Jeep Grand Cherokee Leases NJ

Jeep Grand Cherokee Leases NJ jeeps.truckstrend.com

Introduction: Navigating the Roads of New Jersey with a Grand Cherokee Lease

The allure of the open road, combined with the rugged sophistication of a premium SUV, often leads drivers to one iconic nameplate: the Jeep Grand Cherokee. For residents of the Garden State, leasing a Jeep Grand Cherokee in NJ presents a particularly attractive proposition. A lease, fundamentally, is a long-term rental agreement, allowing you to drive a brand-new vehicle for a set period and mileage, typically with lower monthly payments than a traditional purchase. Opting for a lease in New Jersey specifically means leveraging a competitive local market and understanding state-specific regulations, particularly concerning sales tax, which can significantly impact your overall cost. This comprehensive guide will delve into every facet of securing a Jeep Grand Cherokee lease in NJ, offering actionable insights to help you make an informed decision and embark on your next adventure with confidence.

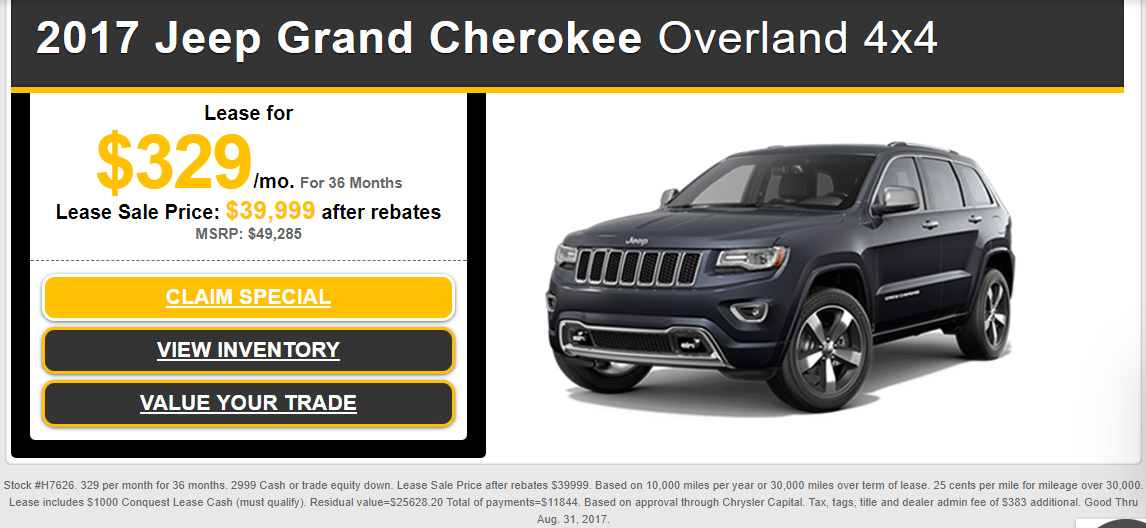

Jeep Grand Cherokee Leases NJ

Why Lease a Jeep Grand Cherokee in NJ? Unpacking the Benefits

Leasing a vehicle offers a unique set of advantages, and these benefits are amplified when considering a popular and capable SUV like the Jeep Grand Cherokee, especially within the New Jersey market.

Financial Flexibility:

- Lower Monthly Payments: Compared to financing a purchase, lease payments are generally lower because you’re only paying for the depreciation of the vehicle during your lease term, not its full purchase price. This frees up cash flow for other expenses or investments.

- Lower Upfront Costs: Many leases require little to no down payment, making it easier to get into a new vehicle without a significant initial outlay.

- Predictable Expenses: With most major repairs covered by the factory warranty for the duration of the lease, you can budget with greater certainty, avoiding unexpected maintenance costs.

Driving Experience & Convenience:

- Always Drive a New Car: Leasing allows you to regularly upgrade to the latest models, enjoying cutting-edge technology, safety features, and design every two to four years.

- Access to Premium Trims: The lower monthly payments of a lease might enable you to afford a higher trim level or more luxurious features on your Grand Cherokee than if you were to purchase it outright.

- Hassle-Free End of Term: At the end of your lease, you simply return the vehicle to the dealership. You avoid the complexities of selling a used car and the concerns about depreciation or trade-in value.

Jeep Grand Cherokee Specific Advantages:

- Maintaining Resale Value: While depreciation is a factor in any vehicle, the Grand Cherokee generally holds its value well. However, with a lease, you don’t bear the risk of its future resale value; that burden lies with the leasing company.

- Versatility for NJ Lifestyles: From navigating city streets to weekend trips to the Shore or the Appalachian mountains, the Grand Cherokee’s blend of luxury, capability, and available 4×4 systems makes it ideal for diverse New Jersey driving conditions.

