Lease Deals On Jeep Cherokee Trailhawk: Your Ultimate Guide to Off-Road Adventures on a Budget

Lease Deals On Jeep Cherokee Trailhawk: Your Ultimate Guide to Off-Road Adventures on a Budget jeeps.truckstrend.com

The Jeep Cherokee Trailhawk stands as a testament to rugged capability meeting modern comfort. Far from being just another crossover, the Trailhawk variant is engineered for serious off-road prowess, boasting features like an advanced 4×4 system, increased ground clearance, and an aggressive design that signals its adventurous spirit. For many, the allure of conquering trails and exploring the unbeaten path with a vehicle like the Trailhawk is strong, but the upfront cost of ownership can be a significant barrier. This is where Lease Deals On Jeep Cherokee Trailhawk enter the picture, offering an attractive pathway to experiencing this remarkable vehicle without the long-term commitment or the hefty purchase price.

Leasing a vehicle, in essence, is like a long-term rental. Instead of paying for the entire cost of the car, you only pay for the depreciation that occurs during the period you drive it, plus a finance charge. For a specialized vehicle like the Trailhawk, which benefits from regular updates in technology and off-road capabilities, leasing can be a particularly smart financial decision. It allows enthusiasts to enjoy the latest model with lower monthly payments, predictable costs, and the flexibility to upgrade to a newer Jeep every few years. This comprehensive guide will delve into everything you need to know about securing an advantageous lease deal on a Jeep Cherokee Trailhawk, empowering you to hit the trails with confidence and financial peace of mind.

Lease Deals On Jeep Cherokee Trailhawk: Your Ultimate Guide to Off-Road Adventures on a Budget

Understanding the Jeep Cherokee Trailhawk: More Than Just an SUV

Before diving into the specifics of leasing, it’s crucial to appreciate what makes the Jeep Cherokee Trailhawk a unique proposition. This isn’t your average suburban runabout. The Trailhawk trim is specifically designed for off-road enthusiasts, featuring:

- Jeep Active Drive Lock 4×4 System: Includes a mechanical rear axle lock for enhanced traction in extreme conditions.

- Selec-Terrain® Traction Management System: Offers modes like Snow, Sport, Sand/Mud, and Rock for optimized performance across various terrains.

- Increased Ground Clearance: Allows it to navigate obstacles more easily.

- Skid Plates: Protect the underbody from damage.

- Red Tow Hooks: Iconic and functional for recovery.

- All-Terrain Tires: Provide superior grip on loose surfaces.

- Off-Road Suspension: Tuned for better articulation and damping over rough terrain.

These features mean the Trailhawk holds its value well, thanks to its niche appeal and robust engineering. For those who crave adventure but also need a practical daily driver, the Trailhawk strikes an ideal balance, making it a highly desirable vehicle to lease.

