 3-5 years), drive many miles, or prefer ownership flexibility. For a Leasehackr, it’s about getting the best value for your usage.

Q2: How do I find Grand Cherokee specific lease incentives?

A2: Check forums like Leasehackr and Edmunds (specifically their manufacturer incentive forums), or directly ask the fleet/internet sales manager at multiple Jeep dealerships. Incentives change monthly, so always get the latest information.

Q3: Can I negotiate the residual value of a Grand Cherokee?

A3: No, the residual value is set by the leasing company (e.g., Stellantis Financial Services) and is non-negotiable. However, you can choose trims or lease terms that inherently have better residual values.

Q4: What’s a "good" discount off MSRP for a Grand Cherokee before incentives?

A4: A good target is typically 8-12% off MSRP. For very popular or newly released models, it might be slightly lower. For outgoing models or less popular trims, it could be higher. Research recent deals on Leasehackr forums for current benchmarks.

Q5: What if a dealer won’t provide the full lease breakdown?

A5: This is a red flag. A transparent dealer should be willing to provide the Cap Cost, Residual, Money Factor, and all fees. If they refuse, move on to another dealership. Insist on a clear lease worksheet.

Q6: Should I put money down on a Grand Cherokee lease?

A6: A core Leasehackr principle is to minimize money down (DAS – Due At Signing) to only the first month’s payment and necessary fees. If the vehicle is totaled, any large down payment beyond that is lost. Use Multiple Security Deposits (MSDs) to lower the monthly payment instead, as these are refundable.

Q7: What’s the best time to lease a Jeep Grand Cherokee?

A7: Generally, the end of the month or quarter, or when a new model year is being introduced and dealers want to clear out the previous year’s inventory. Holidays like Memorial Day, Black Friday, and year-end sales events often bring increased incentives.

Conclusion

The Jeep Grand Cherokee Leasehackr approach empowers you to navigate the complex world of automotive leasing with confidence and precision. By understanding the core metrics – capitalized cost, residual value, money factor, and incentives – and diligently applying the step-by-step negotiation process, you can transform the often-stressful experience of getting a new car into a rewarding financial victory. It requires research, patience, and a willingness to walk away, but the reward is a significantly lower monthly payment for your desired Grand Cherokee. In an era where every dollar counts, becoming a Leasehackr for your next Jeep Grand Cherokee isn’t just smart; it’s essential for maximizing your value and driving away with an elite deal.