New Jersey Market Considerations:

- Competitive Dealerships: NJ boasts a high concentration of Jeep dealerships, fostering a competitive environment that can lead to better lease deals.

- Sales Tax Treatment: New Jersey charges sales tax on the total capitalized cost of the vehicle for leases, rather than on the monthly payment in some other states. Understanding this upfront is crucial for budgeting. While it means a larger upfront tax payment or rolling it into the lease, it simplifies the monthly payment structure.

Understanding the Lease Agreement: Key Terms Explained for NJ Lessees

Before signing on the dotted line, it’s paramount to understand the jargon within a lease agreement. This knowledge empowers you to negotiate effectively and ensures there are no surprises down the road.

- MSRP (Manufacturer’s Suggested Retail Price) / Capitalized Cost (Cap Cost): The Cap Cost is essentially the "selling price" of the vehicle that the lease is based on. It’s the most crucial number to negotiate, as a lower Cap Cost directly translates to lower monthly payments.

- Residual Value: This is the estimated value of the vehicle at the end of the lease term. It’s expressed as a percentage of the MSRP. A higher residual value is beneficial for the lessee because it means the vehicle is expected to depreciate less, resulting in lower monthly payments.

- Money Factor (MF): Often expressed as a very small decimal (e.g., 0.00200), the Money Factor is the equivalent of an interest rate on a loan. To convert it to an annual interest rate, multiply it by 2400 (e.g., 0.00200 x 2400 = 4.8%). A lower money factor means less interest paid over the lease term.

- Lease Term: The duration of the lease, typically 24, 36, or 48 months. Shorter terms mean higher monthly payments but faster access to a new vehicle; longer terms offer lower payments but you drive the same vehicle for longer.

- Mileage Allowance: The maximum number of miles you’re allowed to drive during the lease term (e.g., 10,000, 12,000, or 15,000 miles per year). Exceeding this limit incurs a per-mile penalty (e.g., $0.20-$0.25 per mile) at the end of the lease.

- Acquisition Fee: An administrative fee charged by the leasing company for setting up the lease.

- Disposition Fee: A fee charged at the end of the lease for processing the vehicle’s return. This can sometimes be waived if you lease another vehicle from the same manufacturer.

- Early Termination Penalty: Significant fees incurred if you break the lease agreement before its term ends. This can be very costly, often requiring you to pay the remaining lease payments plus additional penalties.

- New Jersey Sales Tax: In NJ, the 6.625% sales tax is calculated on the total capitalized cost of the vehicle, not on each monthly payment. This amount is usually paid upfront or rolled into the capitalized cost, increasing your monthly payment slightly. Be aware of how this is presented in your lease offer.

The Leasing Process in NJ: A Step-by-Step Guide

Securing your Jeep Grand Cherokee lease in New Jersey can be a straightforward process if you follow these steps:

- Research Models & Trims: Determine which Grand Cherokee model (WL for the newer generation, WK2 for the older, still-available generation), trim level (Laredo, Limited, Overland, Summit, etc.), and optional features best suit your needs and budget. Consider the long-wheelbase "L" variants if you need third-row seating.

- Set Your Budget: Establish a realistic maximum monthly payment and understand how much you’re willing to put down (if any). Remember to account for insurance, fuel, and potential over-mileage charges.

- Check Your Credit Score: Your credit score significantly impacts the money factor you’ll be offered. A higher score (generally 700+) will qualify you for the best rates. Obtain a free credit report to know where you stand.

- Find NJ Dealerships: Identify multiple Jeep dealerships in New Jersey. Use online tools to compare inventory and special lease offers.

- Gather Quotes & Negotiate: Contact several dealerships and request lease quotes for the specific Grand Cherokee you’re interested in. Focus on negotiating the capitalized cost (the "selling price" of the car for the lease) first. Then, inquire about the money factor and residual value. Pit competing offers against each other.

- Test Drive: Always test drive the exact model and trim you intend to lease to ensure it meets your expectations for comfort, performance, and features.

- Review the Lease Agreement: Read every line of the lease contract carefully. Ensure all negotiated terms (Cap Cost, Money Factor, Residual, Term, Mileage, fees, and NJ sales tax treatment) are accurately reflected. Don’t hesitate to ask questions about anything you don’t understand.

- Sign & Drive: Once satisfied, sign the agreement and take delivery of your new Jeep Grand Cherokee.

Tips for Securing the Best Jeep Grand Cherokee Lease Deal in NJ

Maximizing your savings on a Jeep Grand Cherokee lease in New Jersey requires strategy and diligence.