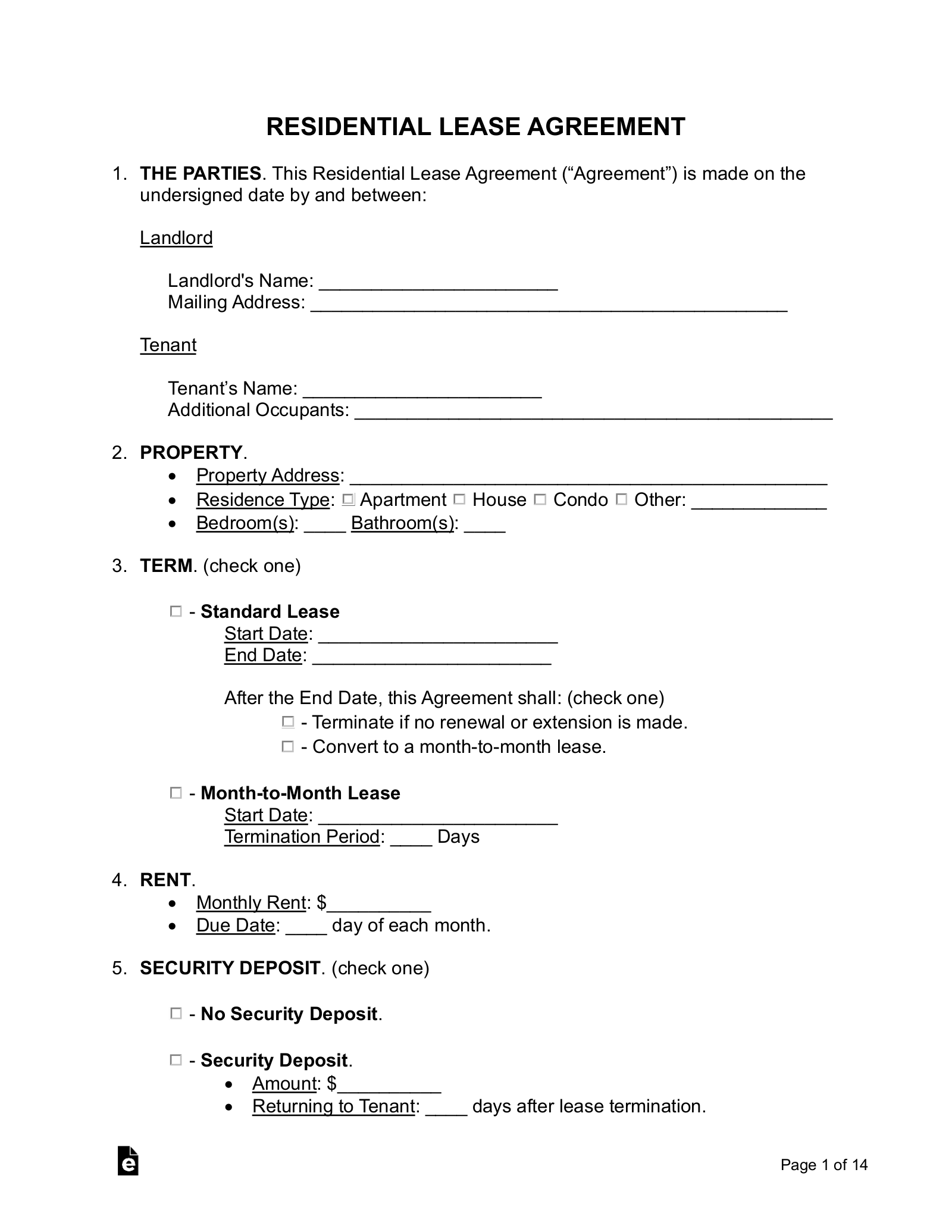

The ABCs of Vehicle Leasing: Key Terms and How They Impact Your Deal

To effectively navigate Lease Deals On Jeep Cherokee Trailhawk, you need to understand the fundamental components of a lease agreement. These terms directly influence your monthly payments and overall lease cost:

- MSRP (Manufacturer’s Suggested Retail Price): The sticker price of the vehicle.

- Capitalized Cost (Cap Cost): The negotiated selling price of the vehicle, similar to the purchase price. This is the starting point for calculating depreciation. Negotiating this down is crucial.

- Residual Value: The estimated value of the vehicle at the end of the lease term, expressed as a percentage of the MSRP. A higher residual value means you pay for less depreciation, resulting in lower monthly payments. Jeep Trailhawks often have good residual values due to their desirability.

- Money Factor: This is the equivalent of an interest rate on a lease, expressed as a very small decimal (e.g., 0.00150). To convert it to an approximate annual percentage rate (APR), multiply by 2400 (0.00150 x 2400 = 3.6% APR). A lower money factor means lower finance charges.

- Lease Term: The duration of your lease, typically 24, 36, or 48 months. Shorter terms usually have higher monthly payments but lower total depreciation.

- Mileage Allowance: The maximum number of miles you’re allowed to drive per year (e.g., 10,000, 12,000, 15,000 miles). Exceeding this limit incurs per-mile penalties (e.g., $0.20-$0.25 per mile).

- Acquisition Fee: A fee charged by the leasing company for setting up the lease.

- Disposition Fee: A fee charged at the end of the lease for processing the vehicle’s return.

- Due at Signing (Drive-off Costs): The total amount you pay upfront, which typically includes the first month’s payment, acquisition fee, taxes, registration, and sometimes a down payment (capitalized cost reduction).

Your monthly payment is primarily calculated based on the difference between the Capitalized Cost and the Residual Value (depreciation) plus the Money Factor (finance charge).

Why Lease the Jeep Cherokee Trailhawk? Benefits and Advantages

Leasing a Jeep Cherokee Trailhawk offers several compelling benefits, especially for those who appreciate new technology and predictable costs:

- Lower Monthly Payments: Compared to financing a purchase, lease payments are generally significantly lower because you’re only paying for depreciation, not the full purchase price.

- Access to New Models: Leasing allows you to drive a brand-new vehicle every few years, ensuring you always have the latest safety features, infotainment, and off-road technology.

