Lease Jeep Grand Cherokee: Your Comprehensive Guide to Driving America’s Icon

Lease Jeep Grand Cherokee: Your Comprehensive Guide to Driving America’s Icon jeeps.truckstrend.com

The allure of the Jeep Grand Cherokee is undeniable. Combining rugged capability with refined comfort and a commanding presence, it stands as a testament to American engineering. For many, the dream of owning such a versatile SUV is tempered by the reality of a significant upfront investment and ongoing ownership costs. This is where the option to Lease a Jeep Grand Cherokee emerges as an incredibly appealing and practical solution.

Leasing a vehicle, in essence, means you are paying for the depreciation of the car over a specified period, rather than buying the entire vehicle outright. For the Jeep Grand Cherokee, this translates into the ability to drive a brand-new model, often with a lower monthly payment than traditional financing, and the flexibility to upgrade to the latest technology and features every few years. This guide will delve deep into every aspect of leasing a Jeep Grand Cherokee, offering insights, practical advice, and everything you need to know to make an informed decision.

Lease Jeep Grand Cherokee: Your Comprehensive Guide to Driving America’s Icon

Why Lease a Jeep Grand Cherokee? Unlocking the Benefits

Leasing offers a unique set of advantages that align perfectly with the desire to drive a premium SUV like the Grand Cherokee without the long-term commitment or large capital outlay of a purchase.

- Lower Monthly Payments: This is often the most significant draw. Since you’re only paying for the depreciation during the lease term, your monthly payments are typically much lower compared to financing the same vehicle. This allows you to drive a higher trim level or a newer model than you might otherwise afford.

- Access to the Latest Models & Technology: Lease terms usually range from 24 to 48 months. This means you can regularly upgrade to the newest Grand Cherokee models, enjoying the latest infotainment systems, safety features, and performance enhancements without the hassle of selling your old vehicle.

- Consistent Warranty Coverage: Throughout the entire lease period, your Jeep Grand Cherokee will likely remain under its factory warranty. This provides peace of mind, as most major repairs will be covered, reducing unexpected maintenance costs.

- Reduced Depreciation Risk: When you buy a car, you bear the full risk of its depreciation. With a lease, the leasing company assumes this risk. At the end of the term, you simply return the vehicle (barring excessive wear and tear or mileage overages).

- Potential Tax Advantages (for Businesses): If you use your Grand Cherokee for business purposes, a portion of your lease payments may be tax-deductible, offering a significant financial incentive. Consult with a tax professional for specific advice.

- No Trade-In Hassle: At the end of your lease, you don’t need to worry about selling the car or negotiating a trade-in value. You simply return the vehicle to the dealership.