- Shop Around Aggressively: This is perhaps the most important tip. Get quotes from at least 3-5 different dealerships across NJ. Dealerships often have different allocations, incentives, and willingness to negotiate.

- Negotiate the Capitalized Cost First: Treat the lease as if you’re buying the car. Aim for the lowest possible "selling price" (capitalized cost) before even discussing lease terms. This is where the biggest savings can be found.

- Understand the Money Factor: Don’t just accept the dealer’s quoted money factor. Research current competitive money factors for prime credit. A lower money factor means less "interest" paid over the lease term.

- Be Aware of Residual Value: While you can’t negotiate the residual value (it’s set by the leasing company), knowing it helps you understand the depreciation amount you’re paying for. Higher residuals generally mean lower payments.

- Scrutinize All Fees: Ask for a breakdown of all fees (acquisition, disposition, documentation, tag/title). Some fees are non-negotiable, but ensure there are no hidden or excessive charges.

- Consider "Zero Down" Leases Carefully: While attractive, "zero down" often means the upfront costs (first month’s payment, fees, sales tax, etc.) are rolled into the monthly payments, making them higher. A small down payment can lower your monthly obligation, but avoid large down payments as you won’t get that money back if the car is totaled.

- Know Your Credit Score: A high credit score (Tier 1 or A+ credit) is essential for securing the best money factor.

- Timing is Key: Look for deals at the end of the month, quarter, or year when dealerships are trying to meet sales targets. New model year introductions can also lead to incentives on the outgoing models.

- Leverage Manufacturer Incentives: Keep an eye out for special lease programs, rebates, or loyalty bonuses offered by Jeep or Stellantis. These can significantly reduce your payments.

End-of-Lease Options for NJ Lessees

As your Jeep Grand Cherokee lease term approaches its conclusion, you’ll have several choices:

- Return the Vehicle: This is the most common option. Schedule an inspection with the leasing company a few weeks before your lease ends to assess any excess wear and tear or mileage overages. Return the vehicle to the dealership, pay any outstanding fees (disposition fee, excess mileage, excessive wear and tear), and you’re done.

- Purchase the Vehicle: If you’ve fallen in love with your Grand Cherokee, you have the option to buy it at the predetermined residual value stated in your lease agreement. You’ll then need to secure financing for this purchase.

- Lease a New Jeep Grand Cherokee (or another vehicle): Many lessees simply return their old vehicle and lease a brand-new one. Dealerships often offer loyalty incentives or may waive the disposition fee to encourage repeat business.

- Extend the Lease: In some cases, if you need more time, you might be able to extend your lease for a few months on a month-to-month basis.

Important Considerations:

- Excess Wear and Tear: Be mindful of dings, scratches, interior stains, or tire wear beyond what’s considered "normal." Address minor issues before the inspection to avoid costly charges.

- Mileage Penalties: Track your mileage throughout the lease. If you’re significantly over, it might be more cost-effective to purchase the vehicle at lease end, as the per-mile penalty can add up quickly.

Common Challenges and Solutions in NJ Grand Cherokee Leases

While leasing offers many advantages, potential challenges exist. Being prepared can save you headaches and money.

- Challenge: High Mileage Usage:

- Solution: If you anticipate driving more than average, choose a higher mileage allowance (e.g., 15,000 or 20,000 miles/year) upfront, even if it slightly increases your monthly payment. It’s almost always cheaper than paying per-mile penalties at lease end. Alternatively, if you’re significantly over, consider buying out the lease.

- Challenge: Excessive Wear and Tear:

- Solution: Maintain your vehicle diligently. Address minor dents, scratches, and interior damage as they occur. Consider "wear and tear protection" plans offered by dealerships, but carefully weigh their cost against potential benefits.

- Challenge: Early Lease Termination:

- Solution: Breaking a lease early is expensive. Explore options like a lease transfer service (e.g., LeaseTrader, Swapalease) which allows someone else to take over your remaining payments. Alternatively, some dealerships might be willing to buy out your lease if you’re getting a new vehicle from them, but expect to pay some penalty.

- Challenge: Understanding NJ Sales Tax:

- Solution: Clearly ask your salesperson how the 6.625% NJ sales tax on the capitalized cost is being handled. Is it paid upfront? Rolled into the monthly payment? Ensure it’s transparently presented in the lease agreement.