- Warranty Coverage: Your Trailhawk will almost certainly be under the manufacturer’s warranty for the entire lease term, minimizing unexpected repair costs.

- Reduced Maintenance Costs: With a new vehicle, major maintenance issues are rare, and routine services are often covered by a maintenance plan or are minimal within the lease period.

- Flexibility at Lease End: At the end of your lease, you have several options:

- Return the vehicle and walk away.

- Lease a new Jeep.

- Purchase your Trailhawk for the residual value.

- Avoid Depreciation Risk: You’re not responsible for the long-term depreciation of the vehicle. When the lease ends, you simply return it, avoiding the hassle of selling a used car.

- Potential Tax Advantages: For business owners, lease payments may be tax-deductible.

Navigating Jeep Cherokee Trailhawk Lease Deals: A Step-by-Step Guide

Securing a great lease deal requires research, negotiation, and attention to detail. Follow these steps to get the best possible Lease Deal On Jeep Cherokee Trailhawk:

- Research Current Deals and Incentives: Start by checking Jeep’s official website for national lease specials. Also, look at local dealership websites. These often highlight specific monthly payments with certain terms and down payments. Be aware that these advertised deals are often for specific trims and mileage allowances.

- Determine Your Needs and Budget:

- Mileage: Be realistic about how many miles you’ll drive, especially if you plan to use the Trailhawk for off-road adventures. Overestimating is better than underestimating.

- Term: Decide if a 24, 36, or 42-month lease suits your lifestyle.

- Desired Features/Packages: While the Trailhawk is well-equipped, identify any specific packages you want (e.g., Technology Group, Sun and Sound Group).

- Budget: Establish a comfortable range for your monthly payment and your "due at signing" amount.

- Understand All the Numbers (Not Just Monthly Payment): When you get a quote, ask for the following:

- MSRP

- Negotiated Capitalized Cost

- Residual Value (as a dollar amount and a percentage)

- Money Factor

- All fees (acquisition, disposition, documentation, etc.)

- Total "Due at Signing" breakdown.

- Never agree to a deal based solely on the monthly payment.

- Negotiate Smartly:

- Negotiate the Capitalized Cost: Treat this like buying the car. Aim for a price close to invoice or below MSRP. This is the most impactful negotiation point.

- Inquire About the Money Factor: While sometimes fixed by the lender, it can occasionally be negotiated down, or you might find a better rate from a different bank.

- Look for Lease Cash/Incentives: Jeep often offers "lease cash" incentives that directly reduce the capitalized cost. Ask if these are included in your quote.

- Shop Multiple Dealerships: Get quotes from at least three different dealerships. Pit them against each other (politely) to secure the best offer.

- Read the Fine Print Carefully: Before signing, review every line of the lease agreement. Pay close attention to:

- Mileage overage charges.

- Excessive wear and tear guidelines.

- Early termination penalties (these can be very steep).

- Insurance requirements (leased vehicles often require higher coverage).

- Arrange Insurance: Get quotes for full coverage insurance, as leasing companies require comprehensive and collision coverage, often with specific deductibles.

Key Considerations for Leasing a Trailhawk

While leasing offers many advantages, there are specific factors unique to the Trailhawk that you should consider:

- Mileage Limits and Off-Roading: If you plan extensive off-road trips, you might exceed standard mileage allowances. Consider purchasing higher mileage packages upfront, or be prepared for potential overage fees. Discuss with the dealer what constitutes "excessive wear and tear" related to off-road use. Minor scratches from trail brush are often accepted, but major body damage or mechanical issues from severe off-roading will be your responsibility.

- Wear and Tear Protection: Given the Trailhawk’s intended use, consider purchasing an optional "wear and tear waiver." This can cover minor dents, dings, scratches, and tire wear beyond normal limits, potentially saving you money at lease end.

- Customization Limitations: If you plan significant modifications (lift kits, large tires, custom bumpers), leasing might not be ideal, as you’ll need to return the vehicle to near-stock condition. Minor, easily reversible modifications are generally fine.

- Early Termination Penalties: Life happens, but breaking a lease early is almost always very expensive. Only commit if you’re confident you’ll keep the vehicle for the full term. Explore lease transfer services if circumstances change.

Maximizing Your Trailhawk Lease Deal

- Credit Score: A strong credit score (typically 700+) is crucial for securing the best money factor, which significantly impacts your monthly payment.

- Timing: Look for deals at the end of the month, quarter, or year when dealerships are trying to meet sales targets. Also, consider leasing when a new model year is being introduced, as dealers want to clear out older inventory.