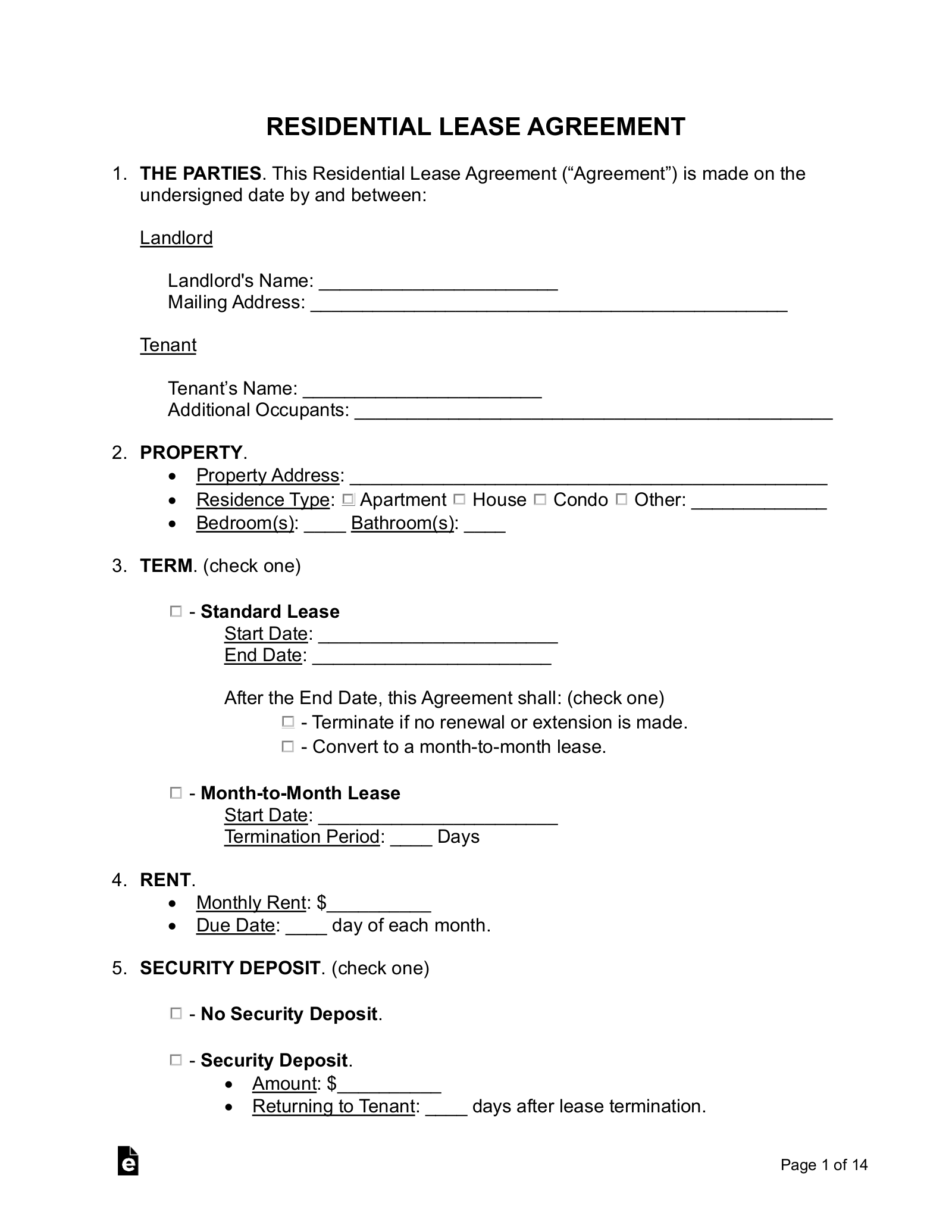

Understanding the Anatomy of a Jeep Grand Cherokee Lease Agreement

Before you sign on the dotted line, it’s crucial to understand the key components that determine your lease payment and overall cost.

- Capitalized Cost (Cap Cost): This is essentially the selling price of the vehicle that the lease is based on. It’s negotiable, just like a purchase price. A lower capitalized cost means lower monthly payments.

- Residual Value: This is the projected value of the Jeep Grand Cherokee at the end of the lease term. It’s expressed as a percentage of the MSRP. A higher residual value means less depreciation to pay for, resulting in lower monthly payments.

- Money Factor: Often referred to as the "lease interest rate," the money factor is how the leasing company calculates the financing charge. It’s a very small decimal (e.g., 0.00250). To convert it to an annual percentage rate (APR), multiply it by 2400 (e.g., 0.00250 x 2400 = 6% APR). A lower money factor is always better.

- Lease Term: This is the duration of your lease, typically 24, 36, or 48 months. Longer terms generally lead to lower monthly payments but accumulate more interest over time.

- Mileage Allowance: Leases come with an annual mileage limit (e.g., 10,000, 12,000, or 15,000 miles per year). Exceeding this limit will result in per-mile charges (e.g., $0.20-$0.25 per mile) at the end of the lease.

- Acquisition Fee: An administrative fee charged by the leasing company for setting up the lease.

- Disposition Fee: A fee charged at the end of the lease when you return the vehicle, covering the cost of preparing it for resale.

- Due at Signing: This includes your first month’s payment, acquisition fee, taxes, license, and registration fees, and any optional down payment (also known as a "capitalized cost reduction"). While a down payment lowers monthly payments, it’s generally advised to keep it minimal in a lease, as you lose that money if the vehicle is totaled early in the term.

The Leasing Process: A Step-by-Step Guide to Your Grand Cherokee

Leasing a Jeep Grand Cherokee is a straightforward process when you know what to expect.

- Research Models & Trims: Identify which Grand Cherokee trim (Laredo, Limited, Overland, Summit, etc.) and features best suit your needs and budget. Consider options like 4×2 vs. 4×4, engine choices, and technology packages.

- Determine Your Budget: Realistically assess what you can comfortably afford for a monthly payment and any due-at-signing costs.

- Check Your Credit Score: Your credit score significantly impacts the money factor you’ll be offered. A higher score (typically 700+) will qualify you for the best rates.