Sample Illustrative Lease Price Table: Jeep Grand Cherokee Laredo (NJ)

Please Note: The figures in this table are illustrative examples only and are subject to significant variation based on current manufacturer incentives, dealership discounts, your credit score, market conditions, and specific trim/options. Always consult multiple actual dealerships in New Jersey for current and personalized quotes.

| Feature / Term | Example Value (Illustrative) | Notes |

|---|---|---|

| Vehicle | Jeep Grand Cherokee Laredo 4×2 | Base Model Example (Higher Trims will have higher costs) |

| MSRP | $42,000 | Manufacturer’s Suggested Retail Price |

| Negotiated Cap Cost | $39,000 | This is the "selling price" the lease is based on. Crucial to negotiate lower. |

| Lease Term | 36 Months | Common lease duration. 24 or 48 months also available. |

| Mileage Allowance | 10,000 Miles/Year | Standard allowance. Higher options (12k, 15k, 20k) available at increased cost. |

| Residual Value | $23,520 (56% of MSRP) | The vehicle’s estimated value at lease end. (Calculated as 56% of the $42,000 MSRP in this example). |

| Money Factor | 0.00180 | Equivalent to ~4.32% APR. Varies by credit score and incentives. |

| NJ Sales Tax | $2,583.75 | 6.625% of the $39,000 Cap Cost. Often rolled into Cap Cost or paid upfront. |

| Acquisition Fee | $895 | Standard fee from the leasing company. |

| Total Due at Sign. | $3,500 – $5,000 (Est.) | Includes first month’s payment, sales tax (if upfront), acquisition fee, doc fee, plates. Varies significantly based on down payment. |

| Estimated Monthly Payment | $420 – $480 | Excludes taxes and fees if not rolled into Cap Cost. Highly variable based on all factors above. |

| Disposition Fee | $395 | Fee charged at lease end for returning the vehicle. Often waived if you lease another Jeep. |

| Excess Mileage Fee | $0.25/mile | Penalty for exceeding mileage allowance. |

Frequently Asked Questions (FAQ) about Jeep Grand Cherokee Leases NJ

Q1: Is leasing a Grand Cherokee better than buying one in NJ?

A1: It depends on your priorities. Leasing typically offers lower monthly payments, allows you to drive a new car every few years, and avoids depreciation risk. Buying offers ownership, no mileage limits, and the ability to customize. For many New Jersey drivers who enjoy having the latest features and avoiding long-term commitment, leasing is often preferred.

Q2: What credit score do I need to lease a Jeep Grand Cherokee in NJ?

A2: Generally, a good to excellent credit score (typically 700 or higher) is required to qualify for the best lease rates (lowest money factors). Scores below 650 may still qualify but often come with higher money factors or require a larger down payment.

Q3: Can I negotiate the lease price of a Grand Cherokee in NJ?

A3: Absolutely. The most important number to negotiate is the "capitalized cost" (Cap Cost), which is essentially the vehicle’s selling price for the lease. Negotiate this as if you were buying the car. You can also try to negotiate the money factor, though it’s often tied to current manufacturer programs and your credit.

Q4: What happens at the end of my Jeep Grand Cherokee lease in NJ?

A4: You have three main options: return the vehicle, purchase it at the predetermined residual value, or lease a new Jeep (or another vehicle). Be mindful of excess mileage and wear and tear penalties.

Q5: How is sales tax handled on a lease in New Jersey?

A5: In New Jersey, the 6.625% sales tax is calculated on the total capitalized cost of the vehicle. This amount is usually either paid upfront at signing or rolled into the capitalized cost, which then slightly increases your monthly payments over the lease term.

Q6: Can I go over my mileage allowance without penalty?

A6: No. Exceeding your agreed-upon mileage allowance will result in a per-mile penalty fee at the end of the lease, typically ranging from $0.20 to $0.25 per mile. It’s crucial to estimate your annual mileage accurately upfront.

Q7: Can I lease a Jeep Grand Cherokee with bad credit in NJ?

A7: It’s more challenging but not impossible. You might face a higher money factor, require a larger down payment, or need a co-signer. Some subprime lenders might offer leases, but the terms will be less favorable.

Conclusion: Driving Your Dream Grand Cherokee in New Jersey

Leasing a Jeep Grand Cherokee in New Jersey offers a compelling pathway to enjoying one of the most capable and luxurious SUVs on the market without the long-term commitment and depreciation concerns of ownership. By understanding the core components of a lease agreement, meticulously researching and negotiating with multiple NJ dealerships, and preparing for the end-of-lease process, you can secure an excellent deal. The key is to be an informed consumer, ready to ask the right questions and compare offers. With its blend of rugged capability and refined comfort, a leased Grand Cherokee is perfectly suited for navigating New Jersey’s diverse landscapes, from its bustling urban centers to its scenic shorelines and mountain trails. Embrace the journey, and drive confidently knowing you’ve made a smart choice for your automotive needs in the Garden State.