- Down Payment Strategy: While a larger down payment reduces monthly payments, it’s generally advised to put minimal money down on a lease. If the vehicle is totaled, your down payment is typically lost. Instead, use a lower money factor or negotiate the capitalized cost.

- Lease vs. Buy Analysis: Use online calculators to compare the total cost of leasing versus buying over a similar period. For the Trailhawk, if you plan to upgrade frequently or use it heavily off-road, leasing might be more financially sound.

Potential Challenges and Solutions

- Overage Mileage: If you anticipate exceeding your mileage limit, consider purchasing additional miles upfront at a lower rate than the end-of-lease penalty. Alternatively, if you love the vehicle, buying it out at the end of the lease might be an option, as mileage limits typically don’t apply to a purchase.

- Excessive Wear: Get a pre-inspection from the leasing company a few months before your lease ends. This allows you time to repair any identified "excessive" damage yourself (often cheaper than dealer charges) or consider the wear and tear waiver.

- Early Termination: If unavoidable, explore lease transfer services (e.g., LeaseTrader, Swapalease). You find someone to take over your lease payments and term. This can save you thousands compared to outright early termination.

- Confusing Terms: Never hesitate to ask questions. If a term or calculation is unclear, demand a clear explanation before signing. Bring a trusted friend or family member if you feel overwhelmed.

Illustrative Lease Deal Example for Jeep Cherokee Trailhawk

Please note: The following table provides a hypothetical example of a lease deal for a Jeep Cherokee Trailhawk. Actual prices, residual values, and money factors fluctuate constantly based on market conditions, regional incentives, your credit score, and dealership negotiation. This is for illustrative purposes only.

Hypothetical Lease Deal on Jeep Cherokee Trailhawk 4×4

| Parameter | Example Value (Illustrative) | Notes |

|---|---|---|

| Model/Trim | Jeep Cherokee Trailhawk 4×4 | Popular off-road capable trim. |

| MSRP (Approx.) | $42,500 | Manufacturer’s Suggested Retail Price. |

| Lease Term | 36 Months | Standard lease duration. |

| Annual Mileage | 12,000 Miles | Common allowance; adjust based on your driving habits. |

| Capitalized Cost | $39,500 | Negotiated selling price of the vehicle (e.g., $3,000 below MSRP). Crucial for lower payments. |

| Residual Value (%) | 58% of MSRP ($24,650) | Estimated value at lease end. A higher percentage is better for leasing. |

| Depreciation Cost | $14,850 ($39,500 – $24,650) | Amount you pay for the vehicle’s depreciation over 36 months. |

| Money Factor | 0.00180 (Equivalent to ~4.32% APR) | Reflects the interest rate. Lower is better. |

| Monthly Payment (Excl. Tax) | $385 | Calculated based on depreciation + finance charge. |

| Due at Signing | $3,500 (Approx.) | Includes: First month’s payment, acquisition fee ($595), dealer fees, registration, small cap cost reduction ($2,000). |

| Total Lease Cost | $17,390 (Approx.) | Sum of all 36 monthly payments + due at signing (excluding taxes on payments). |

| Excess Mileage Charge | $0.25/mile | Cost per mile if you exceed 36,000 miles over the term. |

| Disposition Fee | $395 | Fee charged at lease end for returning the vehicle. |

Calculation Notes:

- Depreciation Portion: ($39,500 – $24,650) / 36 months = $412.50

- Finance Charge: ($39,500 + $24,650) x 0.00180 = $115.47

- Monthly Payment: $412.50 (depreciation) + $115.47 (finance) = $527.97 (This is incorrect in the table, let me correct the example payment)

Let’s re-calculate the monthly payment for the table example.

Capitalized Cost: $39,500

Residual Value: $24,650

Depreciation: $39,500 – $24,650 = $14,850

Monthly Depreciation: $14,850 / 36 = $412.50

Money Factor: 0.00180

Average Lease Balance: ($39,500 + $24,650) / 2 = $32,075

Monthly Finance Charge: $32,075 * 0.00180 = $57.735

Monthly Payment (before tax): $412.50 + $57.735 = $470.235. Let’s round to $470.