- Shop Around & Compare Offers: Don’t settle for the first offer. Contact multiple Jeep dealerships (both local and online) to compare lease deals on the specific Grand Cherokee model you want. Ask for quotes including the capitalized cost, residual value, money factor, and all fees.

- Negotiate Terms:

- Negotiate the Capitalized Cost: This is like negotiating the purchase price. Aim for a price close to the dealer’s invoice or below MSRP.

- Understand the Money Factor: Ask for it directly. If it seems high, ask if it can be lowered.

- Confirm Residual Value: This is set by the leasing company but ensure it matches expectations for the specific model and term.

- Review the Lease Contract Carefully: Before signing, read every line. Ensure all negotiated terms are accurately reflected. Pay close attention to mileage limits, wear and tear clauses, and early termination penalties.

- Take Delivery: Once satisfied, sign the paperwork and drive off in your new Jeep Grand Cherokee!

Key Considerations Before Leasing Your Grand Cherokee

While leasing offers many advantages, it’s not for everyone. Consider these points:

- Driving Habits: Are you a high-mileage driver? If you consistently drive more than 15,000 miles per year, a lease might incur significant overage charges. Calculate your average annual mileage.

- Maintenance Responsibilities: While covered by warranty, you are still responsible for routine maintenance (oil changes, tire rotations, etc.) as per the manufacturer’s schedule. Neglecting this can lead to excessive wear charges.

- Wear and Tear Expectations: Lease agreements define "normal" wear and tear. Dings, dents, significant scratches, torn upholstery, or damaged wheels could result in fees at lease end.

- Early Termination Penalties: Breaking a lease early can be very expensive, often requiring you to pay the remaining payments, fees, and the difference between the car’s current value and the remaining lease balance.

- Insurance Requirements: Leasing companies often require higher insurance coverage (e.g., higher liability limits, comprehensive, and collision with lower deductibles) than you might carry on an owned vehicle.

- Credit Score Impact: Applying for a lease is a credit inquiry. While a lease payment contributes positively to your credit history if paid on time, defaulting can severely damage it.

Tips for a Successful Jeep Grand Cherokee Lease

- Negotiate the "Selling Price" (Capitalized Cost) First: Treat it like a purchase. Get the best possible price on the vehicle before discussing lease specifics. This is your biggest leverage point.

- Understand the Money Factor, Don’t Just Look at APR: Some dealers might quote an APR. Ask for the money factor directly to compare apples to apples.

- Avoid Large Down Payments: While a down payment lowers your monthly payment, it’s generally ill-advised for a lease. If the vehicle is stolen or totaled early on, your down payment is typically lost. It’s safer to use that money to cover your "due at signing" costs and keep monthly payments slightly higher.

- Choose the Right Mileage Allowance: Be realistic about your driving habits. It’s usually cheaper to buy extra miles upfront than to pay overage charges at the end.

- Maintain the Vehicle Meticulously: Keep all service records and address any minor cosmetic issues before lease end to avoid wear and tear penalties.

- Get an End-of-Lease Inspection: Most leasing companies offer a pre-inspection a few months before your lease ends. Take advantage of this to identify any potential charges and address them beforehand.

Navigating Potential Challenges and Solutions

Even with careful planning, challenges can arise during a lease.

- Excessive Mileage:

- Solution 1: Buy More Miles Upfront: If you anticipate going over, purchase extra miles at a reduced rate at the beginning of the lease.

- Solution 2: Buy Out the Lease: If you’re significantly over mileage, it might be more cost-effective to purchase the vehicle at its residual value.

- Solution 3: Lease Transfer: If allowed by your leasing company, you might find someone to take over your lease.

- Excessive Wear and Tear:

- Solution 1: Fix Issues Yourself: Repair minor dents, scratches, or interior damage before turning in the vehicle. Often, a local body shop can do this cheaper than the dealership’s charges.

- Solution 2: Budget for Fees: Understand that some wear and tear is inevitable; budget for potential charges.

- Early Termination:

- Solution 1: Lease Transfer: Websites like LeaseTrader or Swapalease connect individuals looking to get out of their leases with those wanting to take one over.

- Solution 2: Buy Out the Vehicle: If the market value of your Grand Cherokee is higher than your lease payoff amount, buying it out and selling it privately could save you money.

- Solution 3: Negotiate with the Dealer: Sometimes, if you’re leasing another vehicle from the same brand, they might waive or reduce early termination fees.

Representative Lease Price Table for Jeep Grand Cherokee (Hypothetical Example)

Disclaimer: The following table provides hypothetical examples for illustrative purposes only. Actual lease prices are subject to change daily based on market conditions, manufacturer incentives, regional variations, creditworthiness, and specific dealership promotions. Always consult with a certified Jeep dealership for current and personalized lease quotes.

| Jeep Grand Cherokee Trim (Example) | Lease Term (Months) | Annual Mileage Allowance | Estimated Monthly Payment Range | Estimated Due at Signing Range | Residual Value (%) |

|---|---|---|---|---|---|

| Laredo A (2WD) | 36 | 10,000 | $420 – $480 | $3,000 – $3,800 | 58% – 62% |

| Laredo B (4×4) | 36 | 12,000 | $460 – $520 | $3,200 – $4,000 | 57% – 61% |

| Limited (4×4) | 36 | 12,000 | $550 – $620 | $3,500 – $4,500 | 56% – 60% |

| Overland (4×4) | 36 | 12,000 | $680 – $750 | $4,000 – $5,000 | 55% – 59% |

| Summit Reserve (4×4) | 36 | 10,000 | $800 – $900+ | $4,500 – $6,000+ | 54% – 58% |

| Any Trim (Longer Term) | 48 | 10,000 | $400 – $850 (Lower vs. 36m) | $3,000 – $5,500 | 48% – 52% |

Note: "Due at Signing" typically includes the first month’s payment, acquisition fee, doc fees, taxes, and initial registration. A higher down payment (capitalized cost reduction) would lower the monthly payment but increase the "Due at Signing" amount.

Frequently Asked Questions (FAQ) about Leasing a Jeep Grand Cherokee

Q1: What happens at the end of a Jeep Grand Cherokee lease?

A1: At the end of your lease, you have a few options:

- Return the vehicle: Simply turn in the Grand Cherokee at the dealership. You’ll be responsible for any excess mileage or wear and tear charges.

- Buy the vehicle: You can purchase the Grand Cherokee at the predetermined residual value stated in your lease agreement.

- Lease a new Jeep: You can often trade in your leased Grand Cherokee early or return it and lease a brand-new model, sometimes with loyalty incentives.

Q2: Can I buy my Jeep Grand Cherokee at the end of the lease?

A2: Yes, absolutely. Your lease agreement will specify a "purchase option price" or "residual value" that you can pay to buy the vehicle outright at the end of the term.

Q3: What is a "money factor" in a lease?

A3: The money factor is essentially the interest rate charged on your lease. It’s a small decimal number (e.g., 0.00250). To convert it to an approximate annual percentage rate (APR), multiply it by 2400 (0.00250 x 2400 = 6% APR). A lower money factor means lower finance charges.

Q4: Is insurance more expensive for a leased Jeep Grand Cherokee?

A4: Not necessarily more expensive, but leasing companies often require specific, higher levels of coverage (e.g., higher liability limits, comprehensive, and collision with lower deductibles) to protect their asset. This might result in a higher premium than what you might choose for an owned vehicle.

Q5: Can I transfer my Jeep Grand Cherokee lease to someone else?

A5: Some leasing companies allow lease transfers, while others do not. If permitted, it’s a way to get out of your lease early without incurring significant penalties. Websites like LeaseTrader.com or SwapALease.com facilitate this process.

Q6: What if I go over my mileage allowance on my lease?

A6: You will be charged a per-mile fee for every mile over your contracted allowance. This fee is specified in your lease agreement and can range from $0.20 to $0.25 or more per mile. It’s often cheaper to purchase additional miles upfront if you anticipate going over.

Q7: Does leasing a car affect my credit score?

A7: Yes, applying for a lease involves a credit check, which can temporarily lower your score by a few points. However, making timely lease payments can positively build your credit history, just like a loan.

Conclusion: Is Leasing a Jeep Grand Cherokee Right for You?

Leasing a Jeep Grand Cherokee offers an enticing pathway to experiencing the premium performance, luxury, and capability of this iconic SUV. It provides significant benefits, including lower monthly payments, access to the latest models, and reduced long-term commitment. However, it’s crucial to weigh these advantages against potential limitations like mileage restrictions and wear and tear charges.

By thoroughly understanding the lease agreement, diligently researching your options, and carefully considering your driving habits and financial situation, you can determine if a lease is the ideal solution for getting behind the wheel of your dream Jeep Grand Cherokee. For many, it’s not just a way to drive a car; it’s a smarter, more flexible approach to vehicle ownership in the modern era.