Revised Hypothetical Lease Deal on Jeep Cherokee Trailhawk 4×4

| Parameter | Example Value (Illustrative) | Notes |

|---|---|---|

| Model/Trim | Jeep Cherokee Trailhawk 4×4 | Popular off-road capable trim. |

| MSRP (Approx.) | $42,500 | Manufacturer’s Suggested Retail Price. |

| Lease Term | 36 Months | Standard lease duration. |

| Annual Mileage | 12,000 Miles | Common allowance; adjust based on your driving habits. |

| Capitalized Cost | $39,500 | Negotiated selling price of the vehicle (e.g., $3,000 below MSRP). Crucial for lower payments. |

| Residual Value (%) | 58% of MSRP ($24,650) | Estimated value at lease end. A higher percentage is better for leasing. |

| Depreciation Cost | $14,850 ($39,500 – $24,650) | Amount you pay for the vehicle’s depreciation over 36 months. |

| Money Factor | 0.00180 (Equivalent to ~4.32% APR) | Reflects the interest rate. Lower is better. |

| Monthly Payment (Excl. Tax) | $470 | Calculated based on depreciation + finance charge. |

| Due at Signing | $3,500 (Approx.) | Includes: First month’s payment, acquisition fee ($595), dealer fees, registration, small cap cost reduction ($2,000). |

| Total Lease Cost | $20,420 (Approx.) | Sum of all 36 monthly payments ($470*36 = $16,920) + due at signing ($3,500). (Excluding taxes on payments). |

| Excess Mileage Charge | $0.25/mile | Cost per mile if you exceed 36,000 miles over the term. |

| Disposition Fee | $395 | Fee charged at lease end for returning the vehicle. |

Frequently Asked Questions (FAQ) About Leasing a Jeep Cherokee Trailhawk

Q1: What is the best time to lease a Jeep Cherokee Trailhawk?

A1: The best times are typically at the end of the month, quarter, or year when dealerships are eager to meet sales quotas. Also, when a new model year is about to be released, dealers often offer incentives on the outgoing model. Manufacturer-specific lease specials can pop up at any time, so keeping an eye on Jeep’s official website is beneficial.

Q2: Can I negotiate the lease price on a Trailhawk?

A2: Absolutely! You should negotiate the "capitalized cost" (the price of the car) as if you were buying it. A lower capitalized cost directly translates to lower monthly payments. You can also try to negotiate the money factor and inquire about any available lease cash incentives.

Q3: What happens at the end of my Trailhawk lease?

A3: You generally have three main options:

- Return the vehicle: Simply turn it in, pay any disposition fees, and walk away (assuming no excess mileage or wear and tear).

- Purchase the vehicle: You can buy your Trailhawk for the pre-determined residual value stated in your lease agreement.

- Lease a new Jeep: You can trade in your current lease for a new one, often rolling over any remaining equity or fees into the new deal.

Q4: Is excess wear and tear covered on a Trailhawk lease?

A4: Standard leases cover "normal" wear and tear. However, excessive damage (large dents, broken lights, torn upholstery, severely worn tires beyond acceptable limits, significant scratches from off-roading) will incur charges. Many leasing companies offer optional "wear and tear waivers" for an additional fee, which can cover these potential costs.

Q5: Can I off-road my leased Trailhawk?

A5: Yes, you can! The Trailhawk is designed for off-roading. However, be mindful of the wear and tear clause and mileage limits. Severe damage from off-roading will be your responsibility. Consider the wear and tear waiver if you plan extensive trail use.

Q6: What credit score do I need for a good lease deal?

A6: Generally, a credit score of 700 or higher is considered "Tier 1" or "prime," which qualifies you for the lowest money factors and best lease terms. Scores below this may result in a higher money factor and potentially higher monthly payments.

Q7: Is it better to lease or buy a Jeep Cherokee Trailhawk?

A7: This depends on your individual circumstances:

- Lease if: You like driving a new car every few years, prefer lower monthly payments, want warranty coverage throughout your ownership, and don’t drive excessive miles. It’s also great if you’re uncertain about long-term ownership of a specialized vehicle like the Trailhawk.

- Buy if: You plan to keep the vehicle for more than 4-5 years, drive high mileage, want to customize your vehicle significantly, or prefer outright ownership and building equity.

Conclusion

Securing a Lease Deal On Jeep Cherokee Trailhawk can be an incredibly smart and satisfying way to experience the thrill and capability of this iconic off-road machine. By understanding the core components of a lease, diligently researching current offers, and approaching negotiations with confidence, you can unlock a deal that fits your budget and lifestyle. The Trailhawk’s unique blend of ruggedness and modern appeal makes it an excellent candidate for leasing, allowing you to enjoy the latest features, benefit from warranty coverage, and avoid the long-term commitment of ownership. So, do your homework, negotiate wisely, and prepare to embark on countless adventures with your expertly leased Jeep Cherokee Trailhawk.